- Japan

- /

- Industrials

- /

- TSE:4204

Sekisui Chemical (TSE:4204) Earnings Growth Forecast Tops Market, Dividend Sustainability Remains Key Risk

Reviewed by Simply Wall St

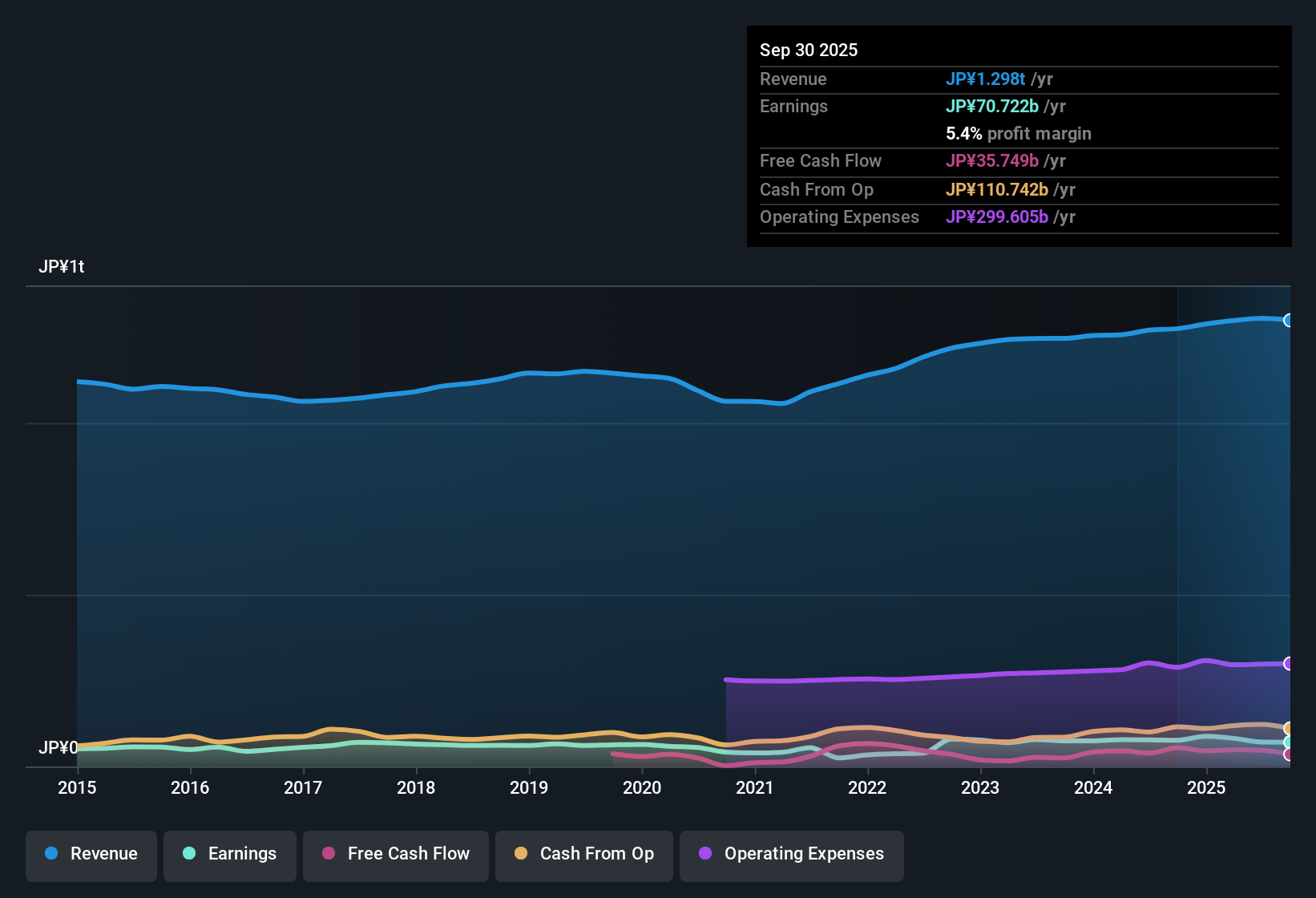

Sekisui Chemical (TSE:4204) is forecasting earnings growth of 12.1% per year, with revenue expected to rise by 4.3% annually. The company's net profit margin stands at 5.4%, down from 6% last year, and over the past five years, earnings have grown at a 16% annual rate even though the most recent year saw earnings decline. Investors are weighing Sekisui’s high quality of earnings and its projected earnings outperformance against the Japanese market, while taking note of risks to dividend sustainability and the current margin trend.

See our full analysis for Sekisui Chemical.Next, we will see how these latest numbers align with the narratives that investors and analysts are following. This will highlight both where the consensus holds and where the market story could shift.

See what the community is saying about Sekisui Chemical

Profit Margin Forecasts to Recover

- Analysts expect Sekisui Chemical’s profit margins to rise from today’s 5.5% to 7.1% in three years, a projected improvement of 1.6 percentage points, provided investments in solar cell capacity and modular construction bear fruit.

- According to the analysts' consensus view, the company is leveraging innovation in premium housing, new energy-efficient materials, and advanced healthcare to drive margin expansion, but faces hurdles from ongoing weakness in international operations and cost pressures in key segments.

- Planned expansion in Europe and infrastructure renovation are positioned as margin tailwinds. Consensus expects these to offset slow demand in Japan and volatile FX trends.

- Bulls may be challenged by persistent reliance on the domestic market and regulatory cost headwinds. Consensus notes these factors could temper the margin improvement story if growth in global segments falters.

See what’s behind analysts’ calls for higher margins and whether the roadblocks to recovery stack up in the full consensus narrative. 📊 Read the full Sekisui Chemical Consensus Narrative.

DCF Value Suggests Upside

- While Sekisui Chemical’s share price is ¥2,675, the DCF fair value estimate stands at ¥4,068.69. This represents a 52% premium over the market price, signaling meaningful upside if those cash flow forecasts are realized.

- The analysts' consensus narrative points out that ongoing profit and revenue growth, supported by new technologies and geographic diversification, justifies a valuation above the sector average. However, this is counterbalanced by divergent analyst price targets and worries about cost inflation.

- Despite being labeled expensive on a P/E basis versus peers, Sekisui trades well below DCF fair value. Analysts see this as a rare opportunity, provided long-term growth assumptions hold.

- The tight gap between the analyst price target (¥2,910) and the market price indicates some skepticism and highlights the need for critical scrutiny of growth forecasts before assuming fair value is truly within reach.

Dividend Durability in Question

- The only major risk currently highlighted is the sustainability of Sekisui Chemical's dividend amid squeezed profit margins and declining demand in some international businesses.

- Analysts' consensus narrative flags that while new products and global expansion could stabilize earnings and support the payout, threats from negative FX effects, rising regulatory costs, and weak medical segment demand highlight why dividend sustainability is more fragile than headline growth may suggest.

- Bears are particularly concerned that ongoing repair costs and slower recovery overseas may drain cash and crimp distributions, especially if margin recovery lags.

- Still, consensus is watching whether profit margin improvement and strategic innovation can counterbalance the headwinds and protect the dividend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sekisui Chemical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might have missed? Put your perspective in motion and craft a custom narrative in just minutes. Do it your way

A great starting point for your Sekisui Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sekisui Chemical’s weakening profit margins, dividend concerns, and heavy reliance on the domestic market may leave investors searching for more dependable income opportunities.

If reliable dividends and financial resilience matter most to you, uncover options offering higher yield and stronger payout track records with these 2008 dividend stocks with yields > 3% built for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4204

Sekisui Chemical

Engages in the housing, urban infrastructure and environmental products, high performance plastics, and medical businesses in Japan, Europe, Asia, and the Americas.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives