- Japan

- /

- Auto Components

- /

- TSE:6923

Stanley Electric (TSE:6923): Fresh Guidance and Dividend Hike Spark New Debate on Valuation

Reviewed by Simply Wall St

Stanley Electric (TSE:6923) just updated its consolidated earnings guidance for the fiscal year ending March 2026, citing foreign exchange tailwinds and a weaker yen as key contributors. In addition, dividend forecasts were raised, signaling positive momentum.

See our latest analysis for Stanley Electric.

Stanley Electric’s revised guidance and boosted dividends have clearly resonated with investors, as shown by its impressive 21% year-to-date share price gain. The stock’s momentum is supported by upbeat earnings expectations and a one-year total shareholder return of nearly 25%, which is ahead of many in the sector.

If today’s announcement has you searching for more opportunities in the auto world, take the next step and explore See the full list for free.

With the company’s earnings outlook and dividends both getting a lift, the question for investors is whether Stanley Electric’s strong run still leaves the stock undervalued, or if future growth is already reflected in its price.

Price-to-Earnings of 13.3x: Is it justified?

Stanley Electric is trading at a price-to-earnings (P/E) ratio of 13.3x, which is below the peer average of 14.2x but above the industry average of 10.7x. The current share price of ¥3,130 reflects this positioning, suggesting the market sees some premium in Stanley Electric’s earnings compared to its sector, though not as expensive as some direct competitors.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. For auto components companies, it can hint at expected future growth and profitability, which is particularly important as the industry adapts to changing demand and technology trends.

Although Stanley’s P/E is higher than the broader sector, the company is also trading well below the estimated fair value, adding a compelling layer to the story. The market seems to recognize the firm’s reliable profit generation, but there is a clear gap to its fundamental worth based on the SWS DCF model.

Compared to the industry average, Stanley Electric’s multiple is on the more expensive side, but still represents better value than its peer average. If the market starts pricing in improving fundamentals, the P/E could shift toward its estimated fair ratio, a level that often corrects as earnings outlooks become clearer.

Explore the SWS fair ratio for Stanley Electric

Result: Price-to-Earnings of 13.3x (ABOUT RIGHT)

However, a slowdown in annual sales growth or unexpected shifts in exchange rates could quickly change the outlook for Stanley Electric’s shares.

Find out about the key risks to this Stanley Electric narrative.

Another View: Discounted Cash Flow Shows Undervaluation

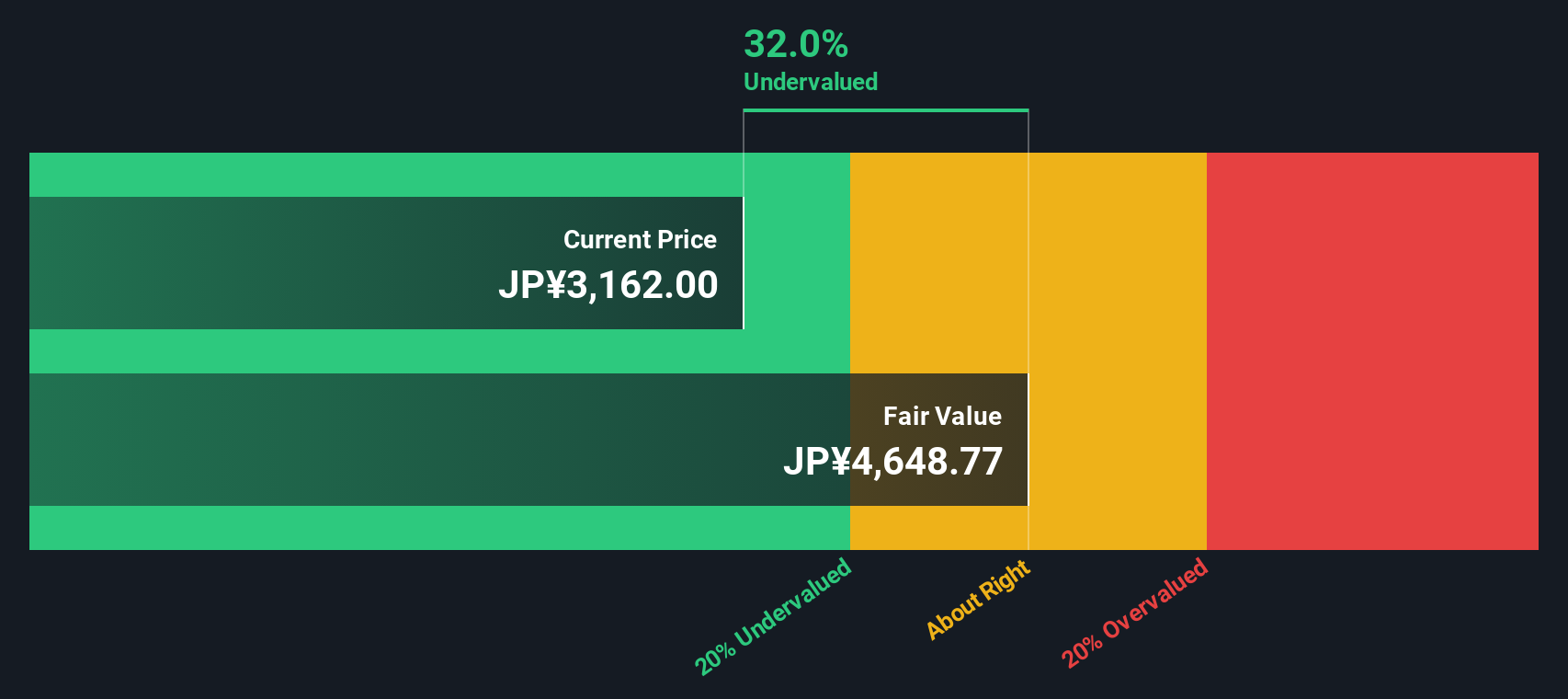

Looking through the lens of the SWS DCF model, Stanley Electric stands out as significantly undervalued. With shares trading around 32% below our estimate of fair value, this approach challenges the story told by price-to-earnings ratios. Could the market be overlooking longer-term cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stanley Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stanley Electric Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily craft your own analysis in under three minutes, or simply Do it your way.

A great starting point for your Stanley Electric research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize the advantage with hot opportunities beyond Stanley Electric. The market moves fast, so make sure you give yourself the best shot by checking out other promising stocks before they take off.

- Maximize your portfolio's growth with these 856 undervalued stocks based on cash flows that are trading well below their intrinsic worth. This can offer potential upside others might miss.

- Start earning while you invest by targeting these 15 dividend stocks with yields > 3% featuring yields above 3% and consistent, shareholder-friendly returns.

- Ride the AI wave by uncovering these 25 AI penny stocks shaping the next decade of innovation in technology and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6923

Stanley Electric

Engages in the manufacture, sale, and import/export of automotive and other light bulbs in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives