- China

- /

- Electronic Equipment and Components

- /

- SHSE:688686

High Growth Tech Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming, investors are navigating a landscape marked by geopolitical tensions and economic indicators like declining jobless claims and rising home sales. In such an environment, identifying high-growth tech stocks involves looking for companies that demonstrate innovation, adaptability to market shifts, and the potential to capitalize on emerging trends like artificial intelligence-driven demand for clean energy.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seco S.p.A. is a tech company that develops and delivers cutting-edge solutions, with a market cap of €242.39 million.

Operations: Seco S.p.A. focuses on developing and delivering innovative technology solutions. The company operates in various segments, generating revenue through its advanced tech offerings. Its financial performance is highlighted by a notable gross profit margin trend, which reflects the efficiency of its operations in managing costs relative to revenue generation.

Despite a challenging financial landscape with a net loss of EUR 10.07 million in the recent nine-month period, SECO is positioning itself for recovery and growth through strategic partnerships, notably with Raspberry Pi. This collaboration aims to enhance SECO's product offerings in IoT and industrial applications by integrating advanced computing solutions like the Compute Module 5 into new Human-Machine Interface products. With earnings expected to surge by 117.4% annually, this move could significantly bolster SECO's market position by tapping into evolving industrial demands and expanding its software capabilities through initiatives like incorporating Raspberry Pi Connect into its Clea software stack.

- Get an in-depth perspective on Seco's performance by reading our health report here.

Explore historical data to track Seco's performance over time in our Past section.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing motor vehicle driver intelligent training, testing, and application systems in China, with a market cap of CN¥5.72 billion.

Operations: The company generates revenue primarily from its electronic security devices segment, which contributed CN¥527.80 million.

DuoLun Technology's recent financial performance reveals significant strides, with a net income surge to CNY 42 million from CNY 5.88 million year-over-year, reflecting an impressive growth trajectory. This uptick is underscored by a robust R&D commitment, allocating substantial resources to innovation—evident from R&D expenses constituting 18.3% of revenue. Moreover, the company's strategic acquisition of a 5% stake by Zhang Aoxing for CNY 270 million highlights investor confidence and potential for future expansion in the tech sector. With earnings forecasted to climb by 89.2% annually, DuoLun is poised to capitalize on emerging technological trends and enhance its market presence significantly.

OPT Machine Vision Tech (SHSE:688686)

Simply Wall St Growth Rating: ★★★★★☆

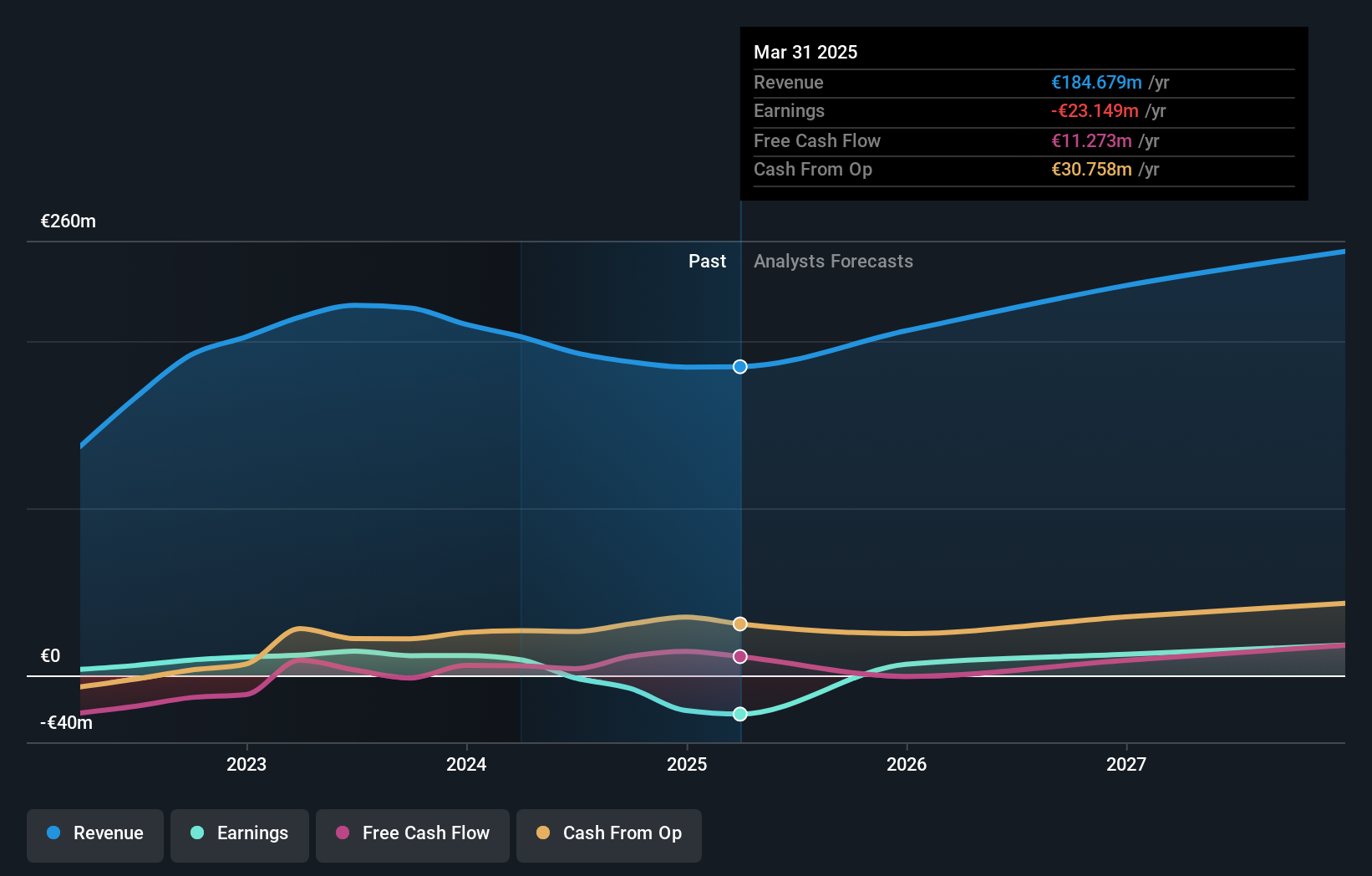

Overview: OPT Machine Vision Tech Co., Ltd. develops and supplies components and software for factory automation worldwide, with a market cap of CN¥8.06 billion.

Operations: OPT Machine Vision Tech generates revenue primarily from its Photographic Equipment & Supplies segment, amounting to CN¥831.18 million.

OPT Machine Vision Tech has demonstrated resilience despite a challenging fiscal year, with a notable decline in net income from CNY 204.8 million to CNY 131.94 million. This downturn contrasts starkly with the company's aggressive R&D investments, which are pivotal for maintaining its competitive edge in the fast-evolving tech landscape. The firm's commitment to innovation is further underscored by its recent share repurchase program aimed at bolstering shareholder value through equity incentives, funded internally and reflecting strategic foresight in capital management. Looking ahead, OPT Machine Vision Tech is poised for recovery with projected earnings growth of 41.6% annually, outpacing the broader Chinese market forecast of 26.2%. This growth trajectory is supported by an anticipated revenue increase of 20.4% per year, signaling robust potential amidst industry shifts.

- Click here to discover the nuances of OPT Machine Vision Tech with our detailed analytical health report.

Gain insights into OPT Machine Vision Tech's past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 1288 High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688686

OPT Machine Vision Tech

Develops and supplies components and software for factory automation worldwide.

Flawless balance sheet with high growth potential.