- Japan

- /

- Trade Distributors

- /

- TSE:2768

How Sojitz’s Latin America Healthcare Move and New Transport Unit (TSE:2768) Has Reshaped Its Diversification Story

Reviewed by Sasha Jovanovic

- In November 2025, Auna S.A. announced that it entered into a Memorandum of Understanding with Sojitz Corporation of America to explore joint healthcare business opportunities in Latin America, initially focusing on Mexico, alongside plans for approximately US$500 million in investments over the next three to five years.

- On the same day, Sojitz revealed the establishment of a specified subsidiary, Sojitz Australia Transport Pty Ltd., with A$300 million in capital for transportation sector investments, highlighting an expansion in both sector and geographic reach.

- We will explore how Sojitz's push into Latin American healthcare could impact its wider growth and diversification narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Sojitz Investment Narrative Recap

To be a shareholder in Sojitz, you need to believe in its capacity to adapt and diversify beyond cyclical commodities, driving growth through well-timed sector expansion and disciplined capital management. The recent announcements regarding joint healthcare ventures in Latin America and transportation sector investments do not materially alter the most important short-term catalyst, Sojitz’s continued success in high-growth industries, or shift the biggest risk, which remains potential margin pressure from rising costs and investment outflows. The establishment of Sojitz Australia Transport Pty Ltd., with A$300 million in capital, is especially relevant, as it underscores Sojitz’s expansion into new geographies and sectors. This diversification effort may influence both the company’s earnings mix and its exposure to sector-specific risks, tying directly to ongoing efforts to reduce reliance on more volatile, commodity-driven revenues. However, before considering any exposure, investors should also be aware of the persistent risk that operating costs from these new ventures may rise faster than anticipated, especially if synergies are not realized…

Read the full narrative on Sojitz (it's free!)

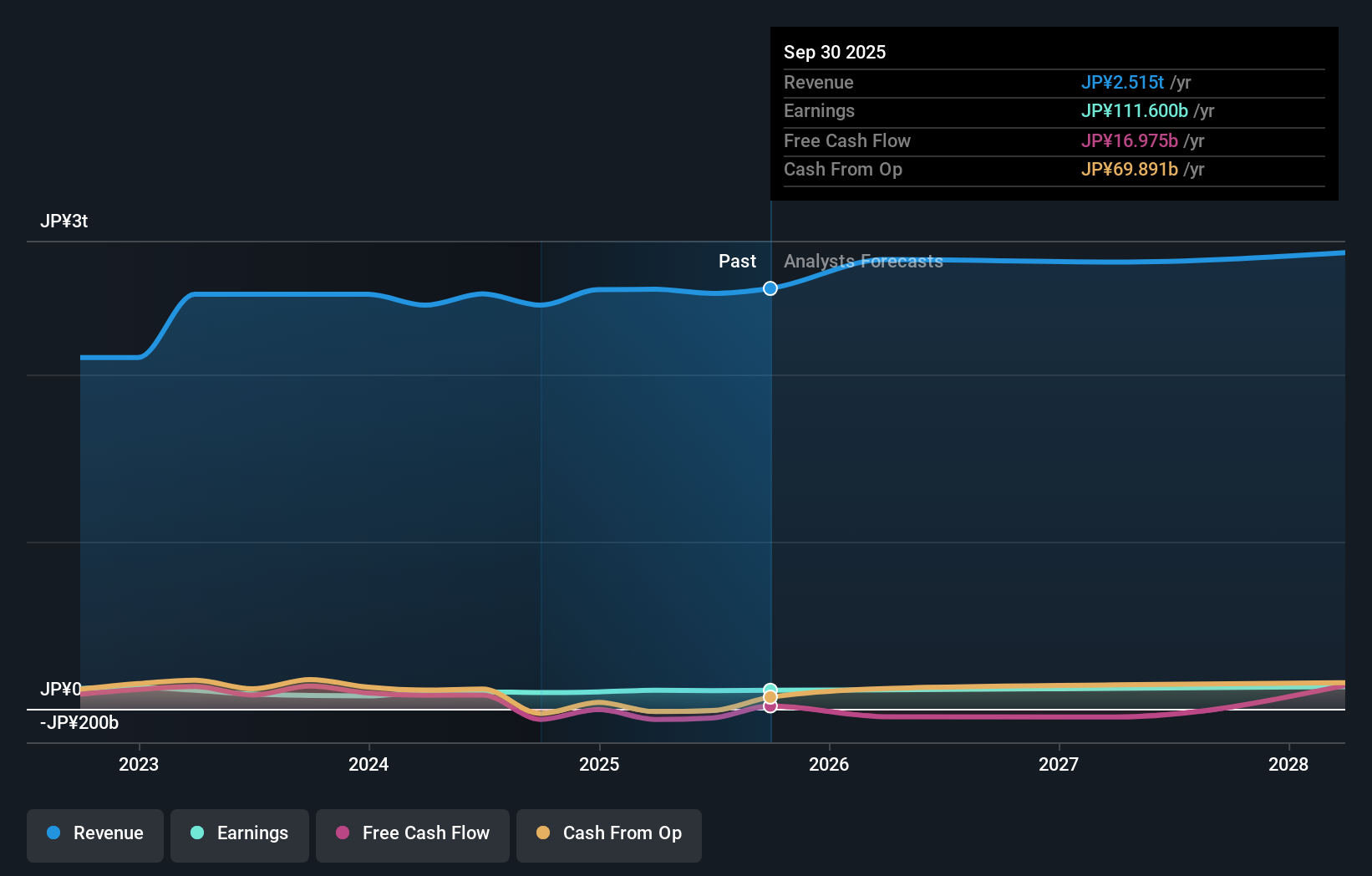

Sojitz's narrative projects ¥2,765.9 billion revenue and ¥131.2 billion earnings by 2028. This requires 3.6% yearly revenue growth and an earnings increase of ¥22.5 billion from the current earnings of ¥108.7 billion.

Uncover how Sojitz's forecasts yield a ¥4490 fair value, in line with its current price.

Exploring Other Perspectives

You have two unique fair value estimates from the Simply Wall St Community, ranging from ¥2,774 to ¥4,490 per share, highlighting a wide spectrum of views. While some see significant value, uncertainty remains about whether rising consolidation costs and expansion efforts can deliver the operational efficiencies Sojitz needs to protect margins and improve outcomes, explore more perspectives for a fuller picture.

Explore 2 other fair value estimates on Sojitz - why the stock might be worth as much as ¥4490!

Build Your Own Sojitz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sojitz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sojitz's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026