- Japan

- /

- Auto Components

- /

- TSE:5991

Should NHK Spring's (TSE:5991) Higher Dividend and China Exit Prompt a Closer Investor Review?

Reviewed by Sasha Jovanovic

- On November 12, 2025, NHK Spring Co., Ltd. held a board meeting to consider dissolving and liquidating its local subsidiaries in China and announced an increase in its second quarter-end dividend to ¥33.00 per share, with year-end guidance unchanged from the previous year.

- This upward dividend adjustment may signal management's confidence in the company’s financial resilience, even as it reconsiders its China operations.

- We’ll explore how NHK Spring’s decision to raise its interim dividend shapes the overall investment narrative for the company.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is NHK Spring's Investment Narrative?

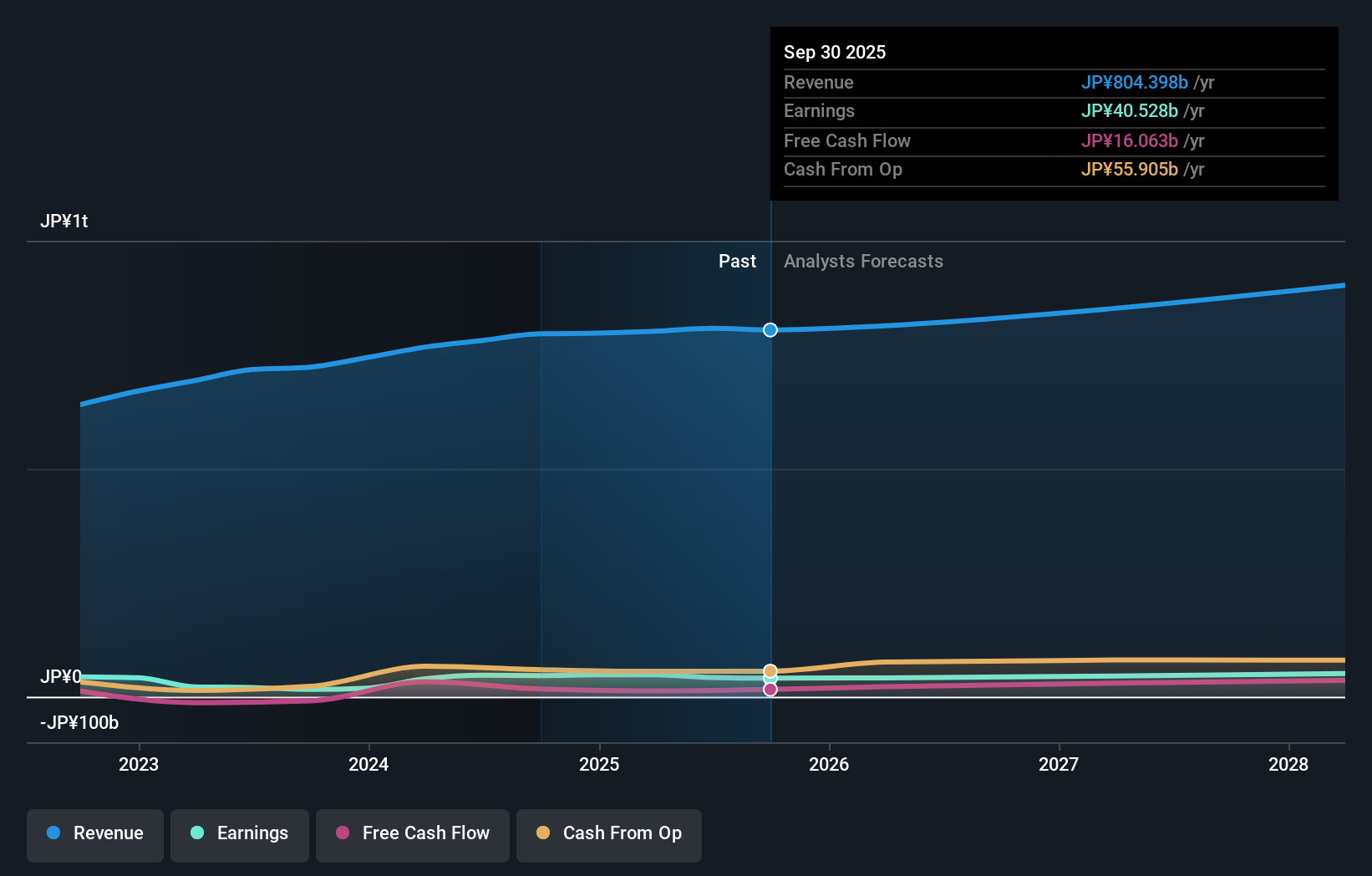

For anyone following NHK Spring, the core story to get on board with has been its emphasis on stable shareholder returns and capital discipline, even while its earnings growth trails the broader market and the business is priced higher than sector peers. The recent move to increase the interim dividend by ¥3 per share could be seen as an effort to reinforce financial strength and shareholder alignment, despite potential headwinds from winding down activities in China. With the board considering dissolution of certain Chinese subsidiaries, one catalyst to watch is how profit margins and overseas exposure might adjust, but there is currently no indication that these changes will materially shift the company’s key drivers in the short term given the continued dividend guidance and robust recent share price moves. The risk profile, however, may need to be revised if overseas restructuring leads to larger-than-expected one-off costs or shifts in growth outlook.

But that upbeat dividend isn’t the end of the story, there are deeper risks to watch for. NHK Spring's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on NHK Spring - why the stock might be worth as much as 26% more than the current price!

Build Your Own NHK Spring Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NHK Spring research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NHK Spring research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NHK Spring's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NHK Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5991

NHK Spring

Manufactures and sells automotive parts in Japan, rest of Asia, America, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives