How Investors Are Reacting To Mitsubishi UFJ Financial Group (TSE:8306) Considering a Share Buyback After Recent Board Meeting

Reviewed by Sasha Jovanovic

- Mitsubishi UFJ Financial Group recently held a board meeting on November 14, 2025, to discuss the potential repurchase of common stock, following its H1 2026 earnings call and a presentation at the Morgan Stanley Asia-Pacific Summit.

- This series of events reflects the company's ongoing focus on capital management and strengthening investor relations through transparency and shareholder engagement.

- We'll assess how the board's consideration of share repurchases shapes Mitsubishi UFJ Financial Group's ongoing investment narrative and capital strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Mitsubishi UFJ Financial Group Investment Narrative Recap

Mitsubishi UFJ Financial Group attracts shareholders who value steady capital management and disciplined shareholder returns, with share buybacks and dividends as core components. The latest board approval for a new buyback program on November 14, 2025, underpins the company’s capital allocation approach but does not materially alter the most pressing short-term catalyst, continued gains from equity sales, or its biggest risk of bond portfolio sensitivity to interest rate changes in the U.S.

Among recent announcements, the November 14 buyback approval directly follows the half-year earnings call and revised fiscal guidance, underscoring management's focus on enhancing shareholder value amid earnings tailwinds. While the buyback may support near-term share performance, investors should continue to monitor the effect of external rate movements and revenue mix as significant catalysts and risks going forward.

However, beneath these shareholder-friendly moves, some risks, such as exposure to U.S. bond yields, remain important for investors to consider if...

Read the full narrative on Mitsubishi UFJ Financial Group (it's free!)

Mitsubishi UFJ Financial Group's outlook anticipates ¥6,429.1 billion in revenue and ¥2,385.3 billion in earnings by 2028. This projection is based on a 5.7% annual revenue growth rate, and represents an earnings increase of ¥1,128.2 billion from current earnings of ¥1,257.1 billion.

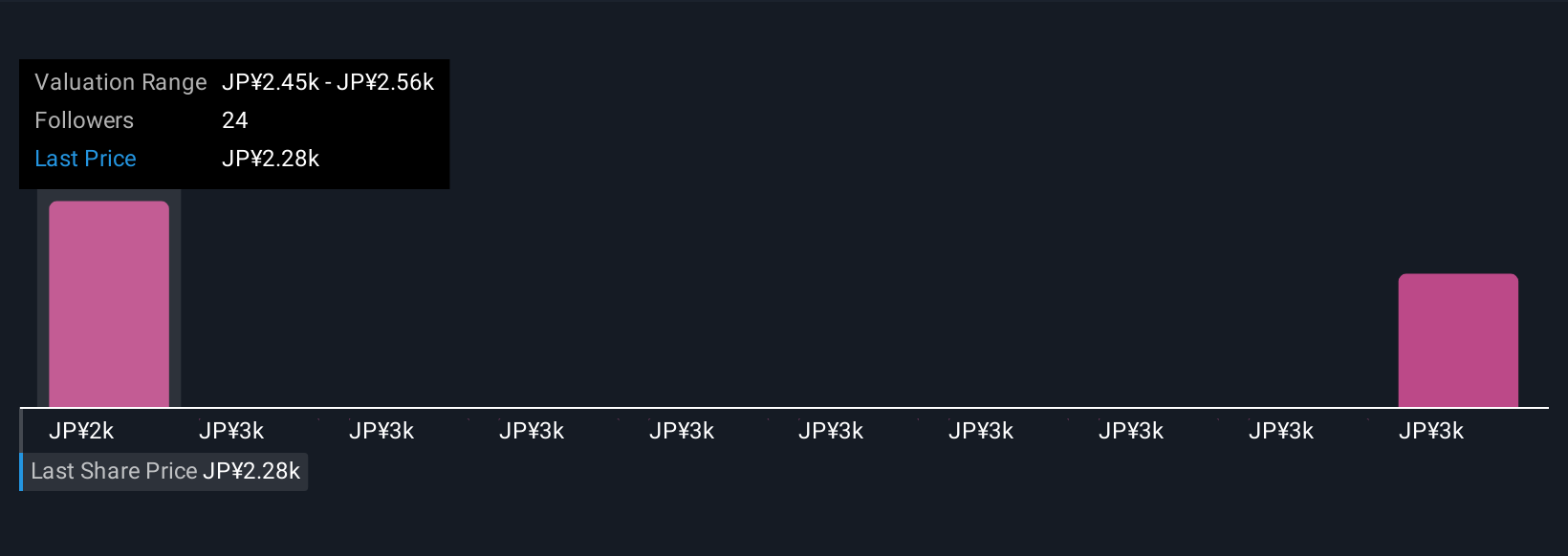

Uncover how Mitsubishi UFJ Financial Group's forecasts yield a ¥2469 fair value, in line with its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from ¥2,469 to ¥3,664 per share, revealing wide variance in outlooks. When weighed against the bank’s dependence on equity sales for profit targets, this diversity shows how much opinions can differ about future earnings resilience, explore several perspectives to build your own informed view.

Explore 3 other fair value estimates on Mitsubishi UFJ Financial Group - why the stock might be worth just ¥2469!

Build Your Own Mitsubishi UFJ Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi UFJ Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi UFJ Financial Group's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026