NGK Insulators (TSE:5333) Deepens US AI Chip Exposure With ¥8.96b Capacity Push – What's Changed

Reviewed by Sasha Jovanovic

- NGK Insulators recently approved an ¥8.96 billion investment in its U.S. subsidiary FM Industries to lift semiconductor manufacturing equipment component capacity by about 20%, with expanded production targeted from January 2027.

- By scaling FM Industries’ Arizona facilities to support rising semiconductor demand linked to AI applications, NGK is deepening its exposure to higher-value technology supply chains.

- Next, we’ll examine how this sizeable semiconductor capacity expansion shapes NGK Insulators’ investment narrative and longer-term growth positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is NGK Insulators' Investment Narrative?

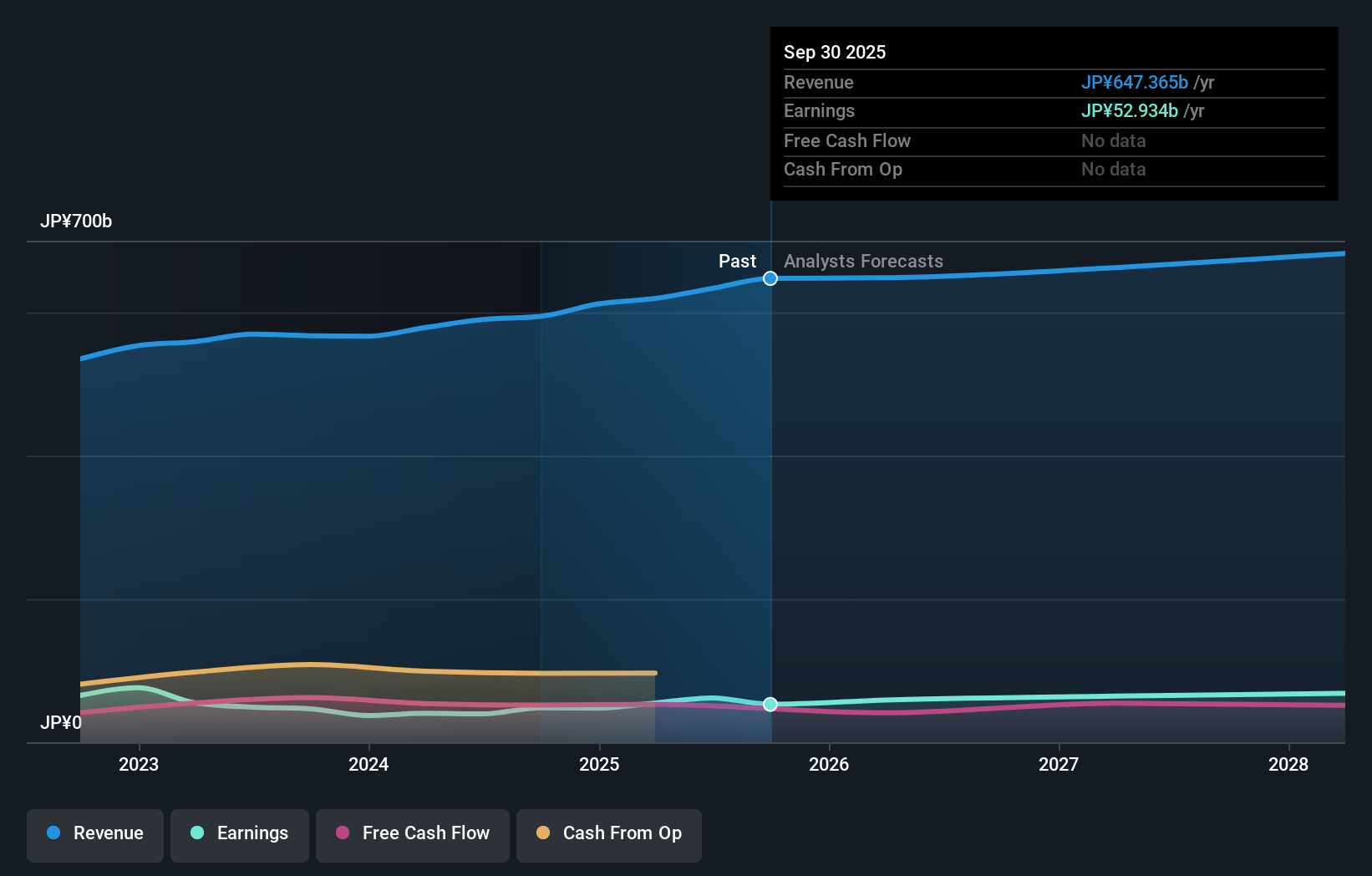

To own NGK Insulators, you need to believe it can compound steadily as a diversified, profit-generating ceramics and components business while selectively leaning into higher-value niches like semiconductors and advanced electronics. Earnings have been growing faster than revenue, and management has paired that with buybacks and dividends, which has already been rewarded by a very strong share price run. The new ¥8.96 billion FM Industries investment nudges the story a bit more toward AI-related semiconductor exposure, but given the scale of NGK’s overall business, this looks more like an incremental catalyst than a near-term game changer. It may slightly sharpen the growth angle, while also increasing capital intensity and execution risk in the U.S. Just remember, the stock is already trading above some fair value estimates.

However, that semiconductor expansion introduces an important new risk investors should understand. NGK Insulators' shares are on the way up, but they could be overextended by 20%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on NGK Insulators - why the stock might be worth as much as ¥2807!

Build Your Own NGK Insulators Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGK Insulators research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NGK Insulators research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGK Insulators' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGK Insulators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5333

NGK Insulators

Manufactures and sells electric power related equipment in Japan, rest of Asia, North America, Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026