As global markets navigate a complex landscape marked by hopes for interest rate cuts and mixed economic signals, investors are increasingly focused on strategies that can provide steady returns amid uncertainty. In this environment, dividend stocks stand out as a compelling option, offering the potential for regular income while participating in market growth.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.68% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.50% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

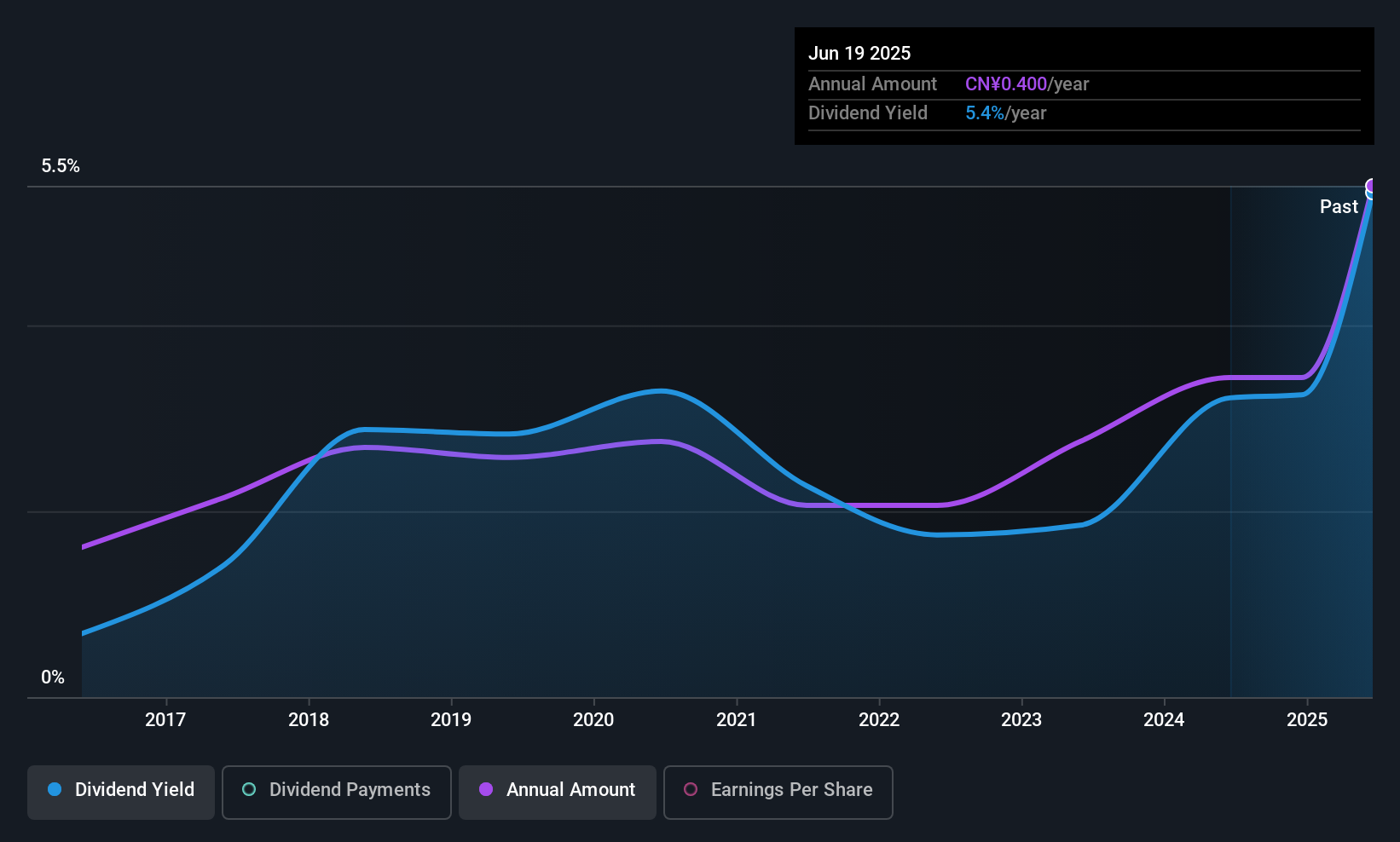

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research, development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.86 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd. generates revenue through its global operations focused on the research, development, production, and sale of bathroom products and accessories.

Dividend Yield: 4.1%

Xiamen R&T Plumbing Technology Ltd. offers a dividend yield of 4.33%, placing it in the top quartile of CN market dividend payers. However, its high cash payout ratio of 95.8% indicates dividends are not well covered by cash flows, raising sustainability concerns despite a reasonable earnings payout ratio of 72.4%. The company's dividends have been volatile and unreliable over the past decade, and recent earnings reports show declining sales and net income, which may impact future payouts.

- Unlock comprehensive insights into our analysis of Xiamen R&T Plumbing TechnologyLtd stock in this dividend report.

- The analysis detailed in our Xiamen R&T Plumbing TechnologyLtd valuation report hints at an inflated share price compared to its estimated value.

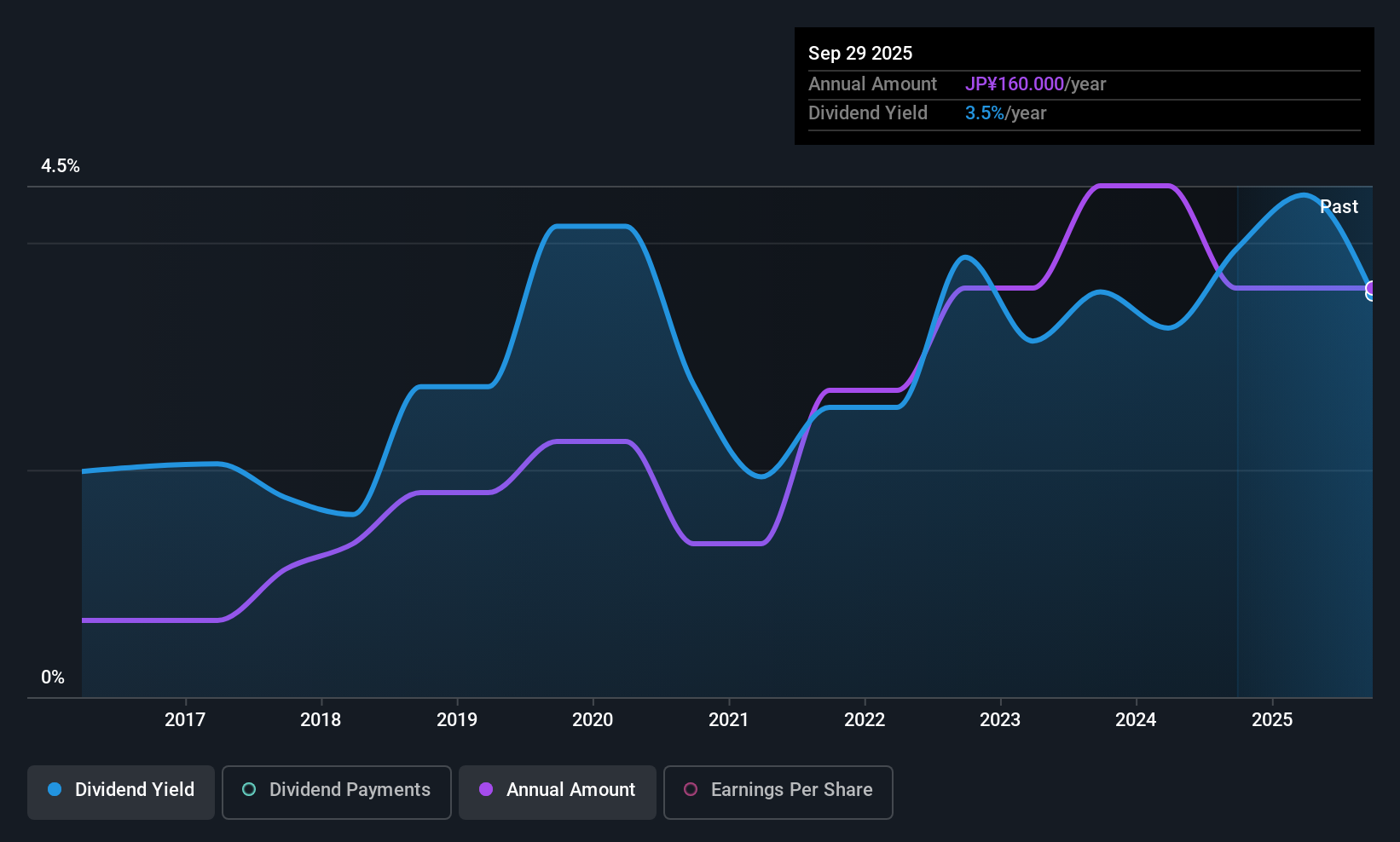

Okamoto Machine Tool Works (TSE:6125)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Okamoto Machine Tool Works, Ltd. is a company that manufactures and sells grinding machines and semiconductor-related equipment both in Japan and internationally, with a market cap of ¥28.72 billion.

Operations: Okamoto Machine Tool Works generates revenue from its Machine Tools segment, contributing ¥29.07 billion, and its Semiconductor Related Equipment segment, adding ¥14.74 billion.

Dividend Yield: 3.6%

Okamoto Machine Tool Works' dividend yield stands at 3.6%, slightly below the top 25% of JP market payers. The company's payout ratio is a reasonable 48.6%, suggesting dividends are covered by earnings, but not by free cash flows, raising sustainability concerns. Despite a low price-to-earnings ratio of 13.5x compared to the JP market average, dividends have been volatile and unreliable over the past decade with periods of significant drops exceeding 20%.

- Click to explore a detailed breakdown of our findings in Okamoto Machine Tool Works' dividend report.

- Our valuation report here indicates Okamoto Machine Tool Works may be overvalued.

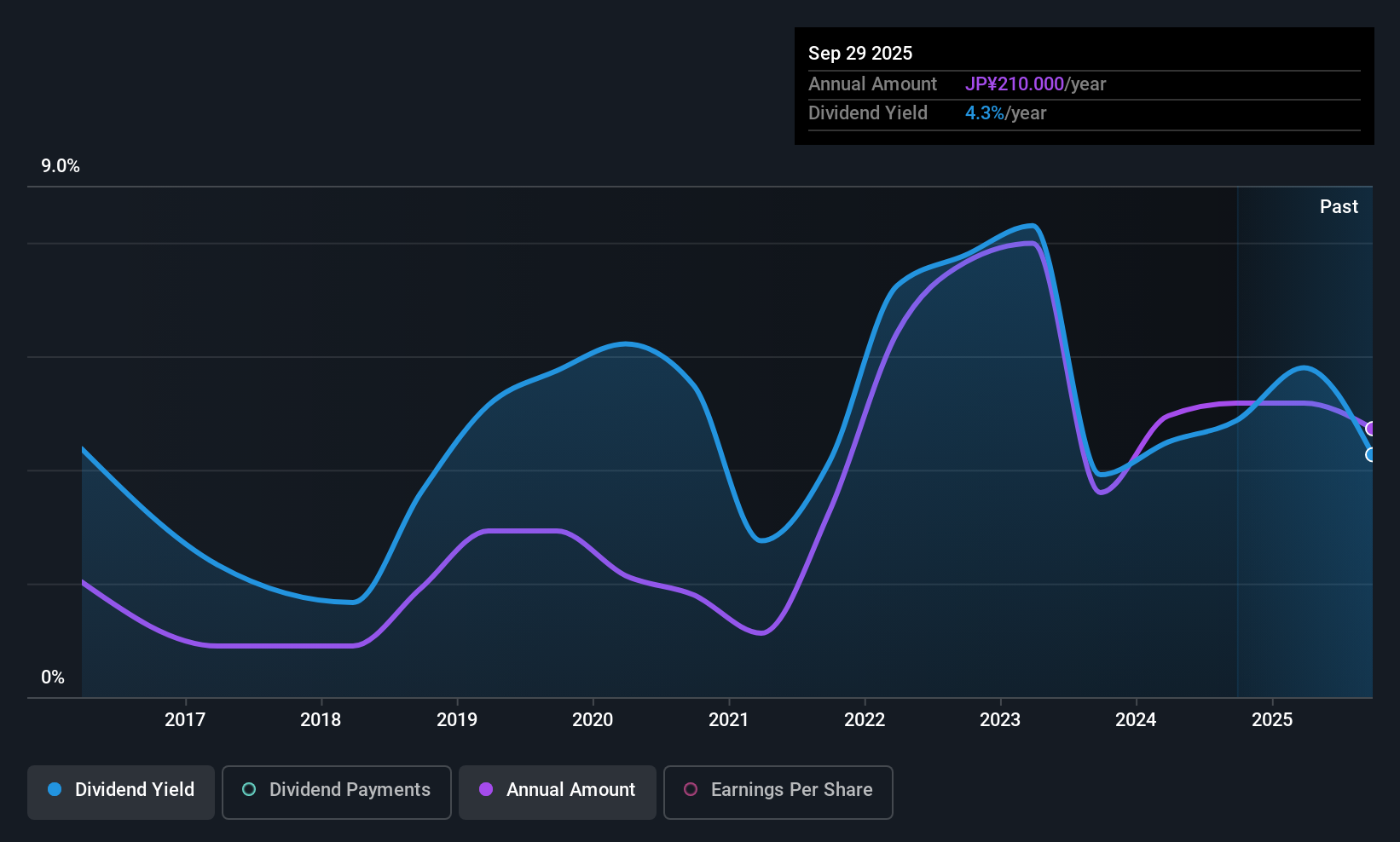

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd. operates in marine transportation services both domestically and internationally, with a market cap of ¥146.58 billion.

Operations: NS United Kaiun Kaisha, Ltd.'s revenue is primarily derived from its Ocean Shipping Business, which generated ¥198.35 billion, and its Domestic Shipping Business, contributing ¥31.86 billion.

Dividend Yield: 3.9%

NS United Kaiun Kaisha's dividend yield of 3.88% ranks in the top 25% of Japanese market payers, supported by a low payout ratio of 26.4%, indicating strong earnings coverage. Despite recent increases to ¥140 per share, dividends have been volatile and unreliable over the past decade with significant fluctuations. However, cash flows cover dividends well at a 20.8% cash payout ratio, suggesting current sustainability amidst improved earnings forecasts driven by robust demand for key cargo services.

- Dive into the specifics of NS United Kaiun Kaisha here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that NS United Kaiun Kaisha is priced lower than what may be justified by its financials.

Make It Happen

- Gain an insight into the universe of 1309 Top Global Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6125

Okamoto Machine Tool Works

Manufactures and sells grinding machines and semiconductor-related equipment in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026