How Suzuki’s Eight New SUV Launches in India Could Shape Maruti’s Future (TSE:7269)

Reviewed by Sasha Jovanovic

- In late October 2025, Suzuki Motor announced plans to launch eight new sport utility vehicles in India over the next five to six years, aiming to regain its historic 50% market share.

- This move highlights both the intensifying competition in India’s automotive sector and Suzuki’s renewed commitment to its largest overseas market.

- Next, we explore how this bold product expansion plan shapes Suzuki's investment narrative amid intensifying competition in India.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Suzuki Motor's Investment Narrative?

To make sense of Suzuki Motor's investment case right now, the big picture hangs on whether the company's long-term India strategy can fend off rising competitive threats and reignite growth in its most important overseas market. The recent plan to introduce eight new SUVs in India marks a clear response to this challenge and signals a willingness to invest heavily in future product cycles. While this could reinforce Suzuki’s position and help recapture market share, it also introduces risk, especially as it could mean higher expenses and execution pressures right as rivals ramp up their offerings. The fresh product push might shift short term catalysts, putting a sharper focus on sales momentum and cost control in India, rather than just earnings growth from efficiency. However, it does not immediately resolve fundamental concerns around the board’s inexperience, still low return on equity, and the pace of expected profit growth, issues market participants have been cautious about before this announcement. If anything, investors now have to weigh not just traditional financial markers but also Suzuki’s ability to deliver on this substantial India bet.

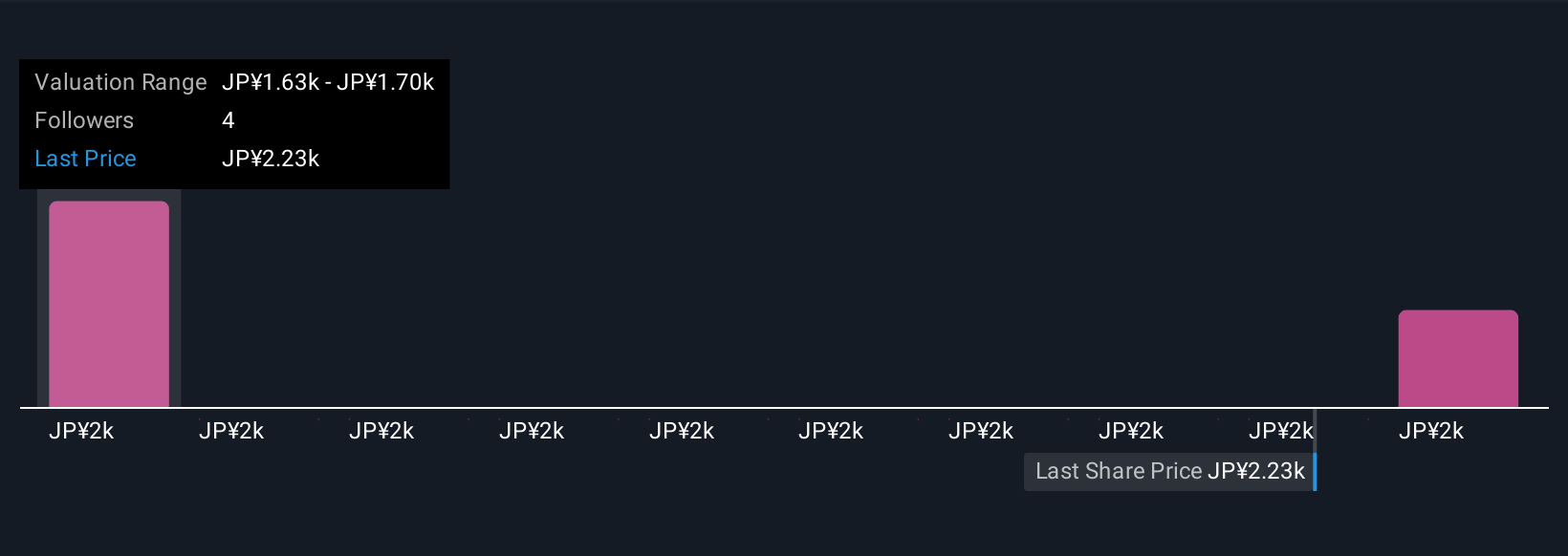

But, while this expansion is ambitious, investors should also keep Suzuki's leadership challenges in mind. Suzuki Motor's shares are on the way up, but they could be overextended by 41%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Suzuki Motor - why the stock might be worth as much as 6% more than the current price!

Build Your Own Suzuki Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suzuki Motor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Suzuki Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suzuki Motor's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7269

Suzuki Motor

Engages in the manufacture and sale of automobiles, motorcycles, outboard motors, electric wheelchairs, and other products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives