- Japan

- /

- Construction

- /

- TSE:1801

Taisei (TSE:1801) Revs Up Guidance: What Do Upgrades Mean for the Stock’s Valuation?

Reviewed by Simply Wall St

Taisei (TSE:1801) just raised its full-year earnings forecasts, citing solid results from domestic operations and the addition of Toyo Construction as a subsidiary. The company's progress on large-scale projects and improvements in margins are boosting expectations.

See our latest analysis for Taisei.

Taisei’s upbeat momentum is hard to miss, with the latest guidance upgrade and successful completion of a major buyback campaign energizing the mood around the stock. Investors have responded, driving a 16.2% one-month share price return and pushing the year-to-date gain to an impressive 84.6%. The three-year total shareholder return sits above 240%. Recent moves suggest optimism is building, supported by both operational performance and strategic financial decisions.

If this kind of uptick has you thinking about what else could be on the rise, now is a great time to see which other companies are making waves among fast growing stocks with high insider ownership.

But with shares up nearly 85% this year and recent upgrades already factored in, the key question is whether Taisei’s current valuation leaves room for more upside or if the market is already ahead of future growth.

Price-to-Earnings of 15.4x: Is it justified?

With Taisei trading at a price-to-earnings (P/E) ratio of 15.4x, the stock appears attractively priced against both peer and fair value benchmarks. This offers investors a potential value opportunity at the recent close of ¥12,155.

The price-to-earnings ratio captures how much investors are willing to pay for each yen of company earnings. For construction companies like Taisei, it helps assess whether the stock’s current valuation reflects its earnings power and future growth prospects.

In Taisei’s case, the P/E ratio is not only below the peer average of 16.8x but also comfortably under its estimated fair P/E of 17.8x. This places the company in a strong position if its recent earnings growth can be sustained or improved, suggesting that the market may be undervaluing its profit potential.

However, Taisei’s P/E remains higher than the broader Japanese construction industry’s average of 12.2x, indicating elevated expectations for the company relative to most competitors. Still, compared to the level our models suggest the market could move toward, Taisei appears well-priced.

Explore the SWS fair ratio for Taisei

Result: Price-to-Earnings of 15.4x (UNDERVALUED)

However, temporary revenue and net income growth, combined with Taisei's shares already trading near targets, could quickly shift investor sentiment if trends reverse.

Find out about the key risks to this Taisei narrative.

Another View: Our DCF Model Sees More Upside

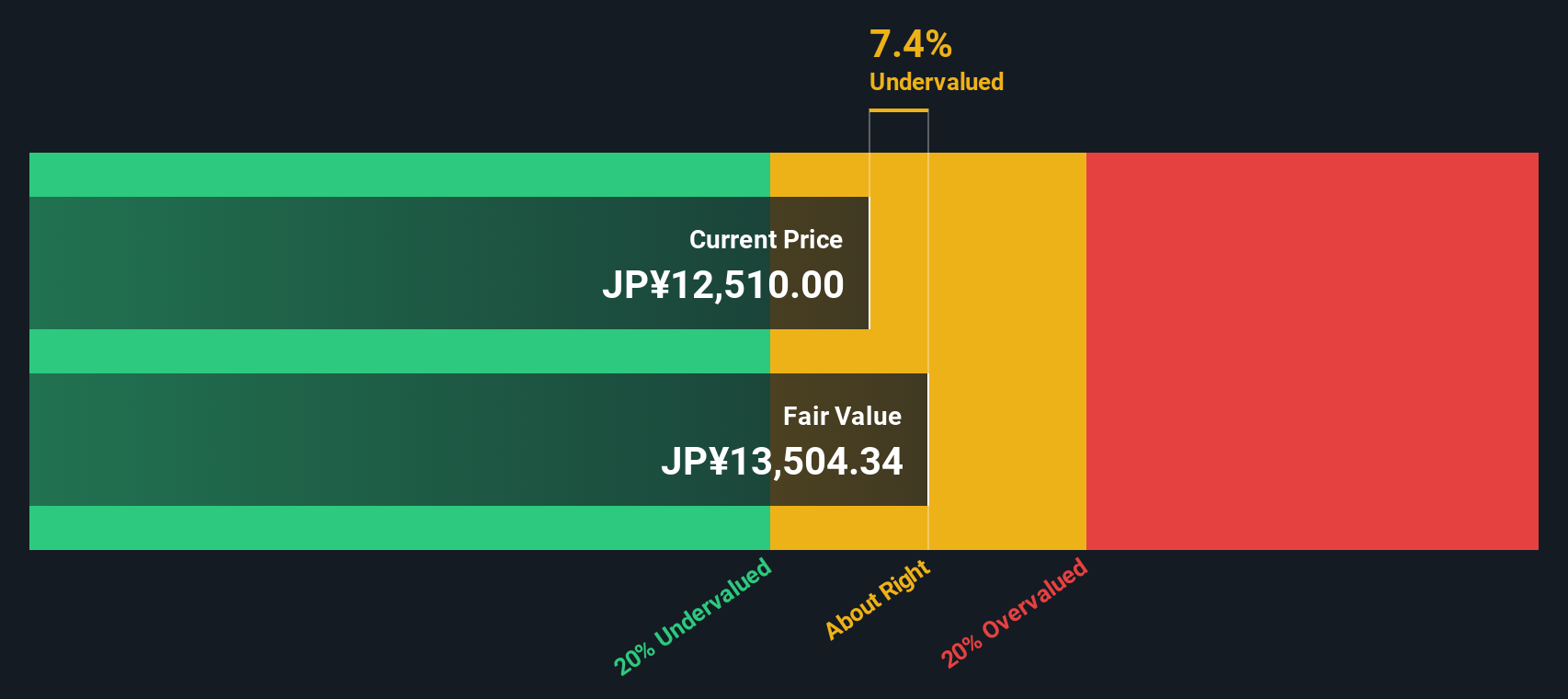

Looking at valuation through a different lens, our SWS DCF model estimates Taisei’s fair value at ¥14,828, about 18% above the current share price. This suggests a deeper undervaluation than indicated by earnings multiples alone. However, does the DCF’s optimism align with real-world results?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taisei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taisei Narrative

If you have your own perspective on Taisei or prefer to dive into the data and reach your own conclusions, you can do so in just a few minutes with Do it your way.

A great starting point for your Taisei research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Action leads to opportunity, so do not let standout investment prospects slip away. Take charge and seek out companies set to make an impact across global markets.

- Uncover fresh growth stories by starting with these 3575 penny stocks with strong financials, which offer explosive potential far beyond the conventional big names.

- Boost your returns with steady income from these 16 dividend stocks with yields > 3%, which consistently deliver attractive yields and long-term financial stability.

- Capture the power of innovation and transformation by evaluating these 24 AI penny stocks, positioned at the forefront of artificial intelligence development and adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taisei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1801

Taisei

Engages in the civil engineering, construction, and real estate development businesses in Japan.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives