Should Dividend Hikes and Upbeat Guidance Prompt Action From Organo (TSE:6368) Investors?

Reviewed by Sasha Jovanovic

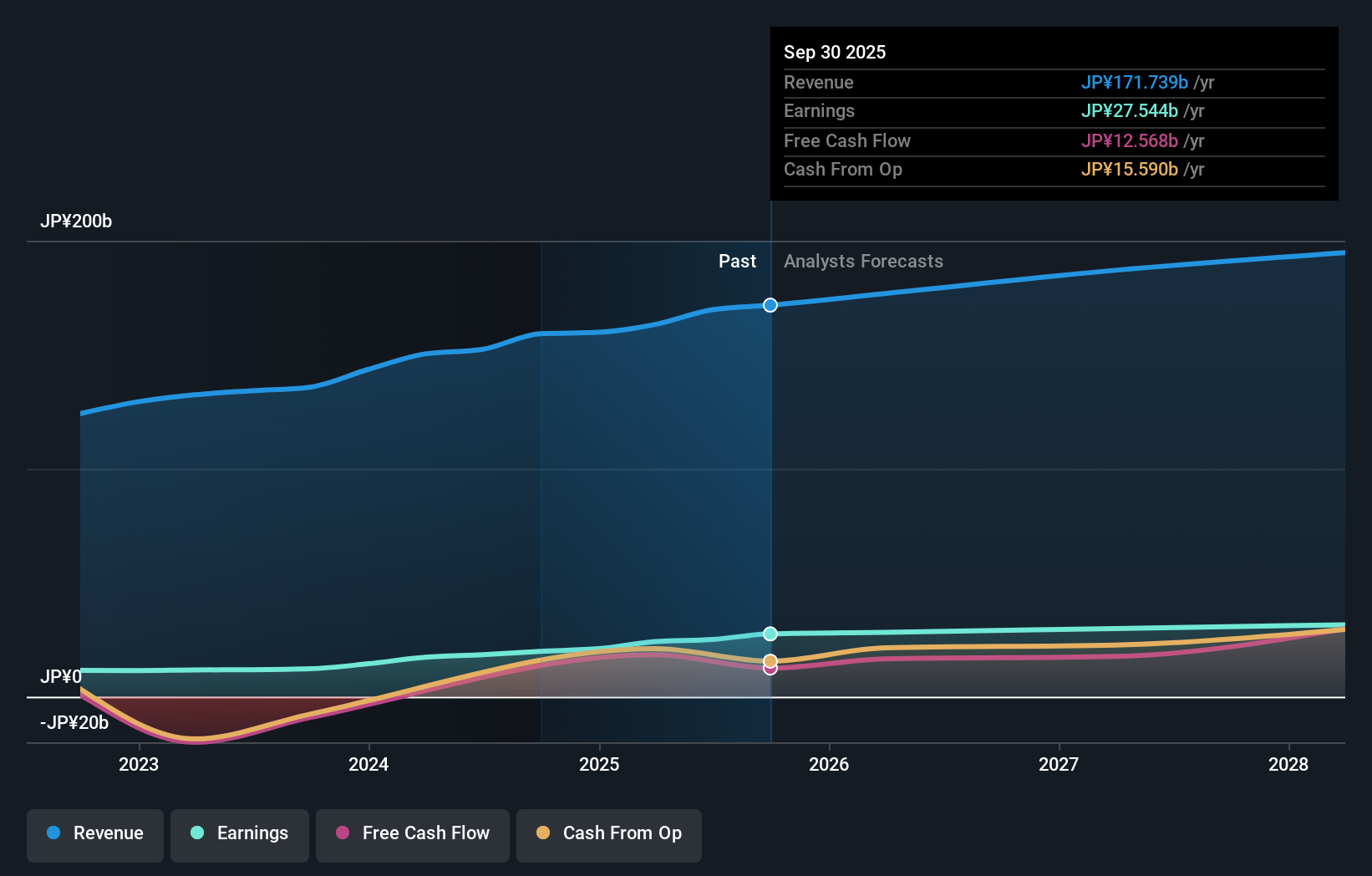

- Organo Corporation recently held a board meeting where it announced increased interim and year-end dividends for the fiscal year ending March 31, 2026, along with upwardly revised earnings guidance following strong orders and improved profit margins.

- This move underscores Organo’s commitment to balancing returns to shareholders with investment in growth, signaling confidence amid robust demand for its solutions projects.

- We will explore how Organo’s higher earnings and dividend forecasts highlight its focus on profitability and continued shareholder returns.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Organo's Investment Narrative?

To be a shareholder in Organo, you need to believe in its ability to consistently harness demand for its solutions projects while maintaining a disciplined approach to both growth investment and shareholder returns. The sharp increase in interim and projected year-end dividends, paired with a raised earnings forecast after strong orders and margin improvement, is set to reinforce two short-term catalysts: optimism around profitability and rising confidence in Organo’s operational execution. This news meaningfully raises the floor for projected cash returns and briefly shifts the spotlight away from valuation concerns, but it also brings to the fore existing risks such as Organo’s above-average price-to-earnings multiple versus its sector, relatively inexperienced board, and a slightly elevated board turnover. While these catalysts may attract fresh attention, sustainability of elevated performance will remain a focal point for investors given recent price moves and high historical returns. Yet, growing dividends and profit do not eliminate the risk of high valuation and management churn.

Organo's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Organo - why the stock might be worth as much as 29% more than the current price!

Build Your Own Organo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organo research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Organo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organo's overall financial health at a glance.

No Opportunity In Organo?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6368

Organo

Engages in water treatment engineering and performance product businesses in Japan, Taiwan, China, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives