- China

- /

- Electrical

- /

- SHSE:601567

Asian Market Stocks Estimated Up To 26% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets closely monitor economic indicators and central bank decisions, Asian stock markets are navigating a complex landscape marked by both opportunities and challenges. Amidst this environment, identifying stocks that are trading below their intrinsic value can be a strategic approach for investors looking to capitalize on potential growth opportunities in the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.22 | CN¥302.65 | 49% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.18 | CN¥161.78 | 48.6% |

| Sinolong New Materials (SZSE:301565) | CN¥28.14 | CN¥55.48 | 49.3% |

| Meitu (SEHK:1357) | HK$7.47 | HK$14.60 | 48.8% |

| Last One MileLtd (TSE:9252) | ¥3530.00 | ¥6867.62 | 48.6% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29250.00 | ₩56972.54 | 48.7% |

| East Buy Holding (SEHK:1797) | HK$20.44 | HK$40.26 | 49.2% |

| COVER (TSE:5253) | ¥1562.00 | ¥3094.02 | 49.5% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.80 | 49.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.28 | CN¥55.83 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution products in China and internationally, with a market cap of CN¥32.52 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates revenue by manufacturing and selling power distribution products both domestically and internationally.

Estimated Discount To Fair Value: 26%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥23.14, significantly below its estimated fair value of CN¥31.29, indicating it may be undervalued based on cash flows. Despite recent volatility, the stock's earnings are forecast to grow 28.81% annually over the next three years, outpacing the broader Chinese market's growth rate of 27.2%. However, its dividend yield of 4.19% is not well covered by current earnings or free cash flows, presenting a potential risk for investors seeking income stability.

- Our earnings growth report unveils the potential for significant increases in Ningbo Sanxing Medical ElectricLtd's future results.

- Get an in-depth perspective on Ningbo Sanxing Medical ElectricLtd's balance sheet by reading our health report here.

Nanya New Material TechnologyLtd (SHSE:688519)

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials with a market cap of CN¥15.91 billion.

Operations: The company generates revenue through its core activities of manufacturing, designing, developing, and selling composite materials.

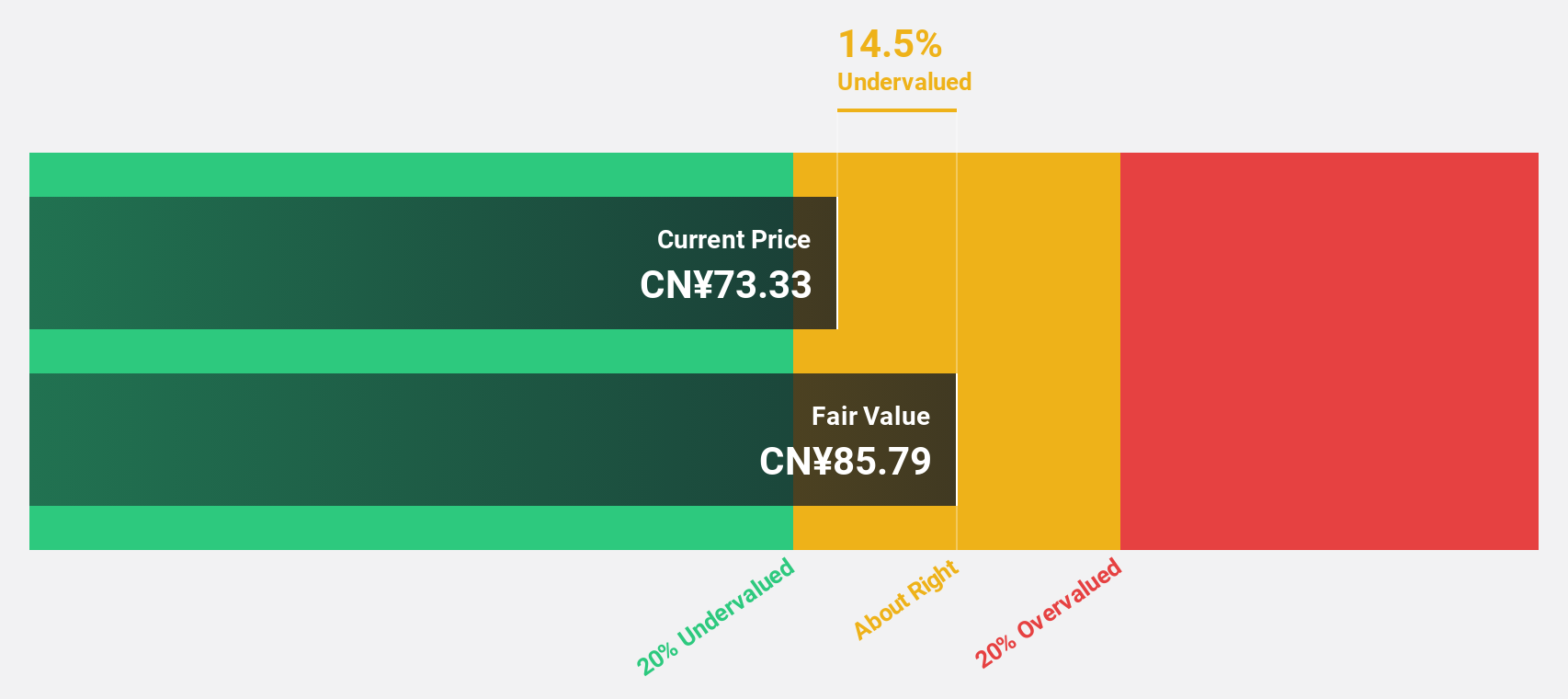

Estimated Discount To Fair Value: 15.7%

Nanya New Material Technology Ltd. is trading at CN¥69.5, below its estimated fair value of CN¥82.48, suggesting potential undervaluation based on cash flows. The company reported significant revenue growth to CN¥3.66 billion for the first nine months of 2025, with net income rising to CN¥158.1 million from the previous year’s figures. Despite a volatile share price and low forecasted return on equity, earnings are expected to grow significantly faster than the market average over the next three years.

- Insights from our recent growth report point to a promising forecast for Nanya New Material TechnologyLtd's business outlook.

- Click to explore a detailed breakdown of our findings in Nanya New Material TechnologyLtd's balance sheet health report.

MonotaRO (TSE:3064)

Overview: MonotaRO Co., Ltd. operates an online store for MRO products catering to factories both in Japan and internationally, with a market cap of ¥1.11 trillion.

Operations: The company's revenue primarily comes from its Indirect Material Sales Business for Factories, generating ¥318.01 billion.

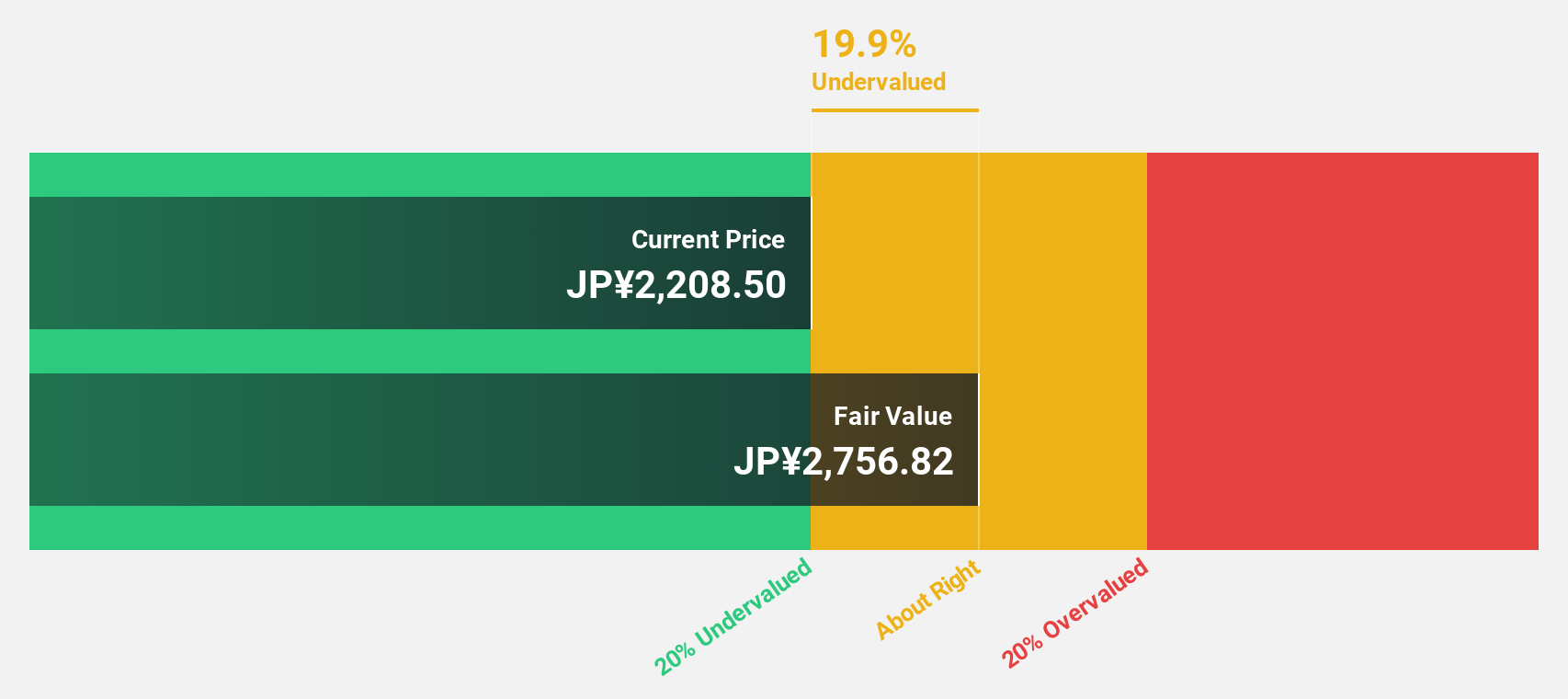

Estimated Discount To Fair Value: 16.6%

MonotaRO is trading at ¥2,230, below its estimated fair value of ¥2,674.47. Recent sales data shows robust growth with October 2025 sales reaching ¥29.42 billion compared to ¥25.35 billion a year earlier. Earnings are projected to grow at 13.5% annually, outpacing the JP market's average of 8.3%, while revenue growth is expected to exceed market rates as well. However, the stock has experienced high volatility recently and trades only slightly below fair value based on cash flows.

- Our expertly prepared growth report on MonotaRO implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of MonotaRO.

Key Takeaways

- Click this link to deep-dive into the 277 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sanxing Medical ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601567

Ningbo Sanxing Medical ElectricLtd

Manufactures and sells power distribution in China and internationally.

Very undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026