- Italy

- /

- Personal Products

- /

- BIT:ICOS

How Investors May Respond To Intercos (BIT:ICOS) Removal From Euronext 150 Index

Reviewed by Sasha Jovanovic

- Intercos S.p.A. was recently removed from the Euronext 150 Index, a development that could impact its standing among institutional investors and index-tracking funds.

- This removal often necessitates portfolio rebalancing, which may result in shifts in demand for the company's shares from funds that track the index.

- We'll now examine how Intercos' exit from the Euronext 150 Index could affect its investment narrative and future market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Intercos Investment Narrative Recap

To be a shareholder in Intercos, you need to believe in its ability to capture long-term growth from innovation, premium client partnerships, and exposure to emerging markets, despite sector volatility and evolving consumer trends. While the recent removal from the Euronext 150 Index may reduce demand from index-tracking funds, this event is not material enough to meaningfully change the current top catalyst, expansion in high-growth Asian markets, or to alter the biggest immediate risk, which remains instability in Hair & Body segment sales.

Of recent announcements, Intercos’ latest half-year results provide context for the index news: first-half sales continued to grow (EUR 524.91 million), but net income declined versus last year. This suggests operational execution is solid but profitability pressures persist, highlighting why exposure to underperforming product lines remains the risk to monitor right now, even after the index exit.

By contrast, it’s the underlying weakness in Hair & Body segment sales that investors should really have on their radar, especially if...

Read the full narrative on Intercos (it's free!)

Intercos' outlook forecasts €1.3 billion in revenue and €93.1 million in earnings by 2028. This is based on a 4.7% annual revenue growth rate and a €45.8 million increase in earnings from the current €47.3 million.

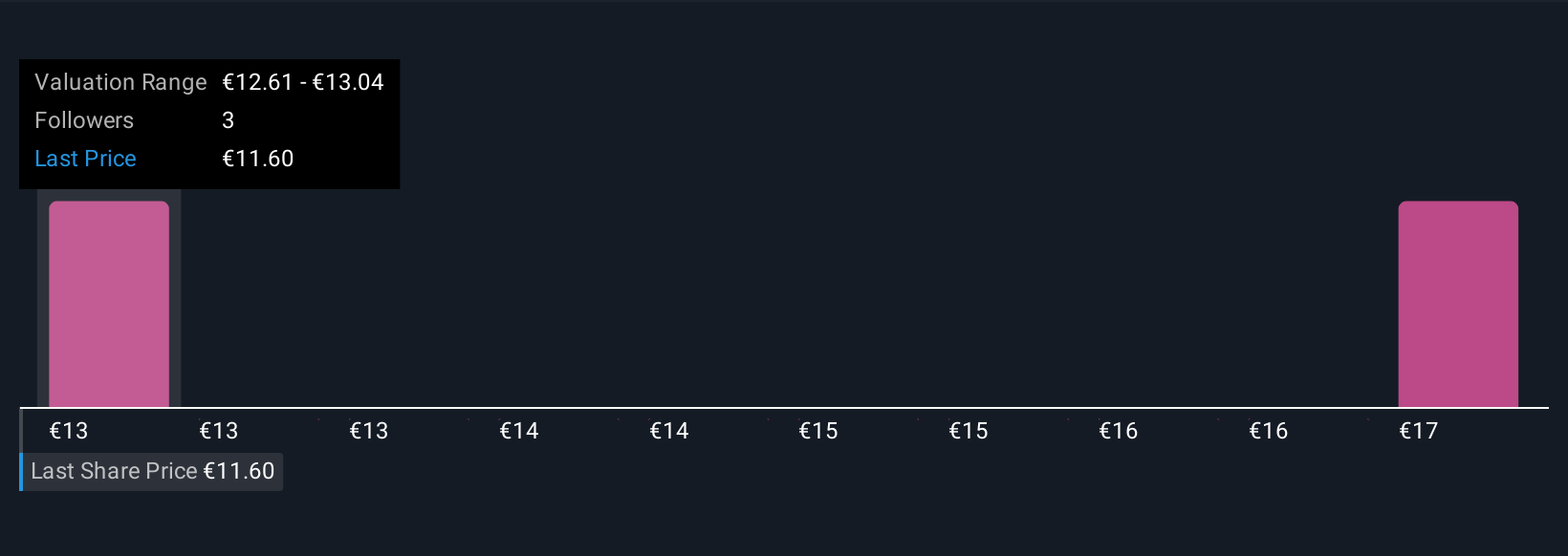

Uncover how Intercos' forecasts yield a €16.99 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates on Intercos ranging from €9.46 to €16.99, with just two opinions reflected. In light of the company’s recent index removal, both institutional positioning and Hair & Body segment trends could play a key role in shaping where the share price goes from here, explore how your view fits alongside these community perspectives.

Explore 2 other fair value estimates on Intercos - why the stock might be worth as much as 49% more than the current price!

Build Your Own Intercos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercos research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intercos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercos' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOS

Intercos

Intercos S.p.A., together with its subsidiaries, creates, produces, and markets cosmetics and skin care products worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives