- Japan

- /

- Auto Components

- /

- TSE:7259

Aisin (TSE:7259) Net Margin Jumps to 3.4%, Reinforcing Profitability Narrative

Reviewed by Simply Wall St

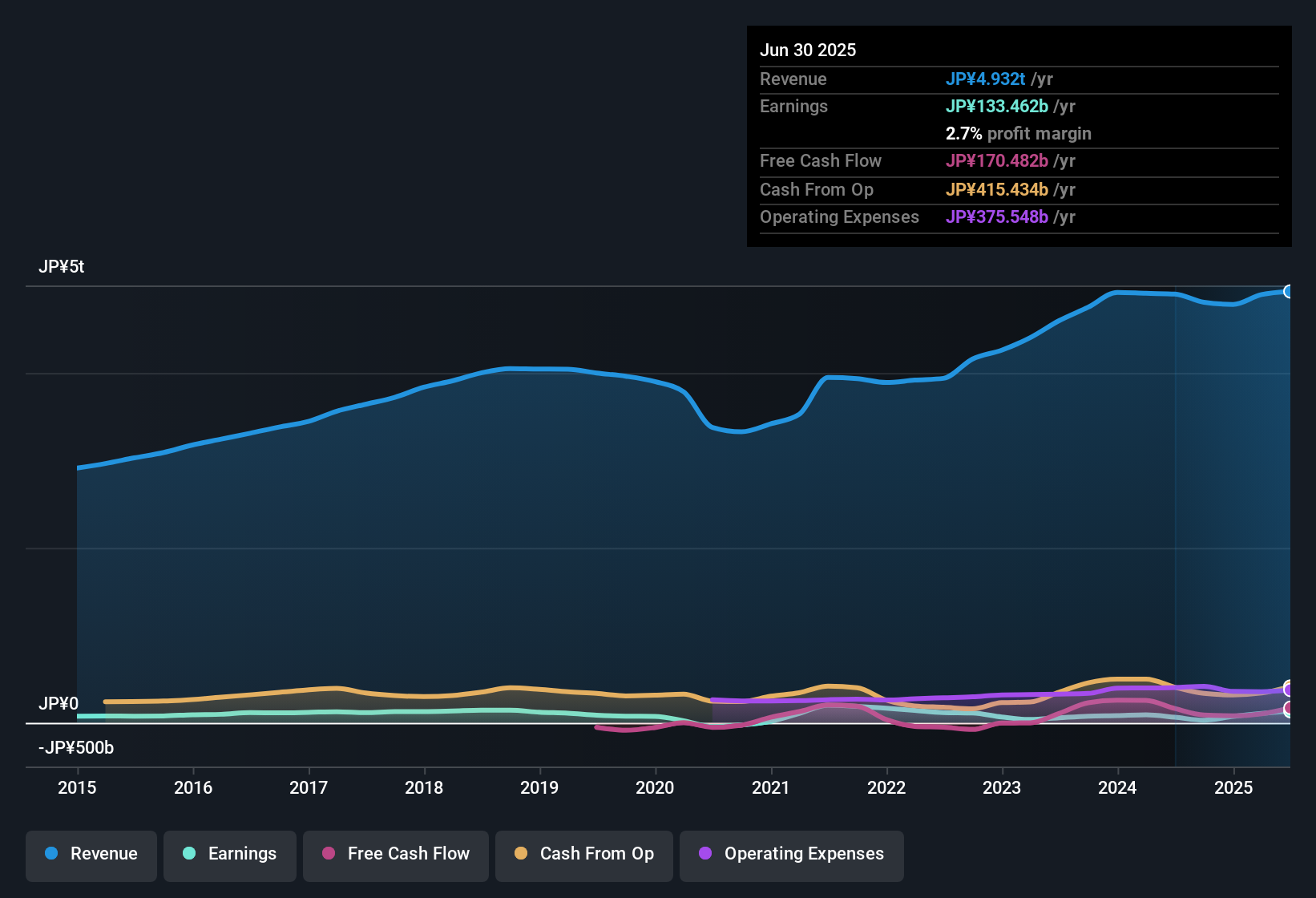

Aisin (TSE:7259) delivered a net profit margin of 3.4%, up sharply from 0.6% the prior year, with current-year earnings growth coming in at a staggering 479.2% versus the five-year average of 1.4%. Looking forward, earnings are forecast to grow at 6.7% per year, which trails both the broader Japanese market and revenue growth expectations. The stock trades at a 12.1x P/E, which is below peer averages but slightly above its industry benchmark. With improving profitability and a share price (¥2,774.5) still below estimated fair value, attention turns to sustained earnings quality and dividend support for investors evaluating Aisin's evolving growth story.

See our full analysis for Aisin.In the next section, we will see how this latest round of numbers matches up to the prevailing narratives about Aisin, highlighting where the data supports the story and where expectations might need reconsideration.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Surge Outpaces Five-Year Trend

- Net profit margin jumped to 3.4%, far above the five-year average annual earnings growth of just 1.4%, signaling a significant shift in the company’s profitability profile.

- What stands out in the prevailing analysis is how this margin recovery is seen as evidence of Aisin's resilience, with

- sustained profitability now providing a foundation that supports ambitions to innovate and expand into new automotive technologies.

- However, some observers are cautious, pointing out that while this improvement sets a higher bar, the company’s growth expectations (6.7% per year) still underperform the Japanese market average of 7.8%, leaving upside capped unless profitability is maintained.

Pace of Revenue Growth Lags Market Peers

- Projected annual revenue growth stands at 2.3%, well below Japan’s broader market average of 4.5%, making Aisin’s top-line momentum a clear watchpoint.

- The prevailing market perspective highlights a tension between steady operations and missed opportunity, since

- being profitable and stable keeps Aisin favored as a core sector holding, especially among investors seeking reliability.

- Yet this slower growth track means new sector trends, like electric vehicle component demand, will have to break through for the company to win back market share from faster-growing competitors.

Valuation Discount Seen Against Peer Group

- Trading at a P/E of 12.1x, Aisin sits at a discount to its peer average of 15.8x, but slightly above the Japanese Auto Components industry average of 11.6x. Notably, the current share price of ¥2,774.5 is well below the DCF fair value estimate of ¥5,082.25.

- Prevailing analysis points out a valuation gap that may draw investor interest, as

- shares appear attractively priced compared to sector peers, encouraging buyers who prioritize value and improving fundamentals.

- At the same time, the premium relative to the immediate industry benchmark hints that market participants are willing to pay up for quality, but expect follow-through on profit growth and dividend stability.

If you want a quick snapshot of how the numbers actually shape Aisin’s investment story, see the full narrative for both upside and risks here: 📊 Read the full Aisin Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aisin's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Aisin’s muted revenue growth and earnings outlook underperform peers, with its top-line momentum trailing well behind the wider Japanese market.

If you want steadier performance and clearer growth trajectories, check out stable growth stocks screener (2101 results) to discover companies consistently expanding revenue and earnings year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7259

Aisin

Manufactures and sells automotive parts, lifestyle, and energy and wellness related products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives