3 European Stocks That May Be Priced Below Their Estimated Value In December 2025

Reviewed by Simply Wall St

As European markets experience a positive momentum, with the STOXX Europe 600 Index and major country-specific indexes seeing gains, investors are increasingly focused on identifying stocks that may be undervalued in this evolving landscape. In such an environment, a good stock is often characterized by strong fundamentals and the potential for growth that isn't yet fully reflected in its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sanoma Oyj (HLSE:SANOMA) | €9.37 | €18.43 | 49.2% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Mangata Holding (WSE:MGT) | PLN63.60 | PLN123.06 | 48.3% |

| Jæren Sparebank (OB:JAREN) | NOK382.60 | NOK752.15 | 49.1% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €11.40 | €22.03 | 48.2% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.10 | 48.8% |

| Elekta (OM:EKTA B) | SEK58.00 | SEK114.12 | 49.2% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Allcore (BIT:CORE) | €1.365 | €2.66 | 48.6% |

| Aker BioMarine (OB:AKBM) | NOK88.50 | NOK176.88 | 50% |

Here we highlight a subset of our preferred stocks from the screener.

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that researches, develops, produces, and sells its products in various countries including Italy, the United States, and several European nations with a market cap of €10.41 billion.

Operations: The company's revenue is primarily derived from its Specialty & Primary Care segment, generating €1.54 billion, and the Pharmaceutical Sector for Rare Diseases, contributing €1.01 billion.

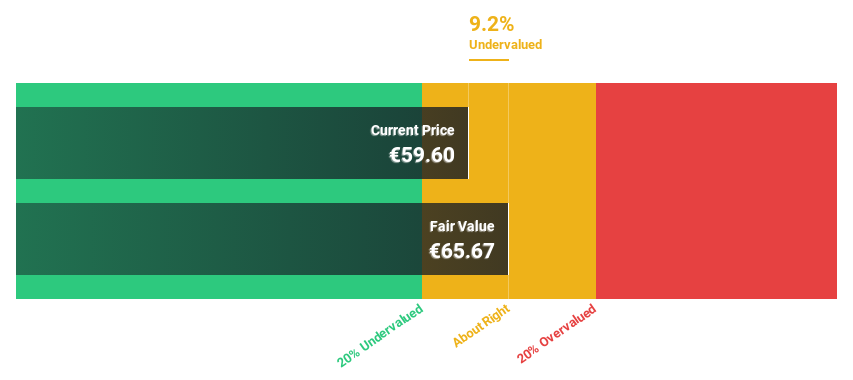

Estimated Discount To Fair Value: 25.7%

Recordati Industria Chimica e Farmaceutica appears undervalued, trading at €50.9, below its estimated fair value of €68.46. Despite high debt levels and a dividend not fully covered by free cash flows, the company boasts strong earnings growth forecasts of 15.1% annually, outpacing the Italian market's 9.9%. Recent earnings showed sales growth but a slight dip in net income compared to last year, while management reaffirmed robust revenue targets for 2025 and beyond amidst challenging conditions.

- Our growth report here indicates Recordati Industria Chimica e Farmaceutica may be poised for an improving outlook.

- Get an in-depth perspective on Recordati Industria Chimica e Farmaceutica's balance sheet by reading our health report here.

CCC (WSE:CCC)

Overview: CCC S.A. is a retailer specializing in the sale of footwear and other products across Poland, Central and Eastern Europe, and Western Europe, with a market cap of PLN11.29 billion.

Operations: The company's revenue segments include Halfprice, generating PLN2.08 billion, and Segment Adjustment, contributing PLN8.81 billion.

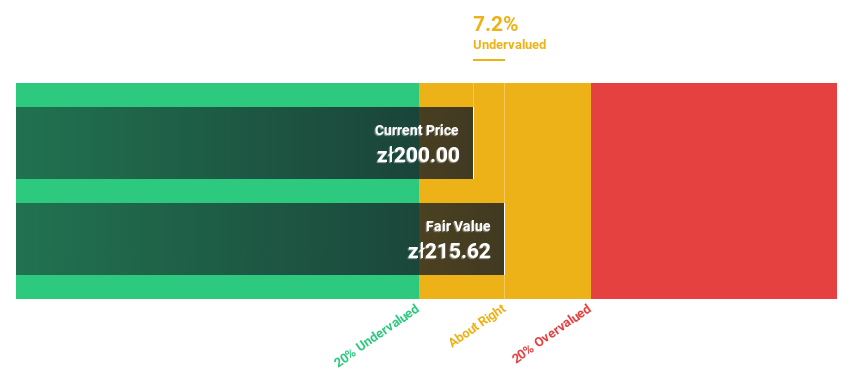

Estimated Discount To Fair Value: 19.7%

CCC S.A. is trading at PLN 135.1, below its estimated fair value of PLN 168.28, reflecting potential undervaluation based on cash flows. Despite recent earnings showing increased sales but declining net income, the company forecasts significant annual profit growth of 31.4%, surpassing the Polish market's average rate. However, interest payments are not well covered by earnings and shareholder dilution occurred last year, indicating some financial challenges amidst its growth trajectory.

- Insights from our recent growth report point to a promising forecast for CCC's business outlook.

- Unlock comprehensive insights into our analysis of CCC stock in this financial health report.

RENK Group (XTRA:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally, with a market cap of €5.05 billion.

Operations: The company's revenue segments include Slide Bearings at €124.68 million, Marine & Industry at €365.83 million, and Vehicle Mobility Solutions at €813.93 million.

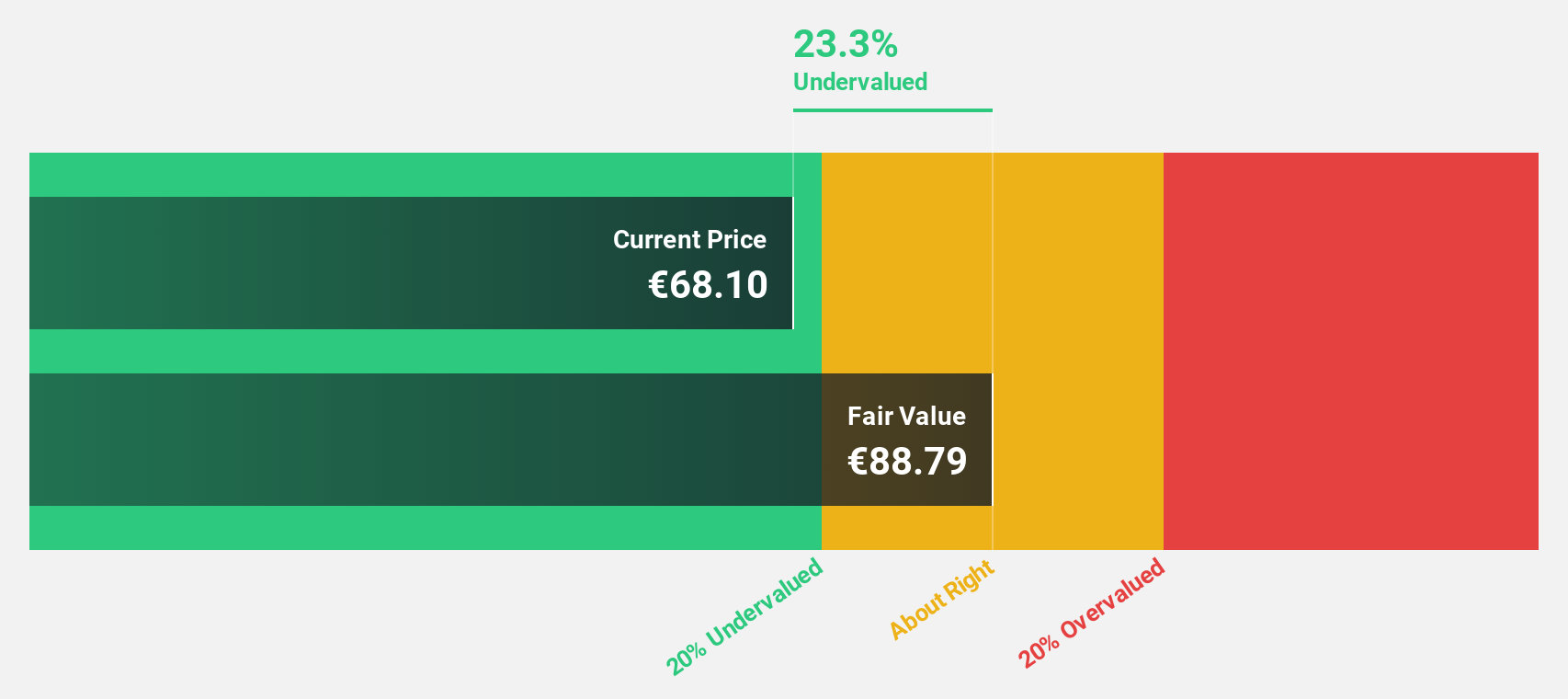

Estimated Discount To Fair Value: 36.8%

RENK Group is trading at €50.45, significantly below its fair value estimate of €79.82, highlighting potential undervaluation based on cash flows. Despite high debt levels, RENK's earnings are projected to grow 25.9% annually, outpacing the German market average. Recent earnings showed substantial growth with net income reaching €55.13 million for nine months in 2025 compared to €7.01 million a year ago, while revenue exceeded €1 billion as M&A opportunities are actively pursued in the U.S., particularly in the Navy domain.

- Our earnings growth report unveils the potential for significant increases in RENK Group's future results.

- Delve into the full analysis health report here for a deeper understanding of RENK Group.

Taking Advantage

- Get an in-depth perspective on all 196 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026