European Penny Stocks: FAE Technology And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

As European markets face renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, major indices have seen declines. Despite these challenges, opportunities still exist within the realm of penny stocks, which often represent smaller or newer companies that can offer growth potential at lower price points. While the term "penny stocks" may seem outdated, their ability to provide unique investment prospects remains significant, especially when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.61 | €81.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.925 | €26.6M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.16 | €67.03M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.385 | €387.57M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.87 | €75.47M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €304.09M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.85 | €28.46M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

FAE Technology (BIT:FAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FAE Technology S.p.A. is an Italian company specializing in the design, development, prototyping, manufacturing, and delivery of embedded and custom electronic products, with a market cap of €50.46 million.

Operations: FAE Technology's revenue is primarily derived from its Ems segment at €43.77 million, followed by Odm at €11.99 million, with additional contributions from Service and Engineering segments at €0.68 million and €1.06 million respectively.

Market Cap: €50.46M

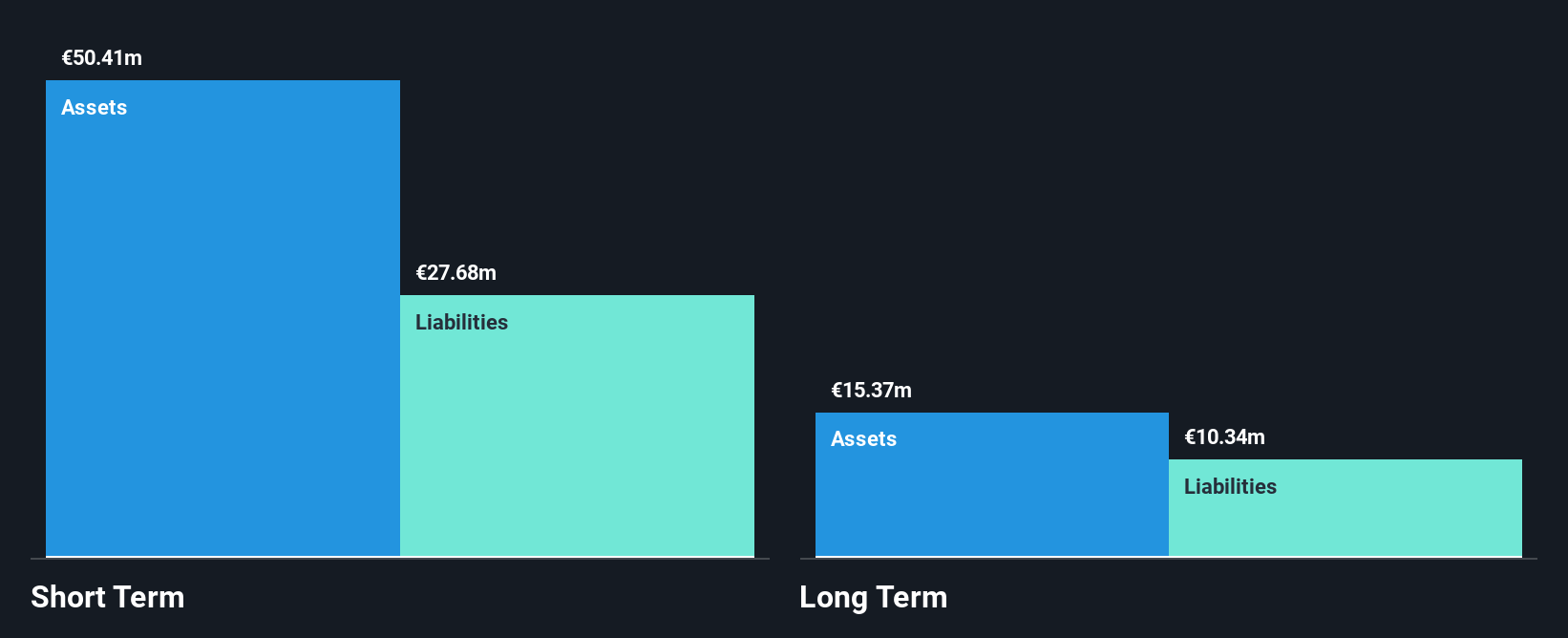

FAE Technology S.p.A., with a market cap of €50.46 million, has experienced volatility typical of penny stocks, with a stable weekly volatility but higher than most Italian stocks. Despite negative earnings growth over the past year, its debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT. The company's net profit margin has decreased from 5.9% to 1.2%. A recent buyback program worth €2 million indicates confidence in its stock value despite lower revenues and net income compared to last year, highlighting both potential risks and strategic moves within this segment.

- Navigate through the intricacies of FAE Technology with our comprehensive balance sheet health report here.

- Examine FAE Technology's earnings growth report to understand how analysts expect it to perform.

Erria (CPSE:ERRIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erria A/S operates globally in shipping, offshore operations, logistics, and trading activities with a market cap of DKK48.91 million.

Operations: Erria A/S has not reported any specific revenue segments.

Market Cap: DKK48.91M

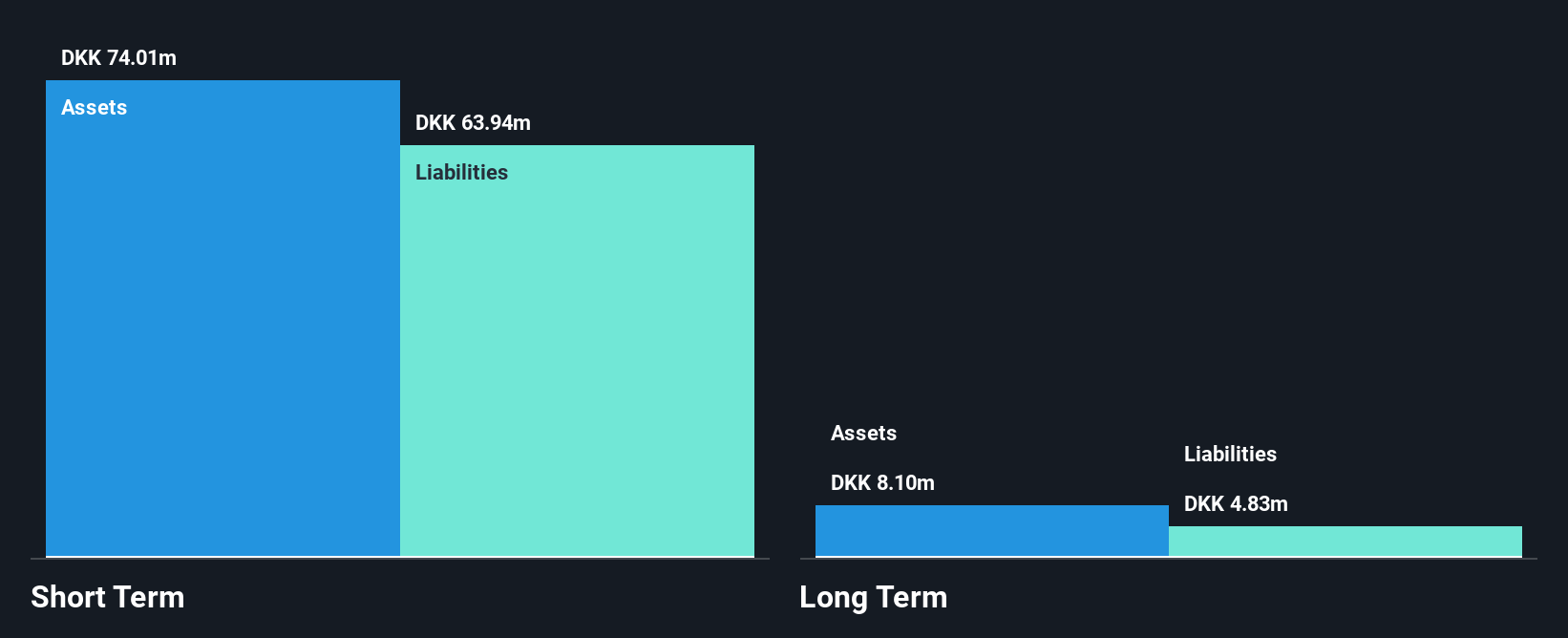

Erria A/S, with a market cap of DKK48.91 million, presents characteristics typical of penny stocks, including high volatility and significant debt levels. However, its financial health shows resilience; the company's interest payments are well-covered by EBIT at 17.5x, and its debt is well-managed with operating cash flow covering 64.8% of it. Erria's short-term assets exceed both short- and long-term liabilities significantly, indicating solid liquidity management. Notably profitable over the past five years with earnings growth accelerating to 54.3% last year from a 37.2% annual average over five years, Erria has not diluted shareholders recently and maintains more cash than total debt.

- Unlock comprehensive insights into our analysis of Erria stock in this financial health report.

- Review our historical performance report to gain insights into Erria's track record.

MDI Energia (WSE:MDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MDI Energia S.A. operates in the renewable energy sector both in Poland and internationally, with a market capitalization of PLN41.69 million.

Operations: The company generates revenue of PLN227.47 million from the construction of civil and water engineering facilities.

Market Cap: PLN41.69M

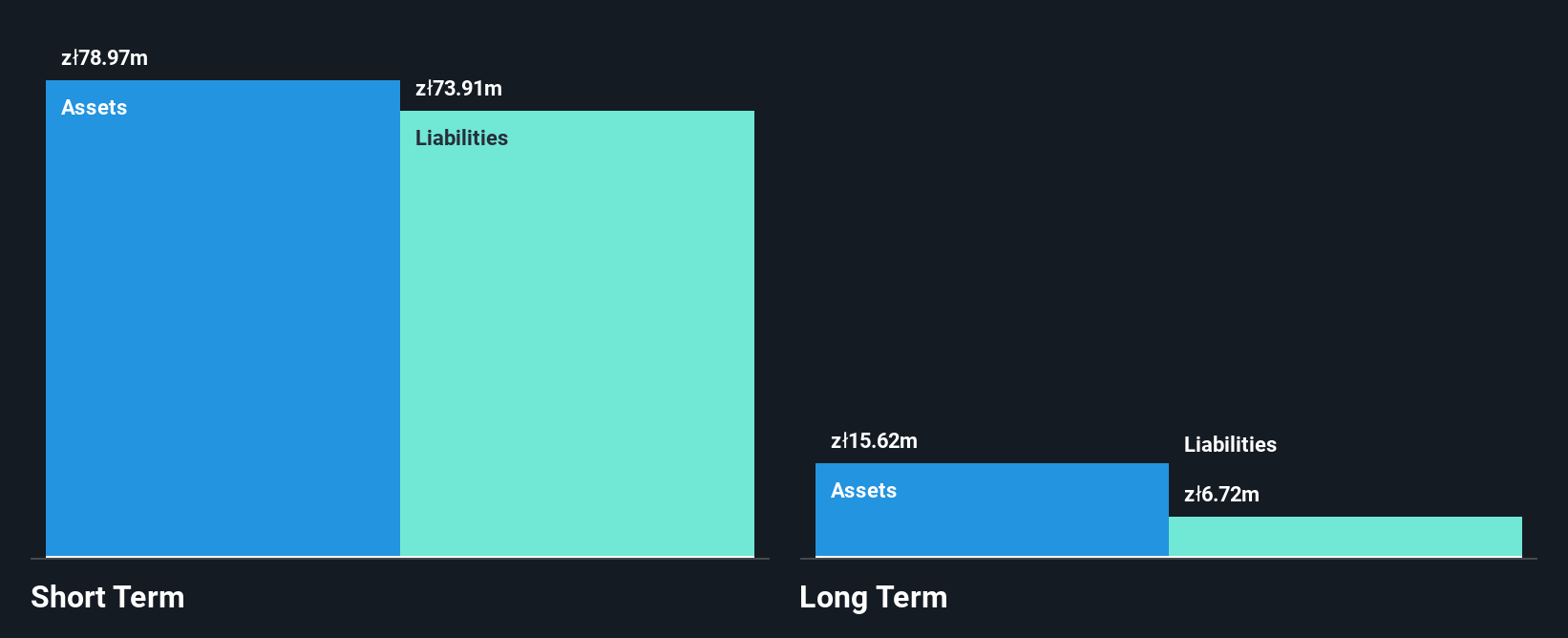

MDI Energia S.A., with a market capitalization of PLN41.69 million, operates in the renewable energy sector and is characterized by high volatility and unprofitability. Despite this, MDI has shown financial resilience; its debt-to-equity ratio has significantly decreased from 146.8% to 35.8% over five years, and it holds more cash than total debt. The seasoned management team averages 9.8 years of tenure, contributing to strategic stability amidst challenges like a negative return on equity (-15.07%) and less than a year of cash runway based on current free cash flow trends. Short-term assets exceed both short- and long-term liabilities, indicating sound liquidity management despite ongoing profitability issues.

- Jump into the full analysis health report here for a deeper understanding of MDI Energia.

- Understand MDI Energia's track record by examining our performance history report.

Taking Advantage

- Discover the full array of 277 European Penny Stocks right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FAE

FAE Technology

Operates in the design, proof of concept (PoC) development, industrial design, prototyping, manufacturing, and solution delivery of embedded and custom electronic products in Italy.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.