Takuma (TSE:6013) Has Announced That It Will Be Increasing Its Dividend To ¥40.00

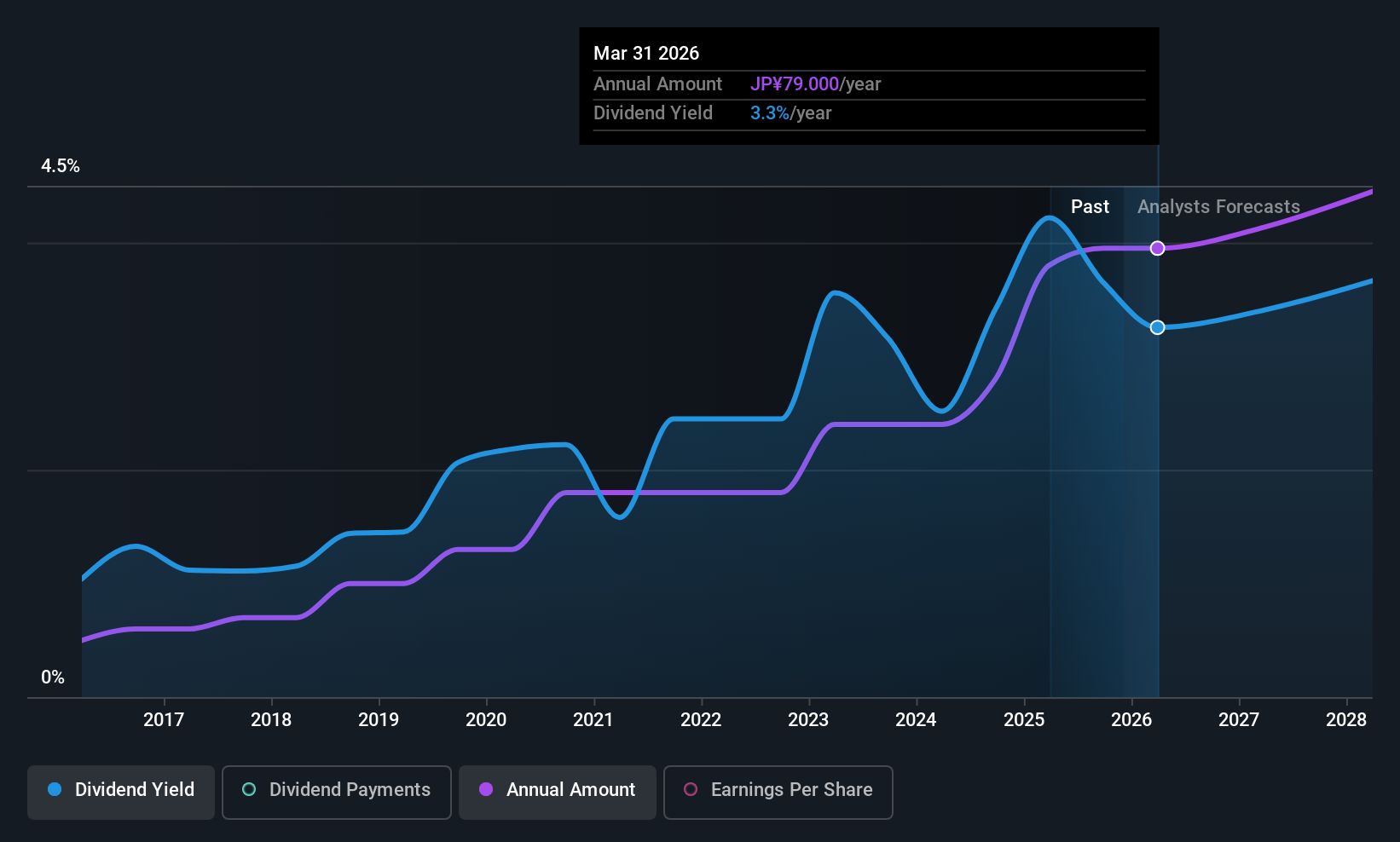

Takuma Co., Ltd. (TSE:6013) will increase its dividend from last year's comparable payment on the 26th of June to ¥40.00. This makes the dividend yield 3.3%, which is above the industry average.

Takuma's Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Takuma's dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 7.7%. If the dividend continues on this path, the payout ratio could be 63% by next year, which we think can be pretty sustainable going forward.

View our latest analysis for Takuma

Takuma Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2015, the annual payment back then was ¥8.00, compared to the most recent full-year payment of ¥80.00. This means that it has been growing its distributions at 26% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Earnings have grown at around 4.3% a year for the past five years, which isn't massive but still better than seeing them shrink. Growth of 4.3% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Takuma Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 4 analysts we track are forecasting for Takuma for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Takuma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6013

Takuma

Engages in the design, construction, and superintendence of various boilers, plant machineries, pollution prevention and environmental equipment plants, heating and cooling equipment, and feed water/drainage sanitation equipment and facilities in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026