- Japan

- /

- Auto Components

- /

- TSE:6995

How Tokai Rika’s Upgraded Dividend and Earnings Forecast Will Impact (TSE:6995) Investors

Reviewed by Sasha Jovanovic

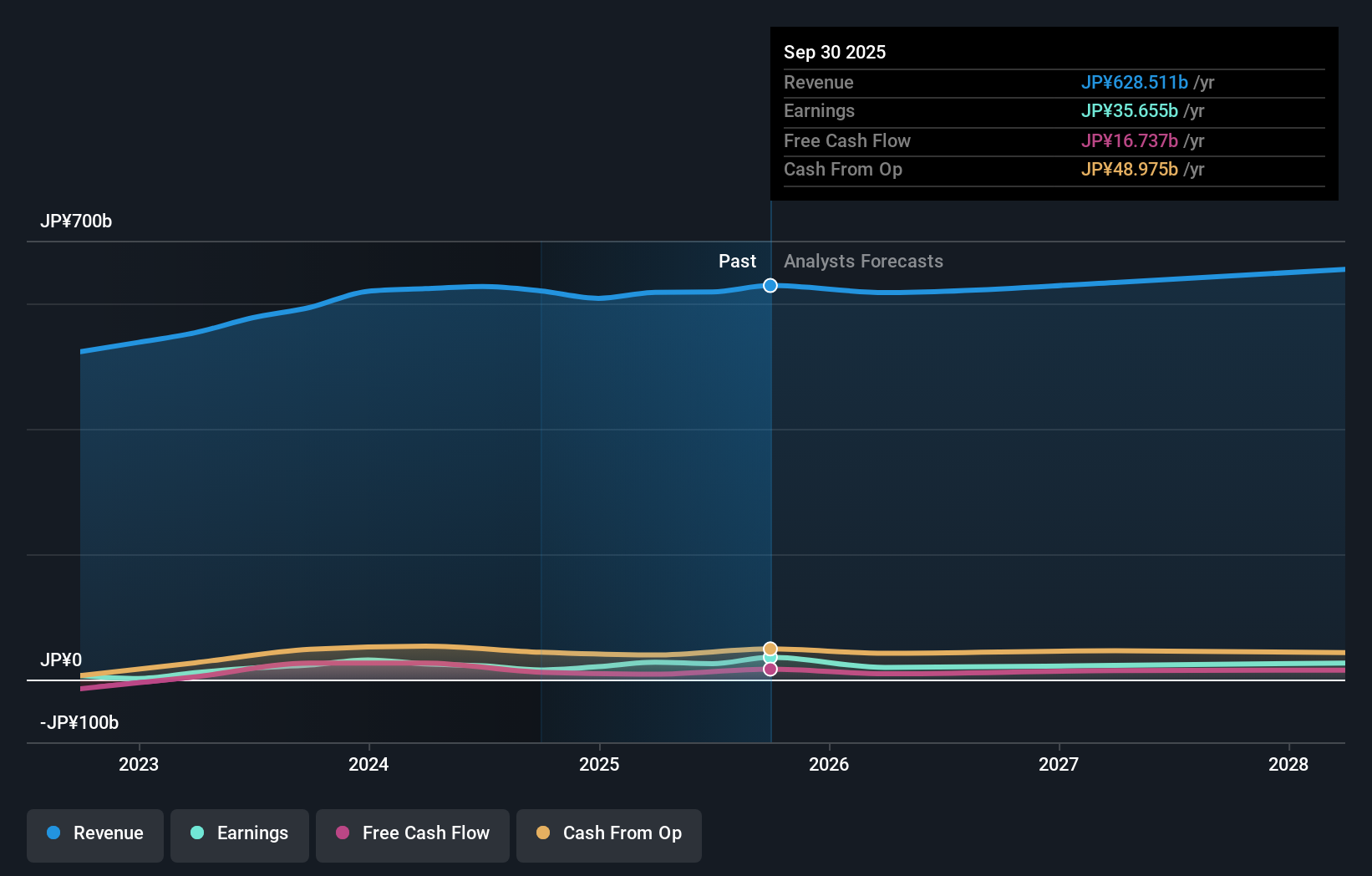

- Tokai Rika Co., Ltd. announced an increase in its interim dividend to ¥55 per share for the second quarter ended September 30, 2025, and also raised its full-year consolidated earnings guidance, including higher net sales and profit expectations for the fiscal year ending March 31, 2026.

- This combination of increased shareholder returns and a significant upward revision of earnings projections suggests growing confidence in the company’s operating outlook.

- We'll explore how Tokai Rika’s stronger financial guidance supports its investment narrative and signals a constructive shift in outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Tokai Rika's Investment Narrative?

For anyone considering Tokai Rika as a potential holding, the big picture rests on belief in the company’s ability to convert momentum in earnings and dividends into sustainable business performance. The recent sharp dividend lift and a significant upward revision in full-year sales and profit guidance mark a real shift in what might drive shares in the short term. Where earlier analysis pointed to risks from a relatively inexperienced board, slowing industry revenue growth, and concerns about return on equity, the company’s updated outlook directly addresses some key investor concerns, most notably, clarity around stronger operating results and improved shareholder returns. That said, while these changes may temper some risks, the sensitivity to management and board execution remains. The result is that the immediate catalysts and downside risks for shareholders have shifted, and recent price moves reflect renewed optimism. Yet, despite these signals, board turnover and low board tenure remain crucial risks that investors should keep in mind.

Tokai Rika's shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Tokai Rika - why the stock might be worth as much as 9% more than the current price!

Build Your Own Tokai Rika Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokai Rika research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tokai Rika research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokai Rika's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokai Rika might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6995

Tokai Rika

Manufactures and sells automotive parts in Japan, North America, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives