Does Nitto Boseki (TSE:3110) Already Price In Its Glass Expansion-Led Future?

Reviewed by Sasha Jovanovic

- Mizuho recently downgraded Nitto Boseki Co Ltd to Neutral from Outperform, arguing that the current share price already reflects its new NE/NER glass capacity expansion.

- Despite the downgrade, Mizuho still highlights a positive longer-term demand backdrop for Nitto Boseki’s glass products, underscoring ongoing structural support for its core business.

- We’ll now examine how Mizuho’s view that expansion benefits are fully priced in shapes Nitto Boseki’s broader investment narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Nitto Boseki's Investment Narrative?

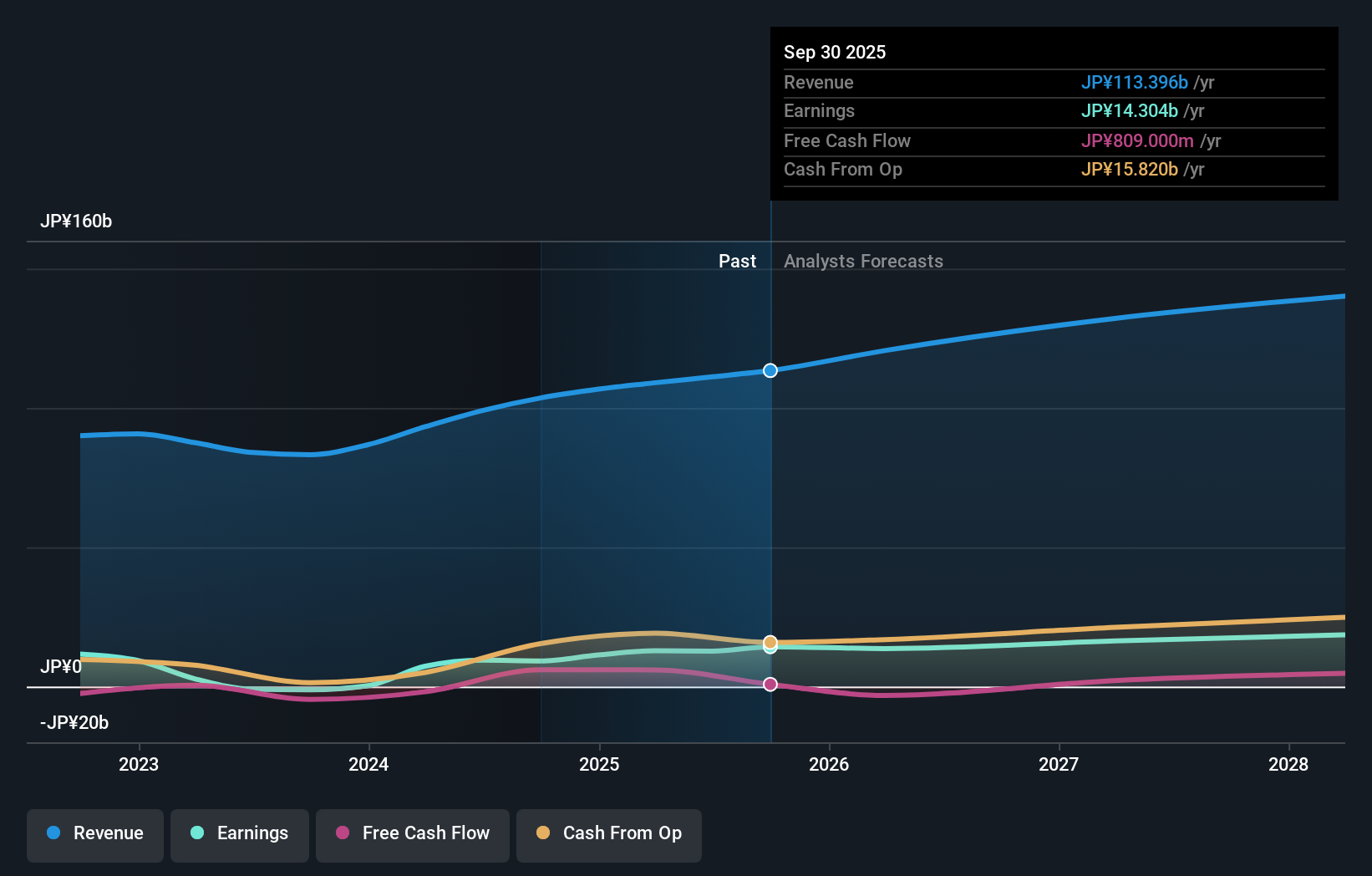

To own Nitto Boseki today, you need to believe its specialty glass and materials platform can keep compounding value even as the easy wins from the NE/NER capacity build fade. The recent Mizuho downgrade effectively says the market has already “banked” that expansion, which slightly cools the near term re rating catalyst from capacity-driven earnings upside, especially after a very large 1 year total return and heightened volatility. That puts more weight on execution against the FY2024–2027 plan, delivery on revised FY2026 guidance and the sustainability of higher dividends funded by both core profits and one off asset sale gains. The key risk now is that a premium valuation and forecast earnings softness leave less room for operational missteps if demand or pricing underwhelm.

But there is one valuation risk here that investors should not ignore. Nitto Boseki's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Nitto Boseki - why the stock might be worth 42% less than the current price!

Build Your Own Nitto Boseki Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nitto Boseki research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nitto Boseki research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nitto Boseki's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3110

Nitto Boseki

Manufactures, processes, and sells glass fiber products, chemical and pharmaceutical products, and textile products in Japan.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026