- Japan

- /

- Auto Components

- /

- TSE:5110

Revenues Tell The Story For Sumitomo Rubber Industries, Ltd. (TSE:5110) As Its Stock Soars 25%

The Sumitomo Rubber Industries, Ltd. (TSE:5110) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

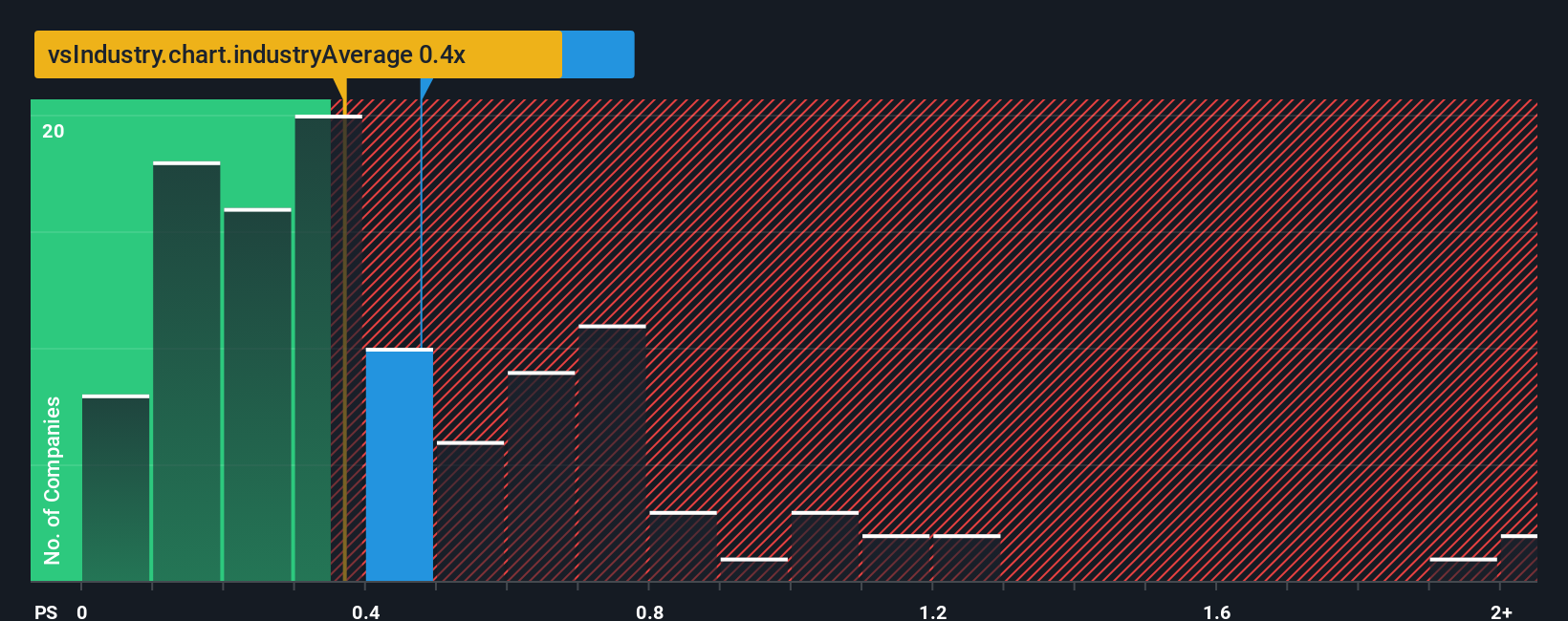

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sumitomo Rubber Industries' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in Japan is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sumitomo Rubber Industries

What Does Sumitomo Rubber Industries' P/S Mean For Shareholders?

Sumitomo Rubber Industries hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sumitomo Rubber Industries.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Sumitomo Rubber Industries would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 2.6% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.8% per year, which is not materially different.

In light of this, it's understandable that Sumitomo Rubber Industries' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Sumitomo Rubber Industries' P/S?

Sumitomo Rubber Industries appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Sumitomo Rubber Industries maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Sumitomo Rubber Industries has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5110

Sumitomo Rubber Industries

Provides tires, sports, and industrial and other products in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives