- Japan

- /

- Construction

- /

- TSE:1959

Kraftia’s Higher Dividend and New Guidance Might Change The Case For Investing In Kraftia (TSE:1959)

Reviewed by Sasha Jovanovic

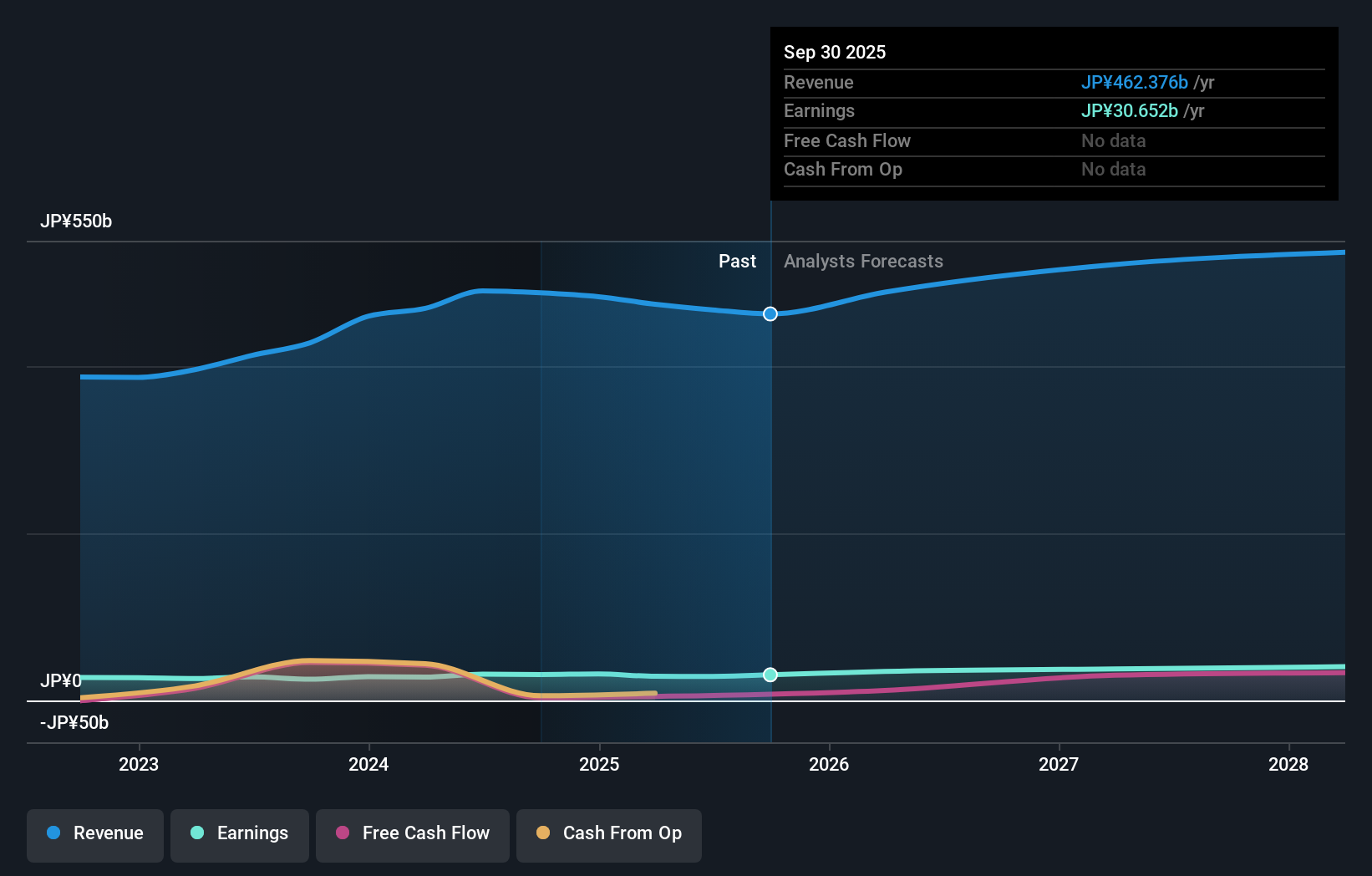

- Kraftia Corporation declared a dividend of ¥90 per share for the second quarter ended September 30, 2025, up from ¥65 per share a year earlier, and also released updated earnings guidance for the fiscal year ending March 31, 2026.

- This combination of a higher dividend and full-year financial forecasts provides investors with additional clarity on Kraftia’s capital return direction and operational outlook.

- We’ll examine how Kraftia’s increased dividend signals its confidence in future earnings and impacts its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kraftia's Investment Narrative?

For someone considering Kraftia as a holding, the bigger picture is about believing in the company’s ability to sustain its growth momentum and deliver attractive returns in a market where peers have seen mixed results. The recent increase in the quarterly dividend gives the impression that management feels good about the year ahead and wants to reward shareholders, while the confirmed earnings forecast signals operational stability for the time being. This combination provides more clarity on near-term catalysts, with the next real test likely to come at the upcoming earnings release and at the general meeting after the business name change. However, the higher dividend has implications for cash flow coverage, a concern that was already on the radar and now becomes even more important to monitor. Most risks and catalysts remain unchanged, but the capital return policy takes on higher meaning after this news.

In contrast, investors should pay close attention to how dividend sustainability could affect future growth.

Exploring Other Perspectives

Explore 2 other fair value estimates on Kraftia - why the stock might be worth just ¥7740!

Build Your Own Kraftia Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraftia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kraftia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraftia's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraftia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1959

Kraftia

Engages in design, construction, and installation of power infrastructure construction business in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives