Toyota (TSE:7203): Exploring Valuation After Recent Steady Momentum and Analyst Views

Reviewed by Simply Wall St

If you are weighing your options on Toyota Motor (TSE:7203) stock lately, you are not alone. Even without any headline-grabbing events, Toyota’s recent trading may catch the attention of investors keeping tabs on global auto giants. Sometimes, an absence of dramatic news can be a signal in itself. This can prompt questions about whether steady price shifts reflect deeper trends in valuation or risk.

Looking at the bigger picture, the past month has seen some encouraging momentum, with shares rising over 6% and up more than 11% over the past 3 months. For the year, Toyota has delivered a total return of 22%, and its long-term record stands out, returning over 140% in five years. These moves come against a backdrop of modest annual revenue growth and a slight dip in net income. This suggests markets may be weighing growth potential against recent financial results.

So, is the current price for Toyota Motor offering investors an entry point, or is the market already building tomorrow's growth into today's stock price?

Most Popular Narrative: 3.7% Undervalued

According to the most widely followed narrative, Toyota Motor is trading slightly below what analysts consider its true worth, implying modest undervaluation based on current forecasts and risk assumptions.

Toyota's investment in internal battery production, including various types of batteries for electric and hybrid vehicles, could bolster long-term revenue and margins. By optimizing battery production and technology, Toyota positions itself competitively in the growing electrified vehicle market.

Curious what powers this bullish outlook? This narrative focuses on forward-thinking investments and sharp financial assumptions that could rewrite Toyota’s growth story. If you want to unpack the future profit forecasts and the metrics behind this eye-catching valuation, the details will surprise you.

Result: Fair Value of ¥3,066.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors like unexpected production halts or sharp exchange rate swings could quickly shift Toyota's outlook and challenge the current consensus.

Find out about the key risks to this Toyota Motor narrative.Another View: DCF Paints a Different Picture

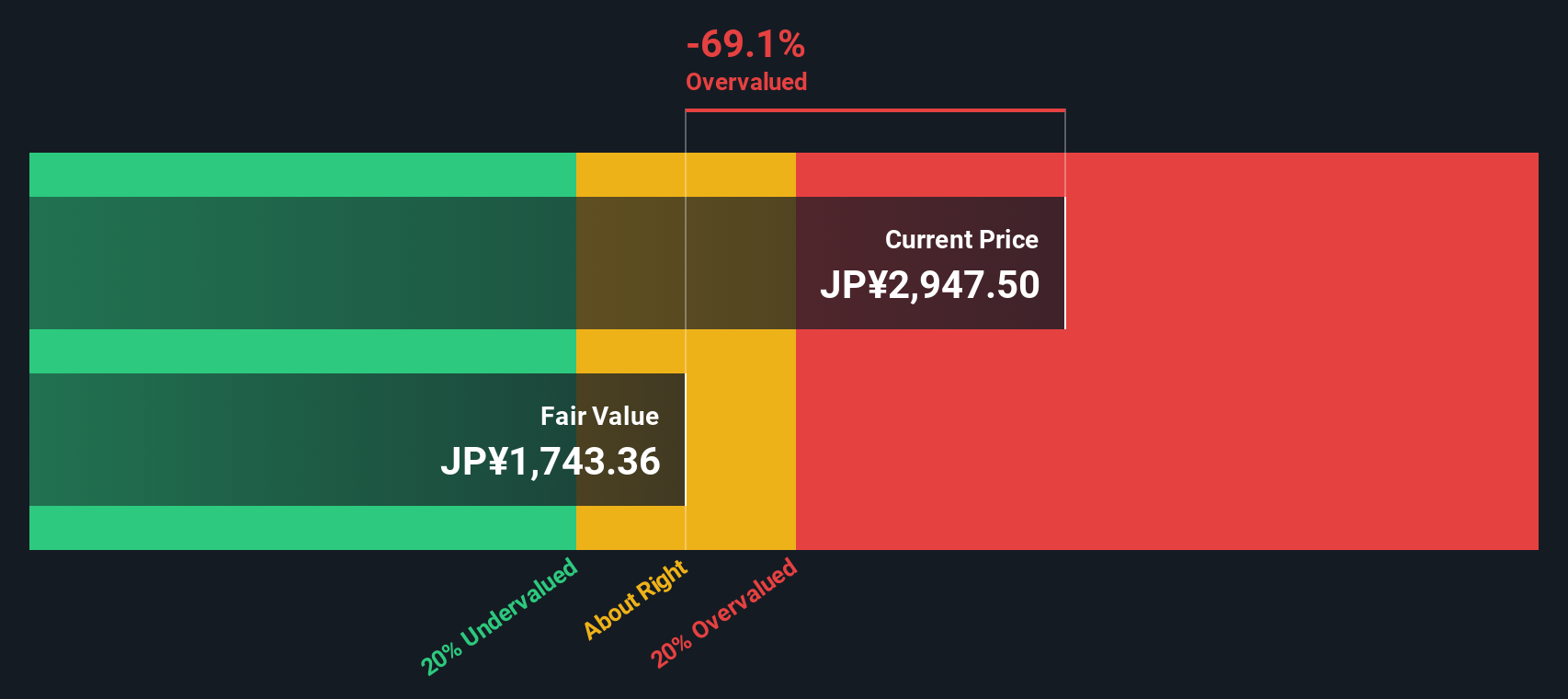

While analysts see Toyota as slightly undervalued based on forecasts, our DCF model presents a very different story and suggests the market price may sit above fair value. Which method do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toyota Motor Narrative

If you see things differently or want to explore the numbers firsthand, you can build your own narrative from scratch in just a few minutes. Do it your way.

A great starting point for your Toyota Motor research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t let your research stop with Toyota. Expand your portfolio potential and get ahead of market shifts by checking out these fresh, high-conviction ideas.

- Boost your passive income and spot under-the-radar companies with reliable yields by checking out dividend stocks with yields > 3% as your next move.

- Tap into the explosive growth of artificial intelligence by uncovering top innovators using AI penny stocks poised for the next wave of tech breakthroughs.

- Capitalize on the market’s hidden gems and seize attractive price points right now through undervalued stocks based on cash flows that highlight strong businesses trading below their worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives