Why Japan Steel Works (TSE:5631) Is Down 5.3% After Reporting Surging Sales and Profits

Reviewed by Sasha Jovanovic

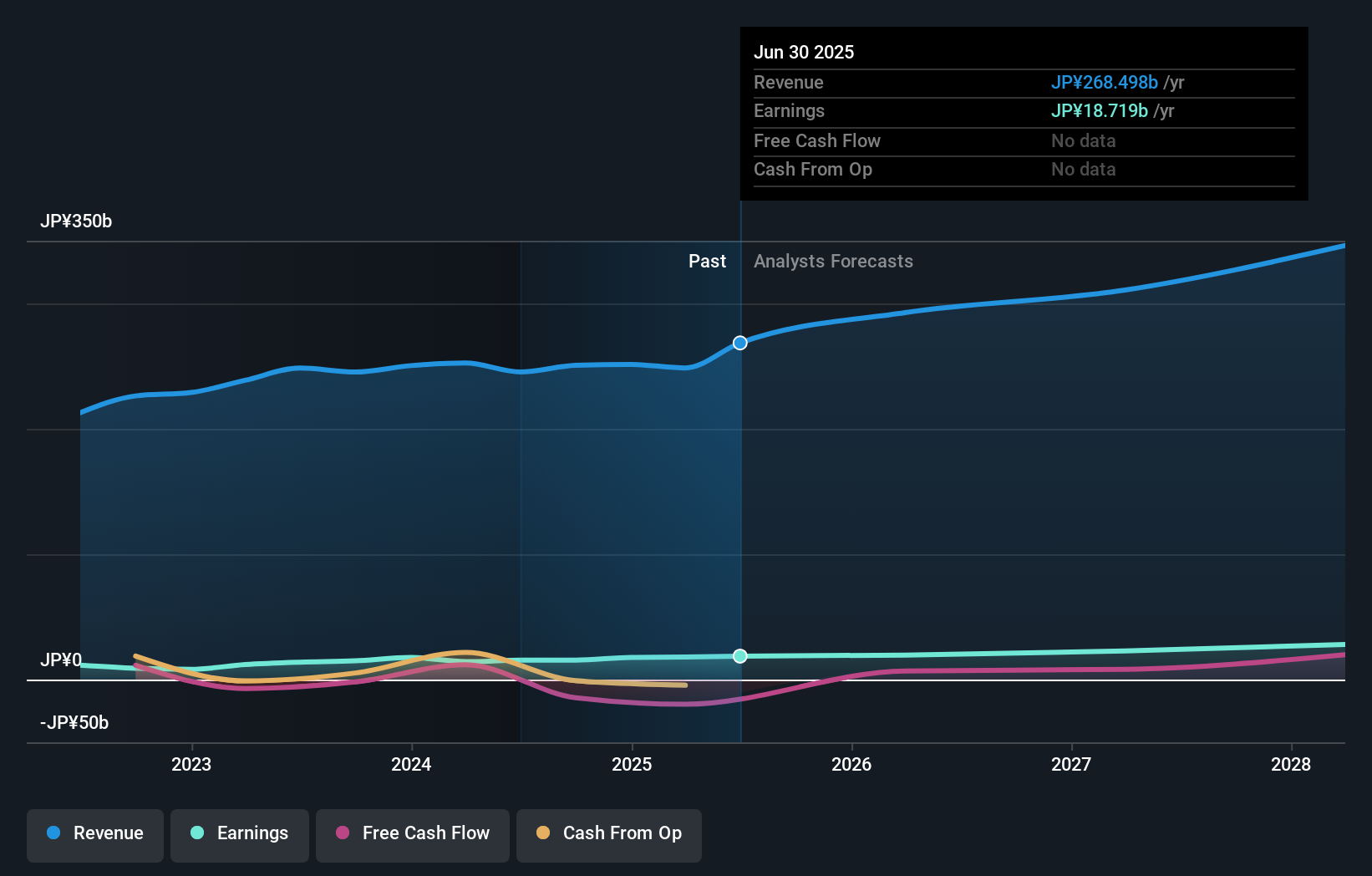

- Japan Steel Works recently reported a strong performance for the six months ending September 30, 2025, with net sales up by 25.3% and profit attributable to owners rising by 67.9% year-on-year.

- This improvement was paired with enhanced financial ratios and higher dividends, signaling greater financial stability for shareholders.

- We'll explore how Japan Steel Works' improved equity-to-asset ratio shapes its investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Japan Steel Works' Investment Narrative?

To be a shareholder in Japan Steel Works, it helps to believe in the strength of its industrial expertise and potential for consistent long-term expansion, despite sector volatility and recent period price fluctuations. The company’s latest report showing a sharp rise in both net sales and profit signals that demand drivers are materializing, which could shift the perceived risks and catalysts for the stock. Before this update, worries about high valuation multiples, relatively low return on equity, and board turnover weighed heavily on the outlook, alongside a forward profit growth rate expected to outpace the market but fall short of extraordinary levels. The strong interim results and improved equity-to-asset ratio might ease near-term concerns about financial health while justifying higher dividends. However, the company's valuation remains elevated, and the market’s subdued price reaction suggests that risks related to competition and sustainable profit improvements still matter.

But with board turnover still high, not all the risks have faded. Japan Steel Works' share price has been on the slide but might be up to 27% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Japan Steel Works - why the stock might be worth 21% less than the current price!

Build Your Own Japan Steel Works Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Steel Works research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Japan Steel Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Steel Works' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5631

Japan Steel Works

Engages in the provision of industrial machinery products, and material and engineering solutions in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives