Nomura Micro Science Co., Ltd.'s (TSE:6254) Shares Bounce 28% But Its Business Still Trails The Market

The Nomura Micro Science Co., Ltd. (TSE:6254) share price has done very well over the last month, posting an excellent gain of 28%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.1% over the last year.

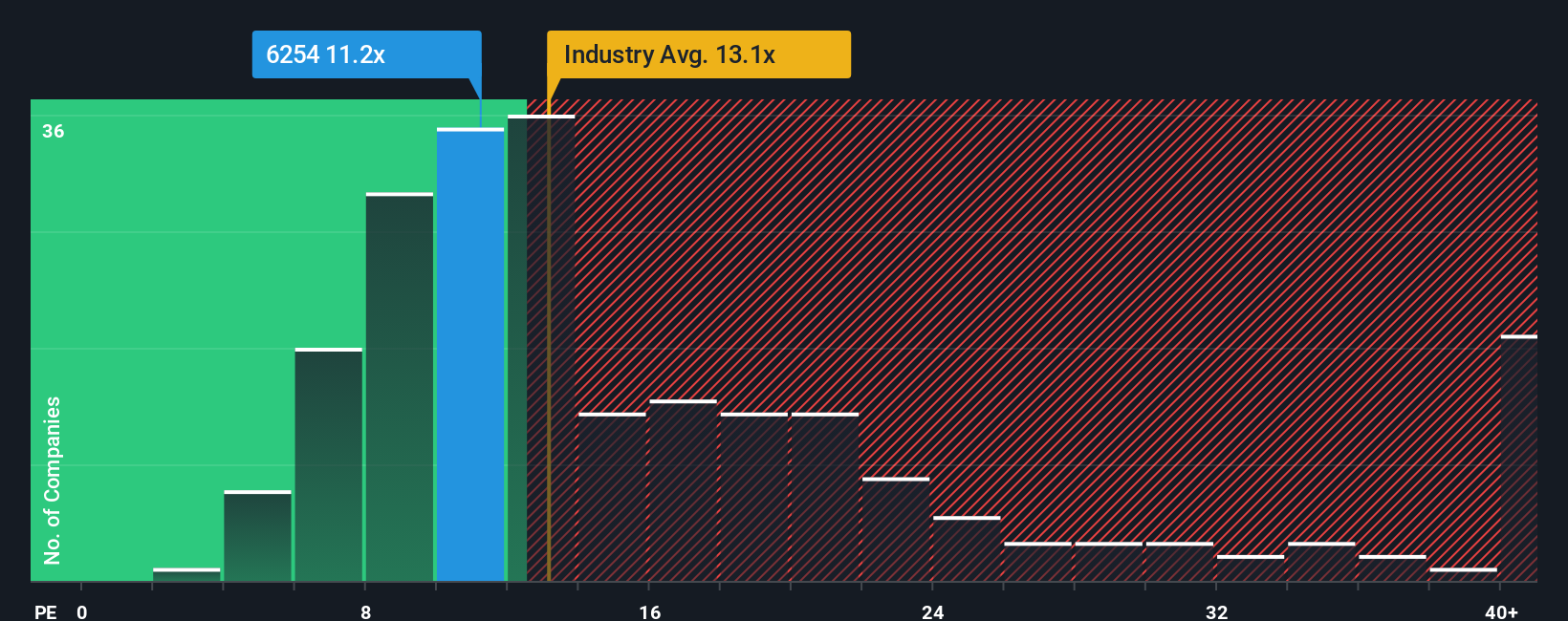

In spite of the firm bounce in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Nomura Micro Science as an attractive investment with its 11.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Nomura Micro Science as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Nomura Micro Science

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nomura Micro Science's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 40%. The strong recent performance means it was also able to grow EPS by 217% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 5.7% per annum over the next three years. That's not great when the rest of the market is expected to grow by 10% per year.

In light of this, it's understandable that Nomura Micro Science's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Nomura Micro Science's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Nomura Micro Science maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Nomura Micro Science (2 are significant!) that we have uncovered.

You might be able to find a better investment than Nomura Micro Science. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nomura Micro Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6254

Nomura Micro Science

Engages in the design, installation, and sale of water treatment technologies in Japan, South Korea, Taiwan, China, and the United States.

Proven track record average dividend payer.

Market Insights

Community Narratives