Is Yamaguchi Financial Group (TSE:8418) Still Undervalued After Announcing a Major Share Buyback?

Reviewed by Simply Wall St

Yamaguchi Financial Group (TSE:8418) just rolled out a share repurchase program, planning to buy back up to 10,000,000 shares, which equals about 5% of its share capital. The move reflects management’s commitment to improving shareholder returns through better capital efficiency.

See our latest analysis for Yamaguchi Financial Group.

The buyback news comes shortly after a period of steady momentum. Yamaguchi Financial Group’s share price jumped 13% this past week and is up 23% year-to-date. The one-year total shareholder return stands at an impressive 33%. With additional board moves and branch reorganizations underway, the stock’s rally reflects renewed optimism about growth and capital returns.

If strong financial momentum gets you thinking about broader opportunities, now is a good time to expand your research and discover fast growing stocks with high insider ownership

With the stock’s sharp gains and a new buyback on the table, is Yamaguchi Financial Group still trading at a discount, or have investors already priced in the company’s future growth potential?

Price-to-Earnings of 10.6x: Is it justified?

Yamaguchi Financial Group’s price-to-earnings ratio of 10.6x sits notably below the Japanese market average of 14.1x. This suggests the stock might be trading at a relative discount compared to its peers.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each unit of a company’s earnings. In Japan’s banking sector, where stable but modest profit growth is typical, a lower P/E can either signal undervaluation or highlight market skepticism about future performance.

At 10.6x, Yamaguchi Financial Group’s P/E is not only lower than the national market but also below the Banks industry average of 11.3x. This means the market is pricing the company’s earnings at a cheaper rate than its industry peers. In addition, our estimates show the fair P/E ratio should be about 12.4x. This hints there is room for the share price to adjust upward if market perceptions improve.

Explore the SWS fair ratio for Yamaguchi Financial Group

Result: Price-to-Earnings of 10.6x (UNDERVALUED)

However, slower net income growth and a share price already near its analyst target could limit further upside for Yamaguchi Financial Group in the near term.

Find out about the key risks to this Yamaguchi Financial Group narrative.

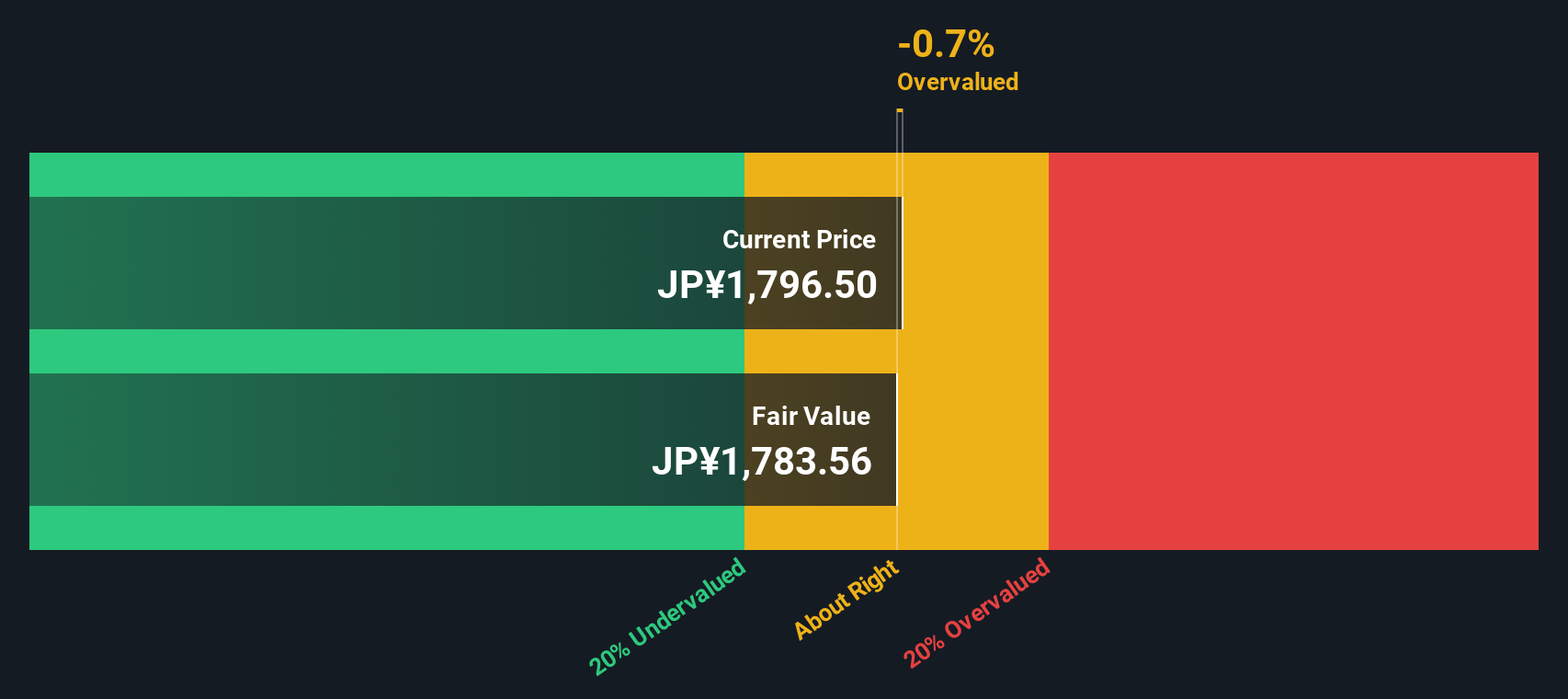

Another View: SWS DCF Model Suggests Limited Upside

While valuation based on earnings shows Yamaguchi Financial Group as undervalued, our SWS DCF model offers a different perspective. The DCF model values shares at ¥1,782.45, which is below the current trading price of ¥2,038. This suggests the stock may actually be slightly overvalued based on projected future cash flows. Is the market looking through short-term momentum, or are future growth assumptions too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yamaguchi Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yamaguchi Financial Group Narrative

If you want to dig deeper or have a different take, you can put together your own analysis in just a few minutes. Do it your way

A great starting point for your Yamaguchi Financial Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make the most of your research time and uncover stocks you might be missing. Tap into new sectors and trends by focusing on companies catching smart investors’ attention.

- Grow your portfolio’s potential with these 920 undervalued stocks based on cash flows. This tool is packed with stocks trading below their intrinsic worth and offers compelling entry points right now.

- Boost income streams by checking out these 15 dividend stocks with yields > 3%, which features established companies known for consistent dividends and attractive yields above 3%.

- Ride the next technology wave by finding these 25 AI penny stocks, a resource highlighting companies at the heart of AI disruption and fueling tomorrow’s innovation leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8418

Yamaguchi Financial Group

Provides various banking products and services in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.