Strong Profit and Income Growth Might Change the Case For Investing in Rakuten Bank (TSE:5838)

Reviewed by Sasha Jovanovic

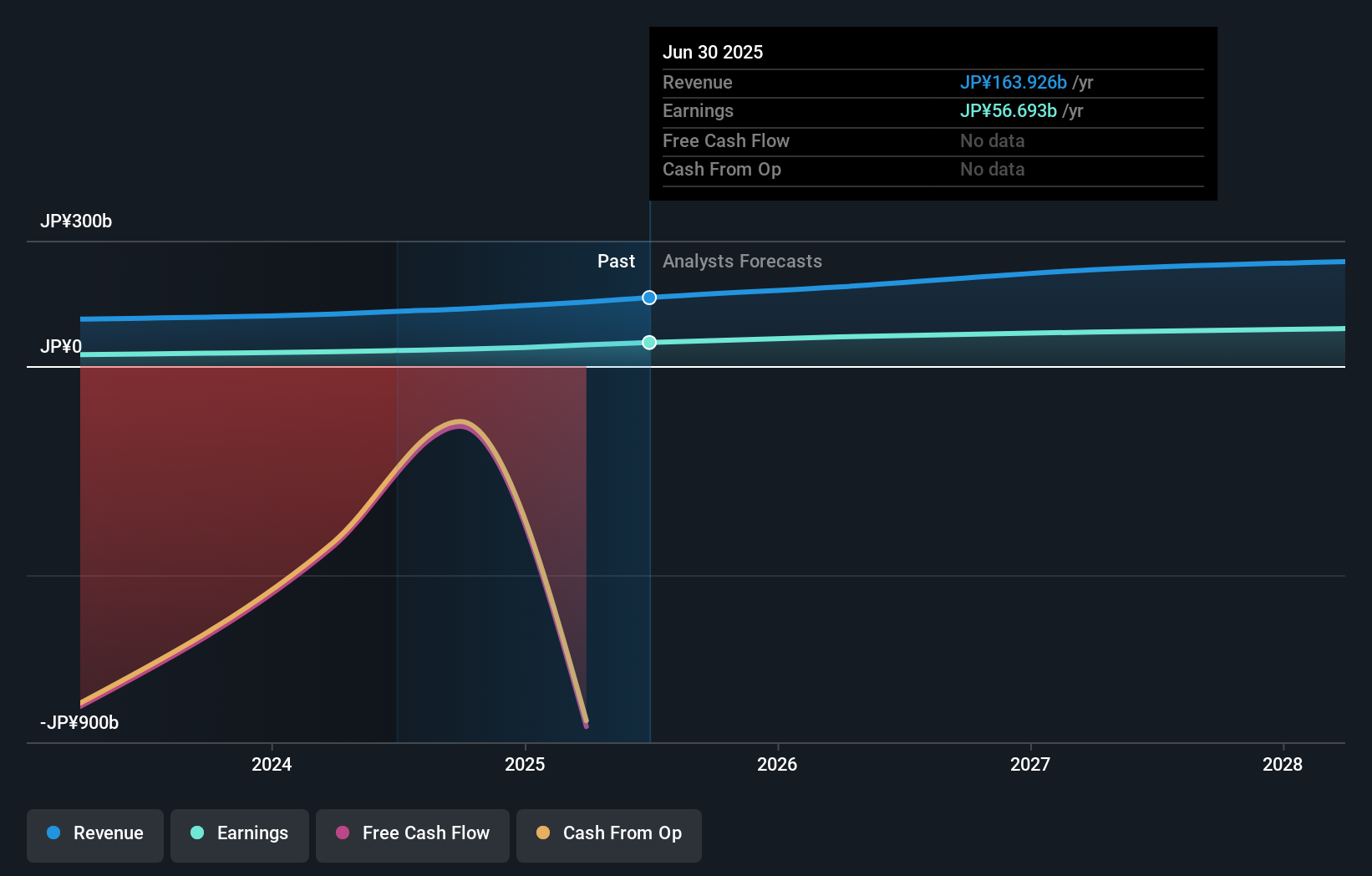

- Rakuten Bank reported strong financial results for the six months ended September 30, 2025, with ordinary income rising 41.4% and profit attributable to owners of the parent increasing 53.5% year-on-year.

- This significant financial improvement highlights the effectiveness of the bank’s operational strategies and its strengthened position in the competitive financial sector.

- We'll explore how the sharp gains in profitability further shape Rakuten Bank’s investment narrative and prospects for operational growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Rakuten Bank's Investment Narrative?

For shareholders, the core belief driving interest in Rakuten Bank centers on its ability to translate operational scale and strategic management into sustained earnings growth, particularly as digital finance disrupts traditional banking. The latest results reinforce this narrative: robust profit growth and surging ordinary income support recent boosted guidance and indicate operational strategies are working. This financial strength may alter the importance of short-term catalysts, especially ahead of the next results, since previous risk factors such as management shifts or volatile share price seem less pressing right now. However, valuation remains a concern, as the bank trades well above sector P/E ratios, and price volatility lingers. With these financials hitting well above prior expectations, some risks tied to leadership changes and execution appear less urgent, but high valuation and market expectations heighten the importance of future guidance. Contrast this with the potential downside of elevated share price volatility, which could resurface unexpectedly.

Rakuten Bank's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Rakuten Bank - why the stock might be worth just ¥8009!

Build Your Own Rakuten Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rakuten Bank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rakuten Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rakuten Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5838

Rakuten Bank

Provides internet banking products and services to individual, corporate, and sole proprietor customers in Japan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives