- Japan

- /

- Electrical

- /

- TSE:5805

Assessing SWCC (TSE:5805) Valuation Following Upbeat Forecast Revisions and Upgraded Dividend Guidance

Reviewed by Simply Wall St

SWCC (TSE:5805) caught investor attention today after its board approved an upward revision to the company’s full-year financial results and dividend forecasts, highlighting strong business momentum and growth trends for the fiscal year.

See our latest analysis for SWCC.

Following the recent upward forecast revision, SWCC’s share price jumped 18.87% in a single day and has now returned 26.51% year-to-date. The strong business update clearly energized investors, capping off a year where total shareholder returns hit 30.34%. In addition, the longer-term three- and five-year total returns of 540.48% and 608.84% are eye-catching proof that momentum has been building, not fading.

If you’re interested in discovering what else is capturing attention among high-growth, well-positioned companies, now’s a great time to broaden your search and uncover fast growing stocks with high insider ownership

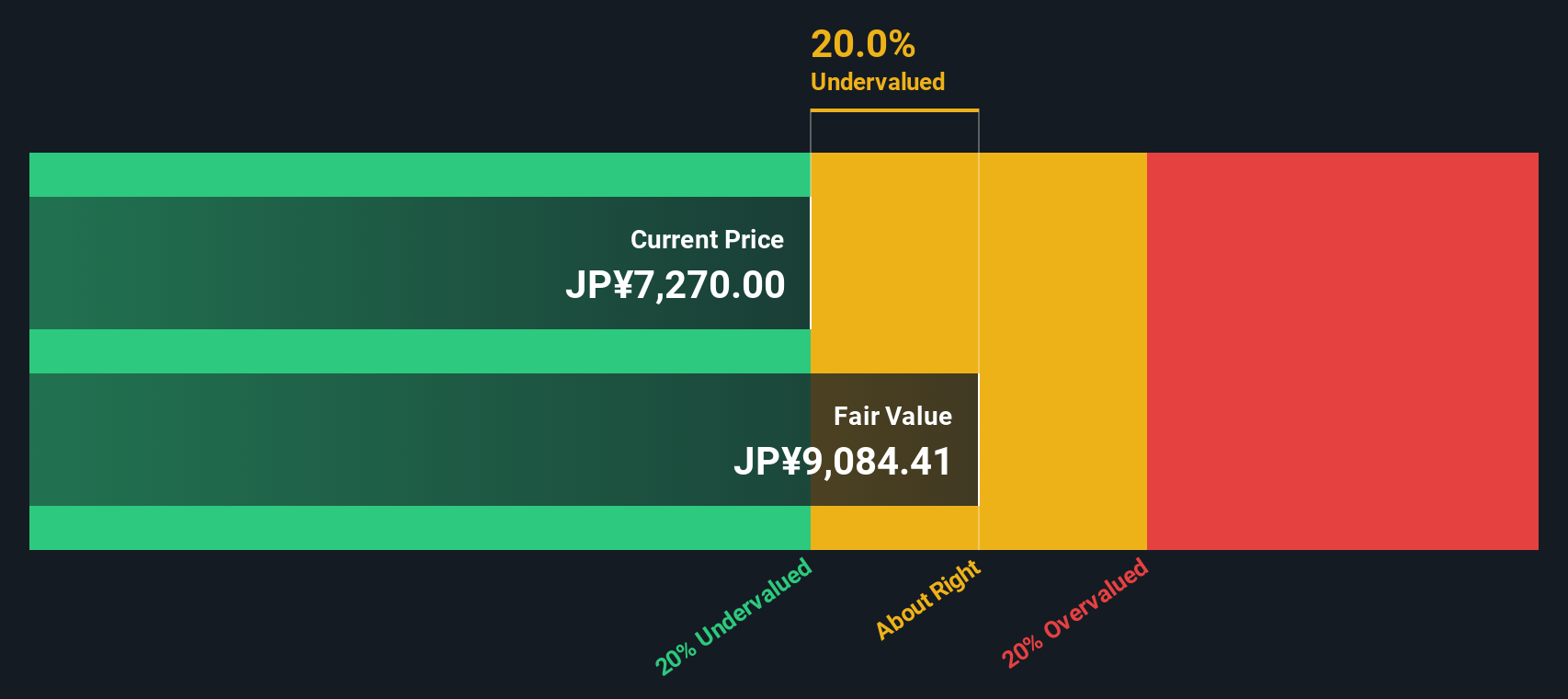

But with its rapid share price appreciation and upgraded outlook, the key question now is whether SWCC remains undervalued by the market, or if investors have already priced in all of its future growth potential.

Price-to-Earnings of 24.3x: Is it justified?

SWCC currently trades at a Price-to-Earnings (P/E) ratio of 24.3x, which stands out compared to both its peer group and the broader market’s typical range. At yesterday’s close of ¥9,450, the stock is notably more expensive than its sector counterparts based on recent earnings.

The Price-to-Earnings ratio measures the price investors are willing to pay today for each yen of the company’s earnings. For an industrials stock like SWCC, it is a key gauge of the market’s growth expectations, earnings reliability, and overall sentiment toward the business.

This premium valuation suggests investors are pricing in solid future earnings growth or strong profitability. However, the company’s net profit margins have slightly slipped compared to last year and recent earnings have been buoyed by large one-off gains. High valuation multiples can be hard to justify if growth slows or earnings become more volatile. Meanwhile, the P/E exceeds both the industry average and the company’s own fair ratio, signaling that the market is awarding a significant premium. This could prove unsustainable if the earnings outlook softens.

Compared to the JP Electrical industry’s average P/E of 14x, SWCC’s multiple is markedly higher. The current P/E also overshoots the stock’s estimated Fair Price-to-Earnings Ratio of 22.9x, indicating that the stock is trading above what regression trends would suggest as fair value for its earnings profile.

Explore the SWS fair ratio for SWCC

Result: Price-to-Earnings of 24.3x (OVERVALUED)

However, downside risks remain if growth stalls or profit margins come under further pressure. This could quickly undermine today’s premium valuation.

Find out about the key risks to this SWCC narrative.

Another View: What Does the SWS DCF Model Suggest?

Looking from a different angle, our SWS DCF model estimates SWCC's fair value at ¥9,294 per share. This is slightly below the current market price of ¥9,450. This approach implies the stock may be mildly overvalued and challenges the optimism seen in its high valuation multiples. Could the market be too enthusiastic about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SWCC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SWCC Narrative

If you have a different perspective on SWCC or enjoy delving into the numbers yourself, crafting your own view takes just a few minutes. Do it your way

A great starting point for your SWCC research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Searching for Your Next Big Move?

Don’t let great opportunities pass you by. Take control of your investment strategy with Simply Wall Street’s screener and find stocks that fit your goals in minutes.

- Uncover hidden potential and pursue growth with these 3575 penny stocks with strong financials featuring the strongest financial fundamentals among emerging names.

- Strengthen your portfolio with reliable passive income from these 14 dividend stocks with yields > 3% offering high yields above 3%.

- Tap into advanced innovation trends with these 32 healthcare AI stocks at the forefront of AI-powered breakthroughs in healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5805

SWCC

Manufactures and sells energy, infrastructure, and communication components in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives