Aeroporto Guglielmo Marconi di Bologna And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index edges higher on hopes of interest rate cuts in the U.S. and UK, investors are keenly observing mixed returns across major European stock indexes. In this dynamic environment, identifying stocks with strong fundamentals and unique growth potential can be crucial for navigating market fluctuations. Aeroporto Guglielmo Marconi di Bologna is one such example, alongside two other lesser-known European companies that may offer intriguing opportunities amidst these conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A. operates and oversees airport facilities in Italy and abroad, with a market capitalization of €354.03 million.

Operations: Aeroporto Guglielmo Marconi di Bologna generates revenue primarily from aviation (€101.12 million) and non-aviation (€77.57 million) segments. The company's financial performance is influenced by these diverse revenue streams, contributing to its overall market presence.

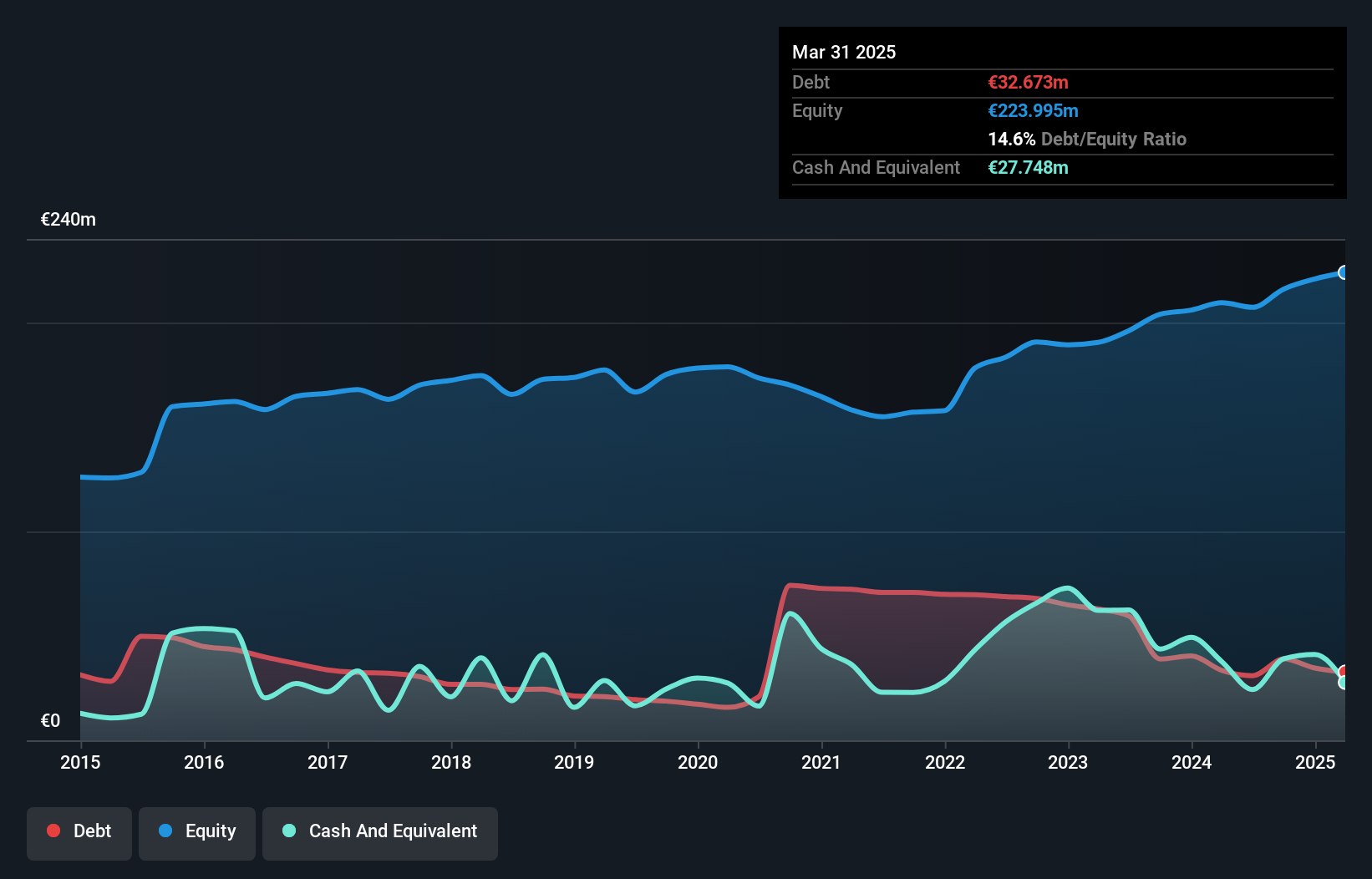

Aeroporto Guglielmo Marconi di Bologna, a relatively small player in the European market, has shown promising financial health. Over the past year, earnings grew by 14%, outpacing the infrastructure industry's -9.8%. The company's net debt to equity ratio stands at a satisfactory 11%, and its EBIT covers interest payments 29 times over. Recent reports indicate revenue climbed to €131 million for nine months ending September 2025 from €119 million previously, with net income slightly rising to €19.76 million. Despite an increasing debt-to-equity ratio of 52% over five years, its P/E ratio of 14x remains below Italy's market average.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) is a financial institution offering solutions for medium-sized corporates, real estate companies, merchants, and private individuals across Sweden, Germany, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK13.26 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate and Consumer segments, contributing SEK1.44 billion and SEK1.03 billion respectively. The Payments and Corporate segments also play significant roles, adding SEK473 million and SEK861 million to the overall revenue.

Norion Bank, with SEK69.4 billion in assets and SEK9.7 billion in equity, stands out for its robust financial foundation. The bank's total deposits of SEK55 billion and loans amounting to SEK49.1 billion underscore its active lending operations, though it faces a high level of bad loans at 20.2%. Despite this challenge, Norion benefits from low-risk funding sources comprising 92% customer deposits, enhancing stability. Earnings have impressively grown by 27% annually over five years and are projected to rise by nearly 4% annually moving forward. Notably, the bank repurchased shares worth NOK410 million recently, reflecting strategic capital management efforts.

- Navigate through the intricacies of Norion Bank with our comprehensive health report here.

Understand Norion Bank's track record by examining our Past report.

XANO Industri (OM:XANO B)

Simply Wall St Value Rating: ★★★★★★

Overview: XANO Industri AB (publ) is a company that develops, manufactures, and sells industrial products and automation equipment across Sweden, the rest of the Nordic countries, Europe, and internationally with a market capitalization of SEK3.96 billion.

Operations: XANO Industri generates revenue primarily from its Industrial Solutions segment, contributing SEK2.04 billion, followed by the Industrial Products segment at SEK892.13 million, and Precision Technology at SEK487.89 million. The company focuses on these segments to drive its financial performance and growth strategy.

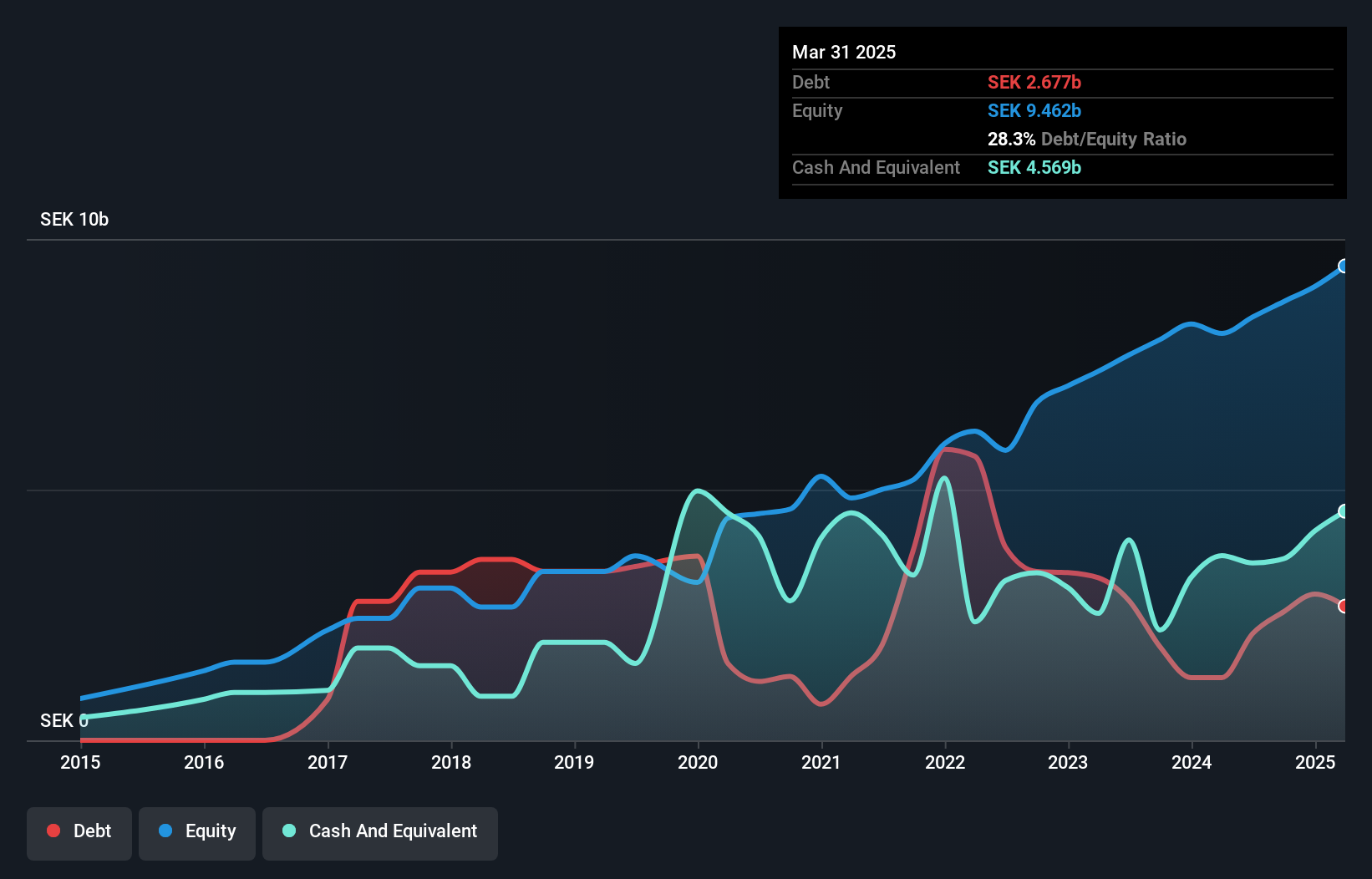

XANO Industri, a smaller player in the machinery sector, has showcased impressive earnings growth of 299.1% over the past year, outpacing the industry's -0.4%. Despite a one-off gain of SEK 66 million impacting recent results, its net debt to equity ratio stands at a satisfactory 38.5%, demonstrating prudent financial management. The company's price-to-earnings ratio of 17.3x suggests it could be undervalued compared to the broader Swedish market's 22.3x average. With interest payments well covered by EBIT at 3.9 times and positive free cash flow, XANO seems positioned for continued stability amidst industry challenges.

Seize The Opportunity

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 309 more companies for you to explore.Click here to unveil our expertly curated list of 312 European Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XANO B

XANO Industri

Develops, manufactures, and sells industrial products and automation equipment in Sweden, rest of Nordic countries, Europe, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026