Should Nissan Motor’s China Export Venture With Dongfeng Prompt Action From TSE:7201 Investors?

Reviewed by Sasha Jovanovic

- In recent days, Nissan Motor revised its consolidated earnings guidance and confirmed a newly approved export-focused joint venture with Dongfeng Motor to ship China-made vehicles abroad, as shared during special calls and an investor webinar on October 30, 2025.

- An important insight is that these moves reflect a response to weak sales and excess capacity in China, with Nissan aiming to reach new overseas markets by leveraging local production and a shift in product strategy.

- We'll examine how Nissan's decision to export China-made cars through its partnership with Dongfeng Motor could influence its long-term business outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nissan Motor Investment Narrative Recap

To own Nissan Motor stock today, you need to believe in the company’s ability to execute on its recovery initiatives and unlock global value despite ongoing restructuring and losses. The recent announcement of a joint venture to export China-made cars is positioned as a potential catalyst, but it does not materially shift the biggest near-term risk: persistent operating losses and pressure on cash flow. Investors should still watch closely for tangible improvements in sales and profitability as short-term signals.

One of the most relevant recent announcements is Nissan’s updated earnings guidance revealing a continued projected operating loss for the current year, even as some one-time cost savings improved first-half results. This announcement underscores that while structural moves like the Dongfeng export partnership could open new doors, managing ongoing losses and restoring positive cash flow remain at the forefront of what investors need to monitor in the months ahead.

By contrast, investors should be aware that ongoing pressure from operating losses and negative cash flow may...

Read the full narrative on Nissan Motor (it's free!)

Nissan Motor's narrative projects ¥12,909.5 billion in revenue and ¥203.3 billion in earnings by 2028. This requires 1.5% yearly revenue growth and a ¥1,018.5 billion increase in earnings from the current ¥-815.2 billion.

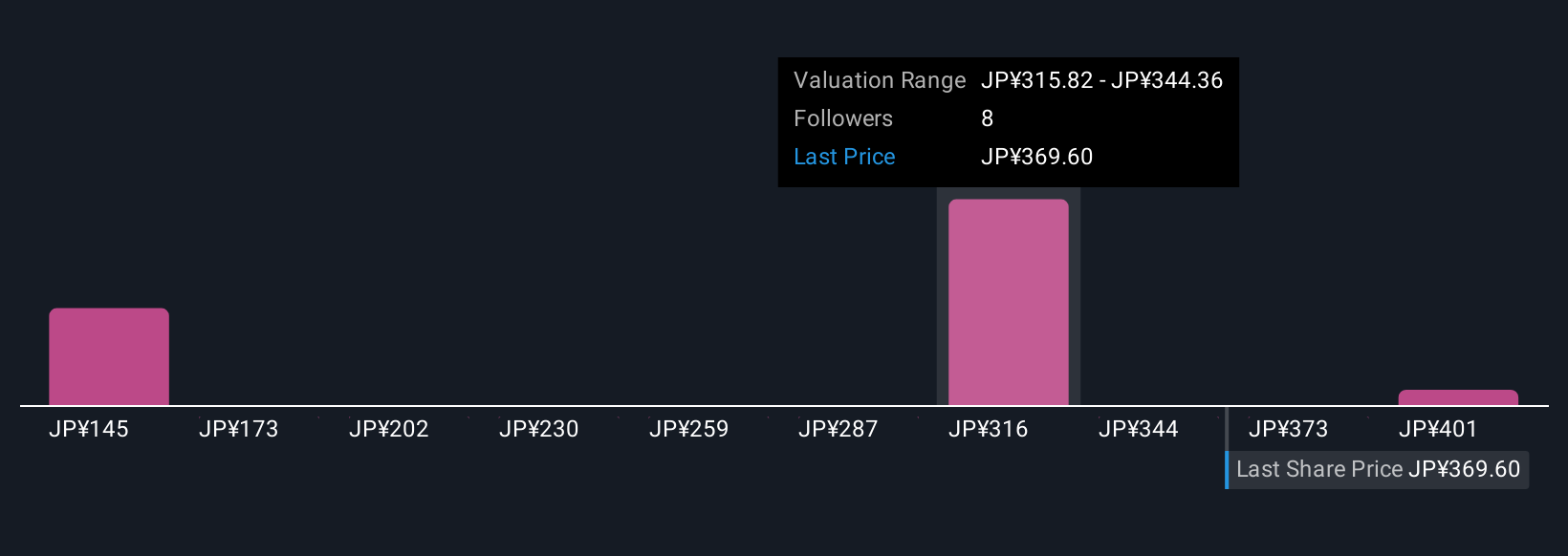

Uncover how Nissan Motor's forecasts yield a ¥336 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community have estimated fair values for Nissan between ¥110.65 and ¥430 from three analyses, showing how opinions can strongly diverge. Amid these differences, pressure on liquidity and ongoing operating losses remain in focus and could affect the company's medium-term prospects, see how your view compares by exploring more community perspectives.

Explore 3 other fair value estimates on Nissan Motor - why the stock might be worth as much as 22% more than the current price!

Build Your Own Nissan Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nissan Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissan Motor's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives