Will Nikon Lab Hosting CELL HANDLER 2 Shift Yamaha Motor's (TSE:7272) Innovation Narrative Beyond Mobility?

Reviewed by Sasha Jovanovic

- In December 2025, Nikon Instruments Inc. announced a partnership with Yamaha Motor under which the Nikon BioImaging Lab near Boston will host Yamaha’s CELL HANDLER 2 system, combining advanced imaging and automated cell picking to support U.S.-based drug discovery researchers.

- The collaboration effectively turns NBIL into a hands-on evaluation hub for CELL HANDLER 2, letting researchers test their own samples and design custom assay workflows, which may help Yamaha deepen its footprint in life-science tools beyond its traditional mobility and marine businesses.

- We’ll now examine how Yamaha Motor’s expansion into drug discovery tools through CELL HANDLER 2 could influence its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Yamaha Motor Investment Narrative Recap

For Yamaha Motor, you need to believe that its core mobility and marine businesses can overcome cost pressures and cyclical demand, while newer technology and robotics initiatives gradually pull more weight. The Nikon partnership around CELL HANDLER 2 is directionally positive for its life-science ambitions, but remains too small to change near term catalysts such as margin recovery and marine demand, or to offset key risks like rising input costs and recent profit volatility.

The Nikon BioImaging Lab collaboration sits alongside Yamaha’s broader push into technology solutions, including its plan to acquire New Zealand based Robotics Plus Limited as a subsidiary. Together, these moves point to a company trying to build higher value, less cyclical revenue streams that complement its premium motorcycle strategy and efforts to stabilize the marine business, even as execution risk and capital allocation trade offs remain very real.

Yet against this backdrop, investors should be aware that rising raw material and labor costs could...

Read the full narrative on Yamaha Motor (it's free!)

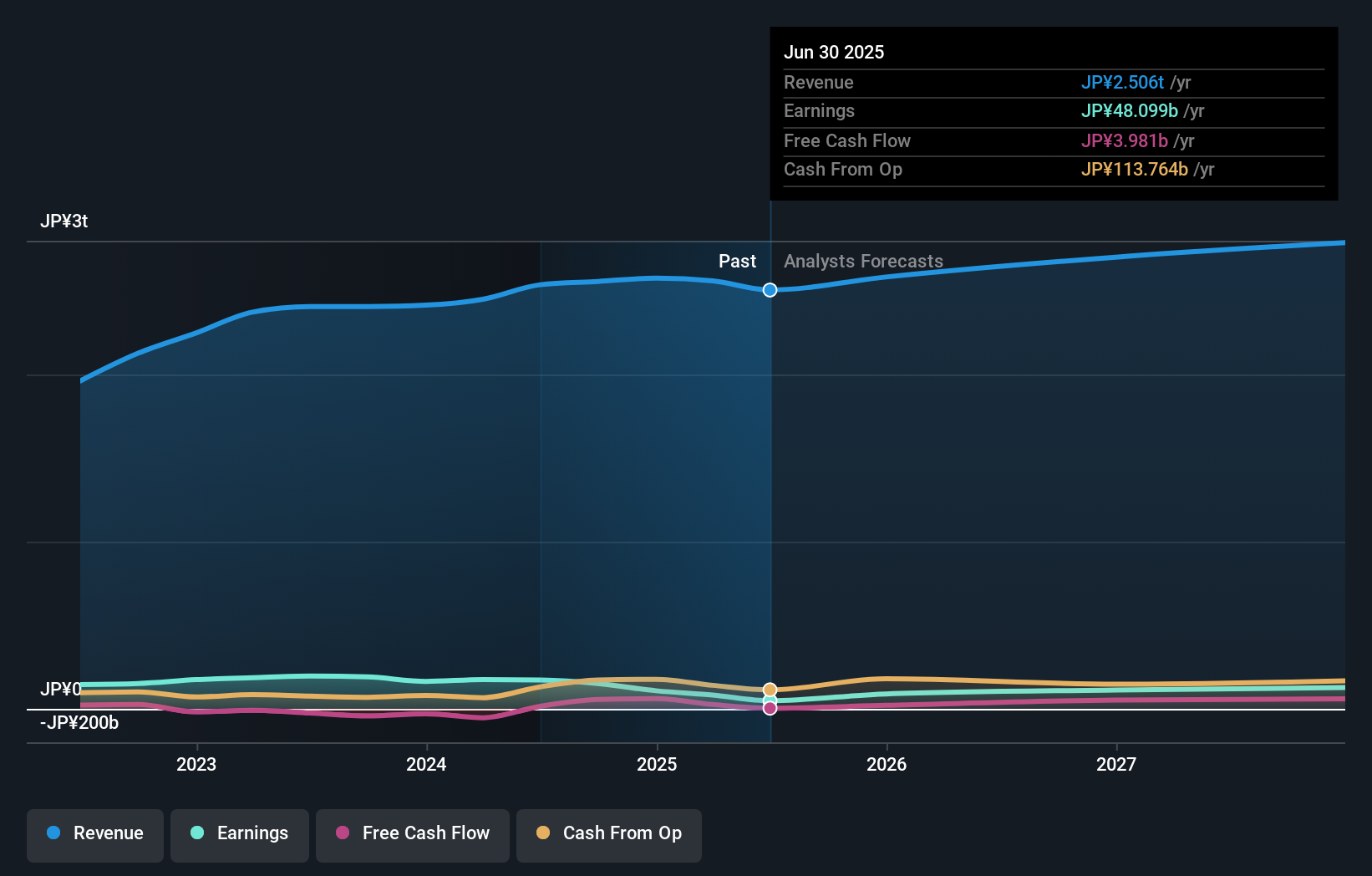

Yamaha Motor's narrative projects ¥2,750.6 billion revenue and ¥143.6 billion earnings by 2028. This requires 3.2% yearly revenue growth and about a ¥95.5 billion earnings increase from ¥48.1 billion today.

Uncover how Yamaha Motor's forecasts yield a ¥1140 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span from ¥763.32 to ¥1,140, underscoring how far apart individual views can be. Against this range, the ongoing pressure from higher raw material and labor costs raises important questions about how resilient Yamaha Motor’s margins and future returns might be, so it makes sense to compare several different opinions before forming your own view.

Explore 2 other fair value estimates on Yamaha Motor - why the stock might be worth 34% less than the current price!

Build Your Own Yamaha Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamaha Motor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Yamaha Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamaha Motor's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026