- Italy

- /

- Diversified Financial

- /

- BIT:PST

Does Poste Italiane’s 47% Surge in 2025 Leave Room for Further Gains?

Reviewed by Simply Wall St

Thinking about what to do with your Poste Italiane stock? You are not alone. After an incredible ride, with a 74.4% gain over the past year and a 256.5% surge over five years, investors are now eyeing every move for signs of what might come next. Even this year alone, the stock is already up 47.0% year-to-date, but lately, it has cooled off just a touch, with a minor -0.0% dip over the last week and a -0.6% slip over the past month. These pauses can make anyone wonder if there is still room left to run or if it is time for caution.

Behind the scenes, Poste Italiane is benefiting from a shifting market landscape. While nothing dramatic has shaken things in recent weeks, the company continues to attract attention for its expansion into financial and insurance services. As investors debate if the stock’s best days are behind it or still to come, one question stands out: is Poste Italiane still undervalued, or has the share price raced too far ahead of itself?

If you look at standard valuation checks, Poste Italiane scores a 2 out of 6 for being undervalued. In other words, it comes out ahead on only two major methods. But the numbers only tell part of the story. Let’s look closer at what these valuation approaches actually mean, and stick around for a more insightful way to judge whether Poste Italiane is a real bargain.

Poste Italiane scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Poste Italiane Excess Returns Analysis

The Excess Returns Model evaluates how effectively Poste Italiane generates profits on the capital it invests, over and above its cost of equity. This approach focuses on the company’s core ability to create value, highlighting how much more it earns compared to what investors might reasonably expect as a minimum return.

Here are the key figures:

- Book Value: €9.20 per share

- Stable Earnings per Share (EPS): €2.03 per share

(Source: Weighted future Return on Equity estimates from 12 analysts.) - Cost of Equity: €1.61 per share

- Excess Return: €0.42 per share

- Average Return on Equity: 19.42%

- Stable Book Value: €10.46 per share

(Source: Weighted future Book Value estimates from 11 analysts.)

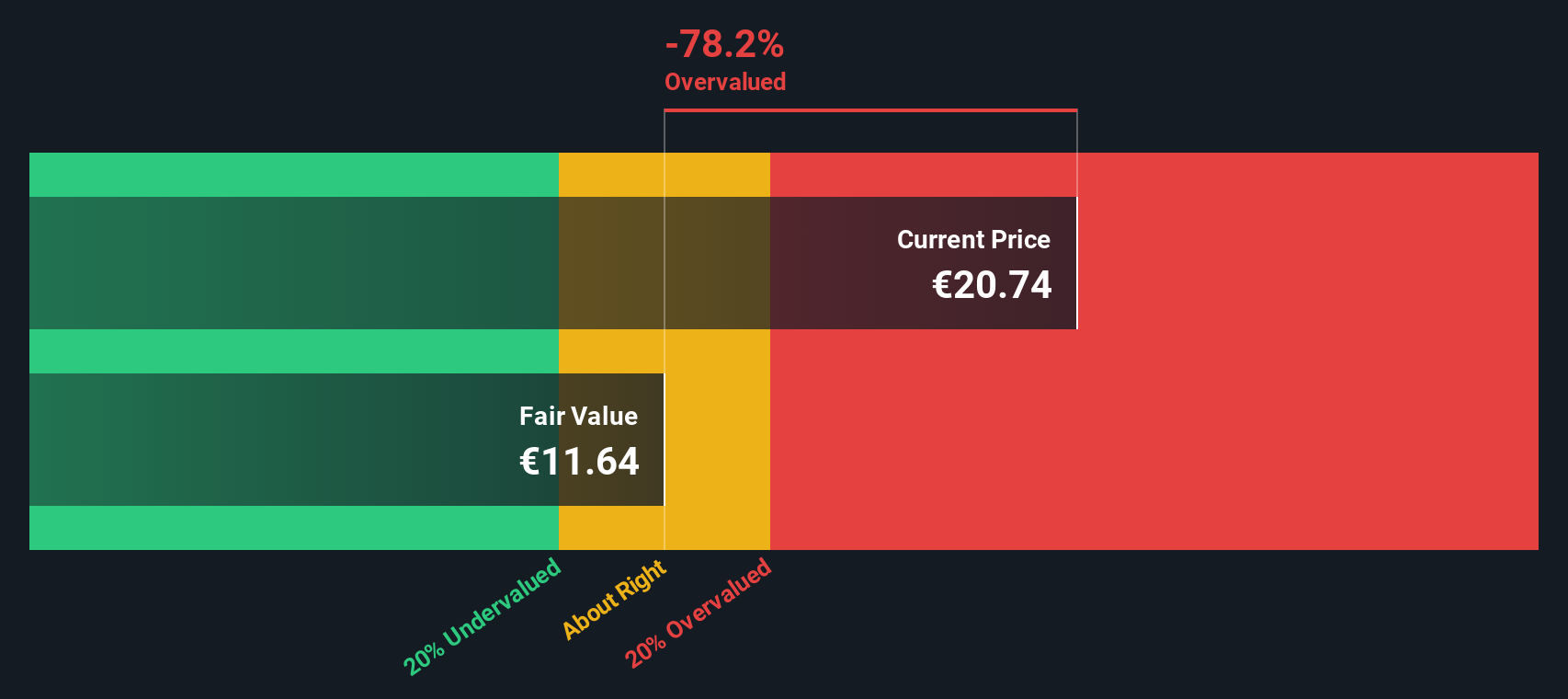

Based on this model, the calculated intrinsic value for Poste Italiane shares is €13.85. Compared to the current share price, this implies the stock is about 45.9% above its fair value according to excess returns, suggesting it may be significantly overvalued at today’s prices.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Poste Italiane.

Approach 2: Poste Italiane Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true tool for valuing profitable companies like Poste Italiane because it centers on the relationship between a company’s current share price and its actual earnings. For businesses that consistently generate a profit, the PE gives investors a direct line of sight into how much they are paying for each euro earned by the company.

However, what actually makes a “normal” or “fair” PE ratio can shift depending on the company’s future growth prospects and the perceived risks facing the business and its sector. Companies expected to grow quickly often trade on higher PEs, while those with flat or uncertain outlooks typically attract lower PE multiples.

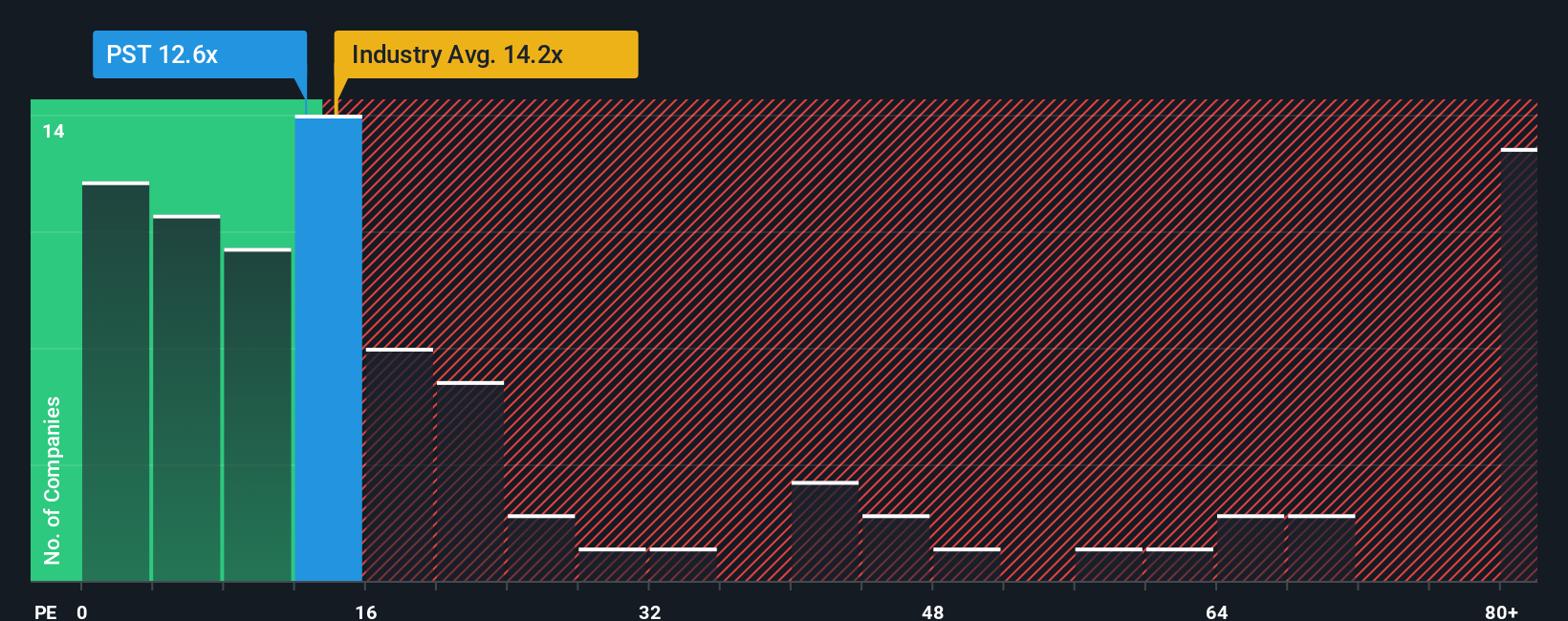

Right now, Poste Italiane is trading at a PE ratio of 12.3x. Compared to the industry average of 12.0x and the peer average of 14.5x, Poste Italiane sits comfortably in the middle of the pack. Looking beyond these broad benchmarks, Simply Wall St's proprietary “Fair Ratio” for the company is 13.5x. This figure weighs in specific factors like Poste Italiane’s actual earnings growth, the risks in its business model, its profit margins, market size, and the dynamics of its industry. Since the Fair Ratio blends these company-specific details, it provides a more targeted sense check than simply looking at what competitors or the wider industry are doing.

With a current PE ratio just below its Fair Ratio, Poste Italiane’s valuation looks about right. Investors are neither overpaying nor grabbing a deep bargain at current levels.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Poste Italiane Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story and outlook on a company, tying together your expectations for its future revenue, profit margins, and what you believe is a fair value. Narratives turn numbers into something meaningful. Narratives connect a company’s real-world story and recent events to a tailored financial forecast, then calculate a fair value from your perspective. They are easy to use and available to everyone on Simply Wall St’s Community page, making professional-grade decision tools accessible for millions of investors. With Narratives, you can quickly see at a glance whether a stock is a buy or a sell by comparing your own fair value to the current price, and they update automatically when earnings, news, or new insights emerge. For example, some investors who focus on Poste Italiane’s rapid growth in digital payments and insurance see a fair value close to €21.0 per share, while others, concerned about challenges like falling mail volumes and industry risks, set their fair value closer to €16.5. By choosing your own Narrative, you are empowered to make genuinely informed decisions aligned with your beliefs and knowledge. Do you think there's more to the story for Poste Italiane? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PST

Poste Italiane

Provides postal, logistics, and financial and insurance products and services in Italy.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives