Organo (TSE:6368) Valuation in Focus After Overseas Profit Surge and Bullish Semiconductor Outlook

Reviewed by Kshitija Bhandaru

Organo (TSE:6368) reported a surge in operating profit, fueled largely by overseas sales growth, particularly in Taiwan, and a steady order backlog. The company’s outlook calls for higher sales and global semiconductor project orders next year.

See our latest analysis for Organo.

Organo’s latest operating profit boost has caught investors’ attention, especially with its rising overseas momentum and a solid pipeline. Against the backdrop of global chip industry shifts, the stock has steadily built on this optimism, delivering a 1-year total shareholder return of 0.6% and an impressive 8% over five years. These are signs that long-term performance and confidence in future growth are holding up despite some short-term volatility.

If you’re looking for more opportunities in industrial leaders riding global tech trends, it’s a great moment to discover fast growing stocks with high insider ownership

But with shares trading near their analyst targets and recent gains, is there still room for further upside, or has the anticipated growth already been factored into Organo’s stock price?

Price-to-Earnings of 21.4x: Is it justified?

Organo’s current price-to-earnings ratio sits at 21.4x, which signals a premium compared to its peers and prompts a closer look at what investors are paying for.

The price-to-earnings ratio (P/E) reflects how much investors are willing to spend for each yen of earnings. For a company like Organo in the industrial machinery sector, the P/E can indicate whether the market sees above-average growth potential or views the stock as fully valued.

Based on this ratio, Organo is attractively priced compared to peer companies, trading below their average of 30.9x. However, when compared to the broader Japanese Machinery industry, which averages just 13.5x, Organo appears significantly more expensive. Notably, the estimated fair P/E for Organo is 20.9x. This suggests the current premium may be nearing its limit if future earnings do not accelerate strongly.

Explore the SWS fair ratio for Organo

Result: Price-to-Earnings of 21.4x (ABOUT RIGHT)

However, global supply chain disruptions or a slowdown in semiconductor demand could present challenges for Organo’s momentum and put pressure on its future earnings potential.

Find out about the key risks to this Organo narrative.

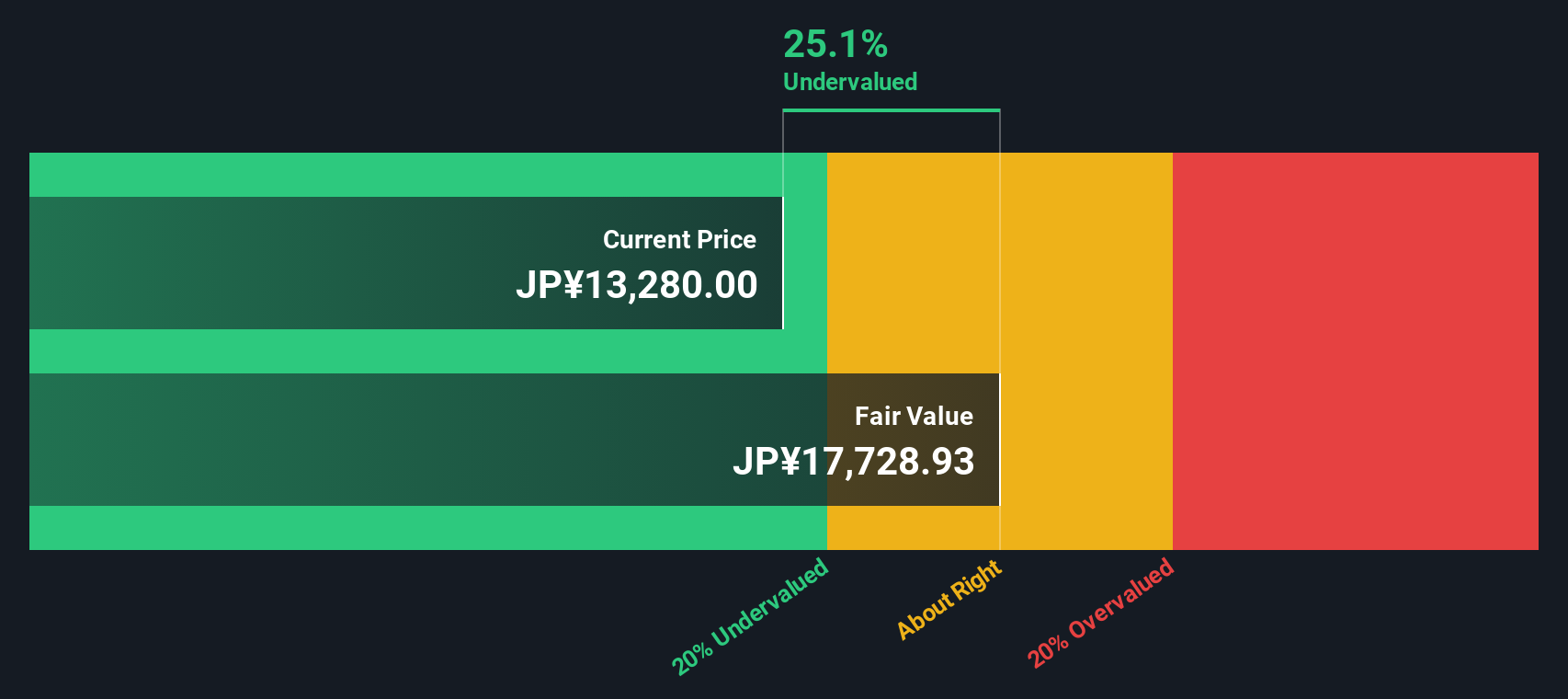

Another View: Discounted Cash Flow Puts Shares in a Different Light

Taking a step back from multiples, our DCF model draws a very different picture. It suggests Organo shares are actually trading about 33.5% below their fair value. This points to a potential undervaluation that is not reflected in standard ratios. Could the market be overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Organo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Organo Narrative

If you see things differently or want to dig deeper on your own, you can easily craft and share your take in just a few minutes. So why not Do it your way?

A great starting point for your Organo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip away while others find their next big winner. Use these powerful tools now to put your money in motion:

- Uncover rapid growth potential in tomorrow’s tech by checking out these 25 AI penny stocks, where emerging AI-driven companies are setting new standards.

- Get ahead of the curve and spot undervalued gems before the crowd with these 892 undervalued stocks based on cash flows, targeting stocks priced below their true potential.

- Seize strong, steady income by scanning these 19 dividend stocks with yields > 3%, which offers yields above 3 percent and reliable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6368

Organo

Engages in water treatment engineering and functional product business in Japan, Taiwan, China, Southeast Asia, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives