- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

3 European Dividend Stocks Yielding Up To 7.3%

Reviewed by Simply Wall St

Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index edged up slightly as investors navigated the complexities of U.S. trade policies and geopolitical developments. In this environment of mixed economic signals and inflationary pressures, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Mapfre (BME:MAP) | 5.86% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.34% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.48% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.41% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| CaixaBank (BME:CABK) | 8.54% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 7.37% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

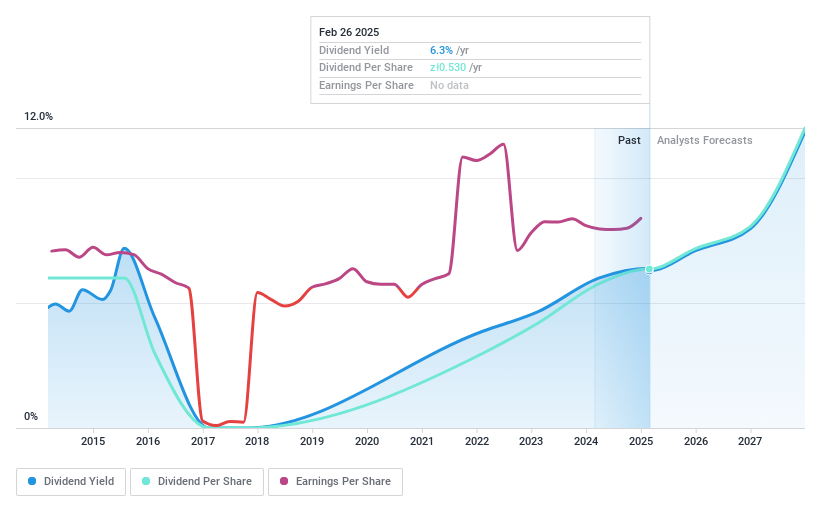

Arnoldo Mondadori Editore (BIT:MN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arnoldo Mondadori Editore S.p.A., with a market cap of €561.99 million, operates in the publishing sector by producing books and magazines across Italy, the rest of Europe, and the United States.

Operations: Arnoldo Mondadori Editore S.p.A.'s revenue segments include Media (€145.86 million), Retail (€209.86 million), Trade Books (€393.84 million), Educational Books (€240.71 million), and Corporate & Shared Services (€86.31 million).

Dividend Yield: 5.6%

Arnoldo Mondadori Editore offers an attractive dividend yield of 5.56%, placing it in the top 25% of Italian dividend payers. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 56.4% and 39.4%, respectively, indicating sustainability. However, despite stable growth in dividends over five years, its short history may concern some investors. Additionally, the stock trades at a significant discount to its estimated fair value but carries a high level of debt.

- Navigate through the intricacies of Arnoldo Mondadori Editore with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Arnoldo Mondadori Editore is trading behind its estimated value.

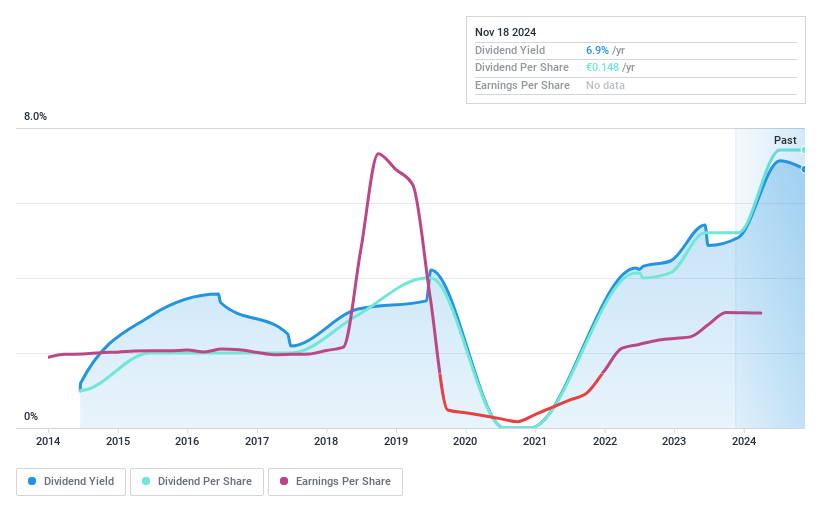

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piquadro S.p.A. designs, produces, and markets leather goods and accessories in Italy, the rest of Europe, and internationally, with a market cap of €95.41 million.

Operations: Piquadro's revenue is primarily derived from its segments, with Lancel contributing €69.18 million, Piquadro €82.34 million, and The Bridge €35.84 million.

Dividend Yield: 7.3%

Piquadro's dividend yield of 7.34% ranks it among the top 25% of Italian dividend payers, supported by a reasonable payout ratio of 61.8% and a cash payout ratio of 46.1%, suggesting sustainability. However, its dividend history has been volatile over the past decade, despite recent growth in payments. The stock trades slightly below its estimated fair value, with earnings showing modest growth recently but no significant events impacting dividends directly reported lately.

- Unlock comprehensive insights into our analysis of Piquadro stock in this dividend report.

- Upon reviewing our latest valuation report, Piquadro's share price might be too pessimistic.

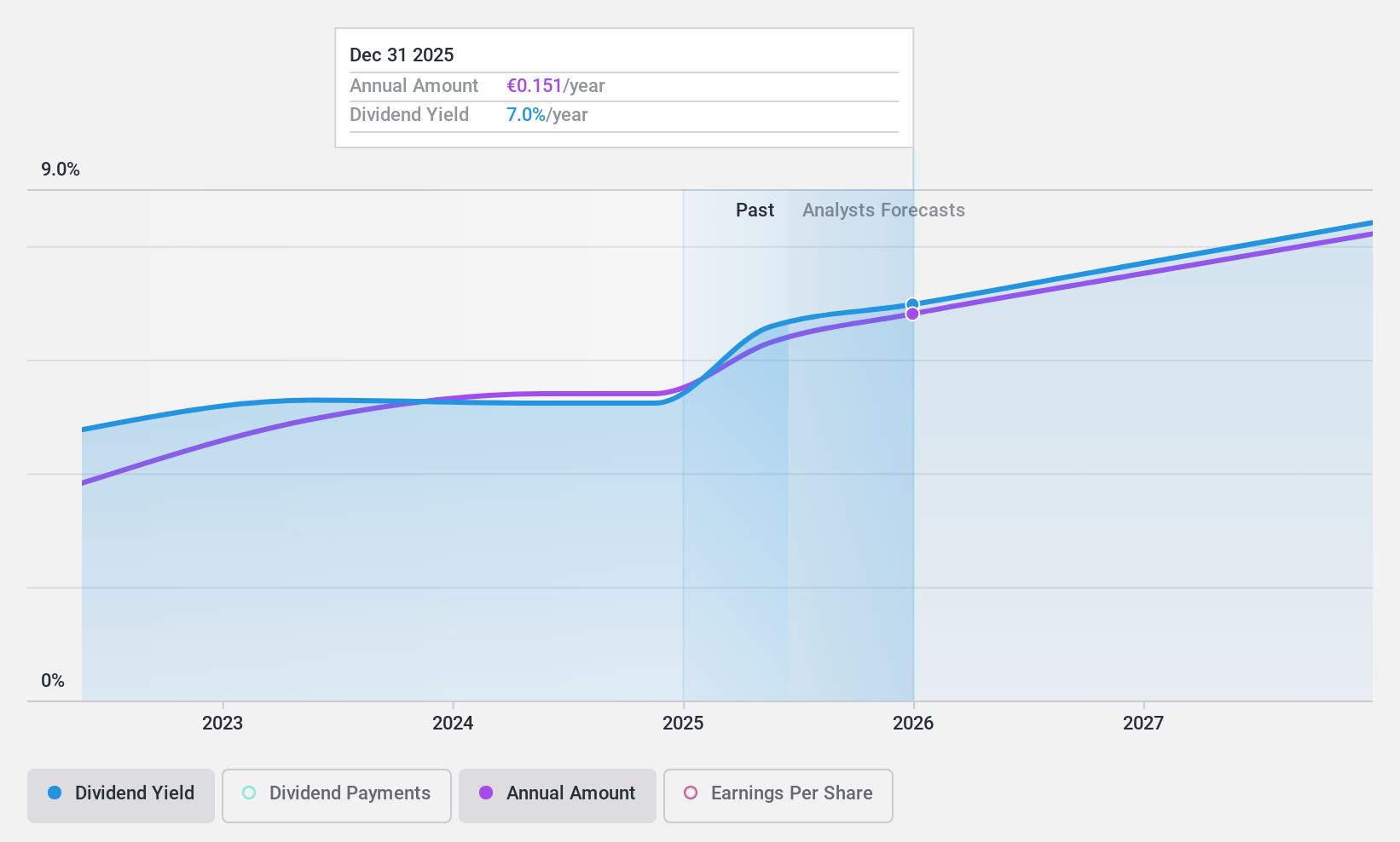

Orange Polska (WSE:OPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orange Polska S.A., with a market cap of PLN11.07 billion, offers telecommunications services to individuals, businesses, and wholesale customers in Poland through its subsidiaries.

Operations: Orange Polska S.A. generates revenue primarily from its telecommunications services segment, which amounted to PLN12.73 billion.

Dividend Yield: 6.3%

Orange Polska's recent dividend increase to PLN 0.53 per share, a 10% rise from last year, is backed by a sustainable payout ratio of 76.2% and cash flow coverage at 66.4%. Despite trading at an attractive valuation below its estimated fair value, the dividend yield of 6.29% is lower than top Polish payers. While earnings grew to PLN 913 million in 2024 from PLN 818 million in the previous year, dividends have been historically volatile over the past decade.

- Take a closer look at Orange Polska's potential here in our dividend report.

- Our valuation report unveils the possibility Orange Polska's shares may be trading at a discount.

Where To Now?

- Unlock our comprehensive list of 205 Top European Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, businesses, and wholesale customers in Poland.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives