As European markets experience a pullback with the pan-European STOXX Europe 600 Index declining by 1.24%, concerns about overvaluation in artificial intelligence-related stocks are weighing heavily on investor sentiment. Amidst this cautious atmosphere, discerning investors may find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite broader market challenges. Identifying such stocks often involves looking for companies with strong fundamentals, innovative business models, or unique market positions that can thrive even when broader indices face headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Intellego Technologies | 6.00% | 71.62% | 80.06% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 6.17% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Rosetti Marino (BIT:YRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Rosetti Marino SpA operates in the energy, energy transition, and shipbuilding sectors across Italy, the European Union, and internationally, with a market capitalization of €1.41 billion.

Operations: Rosetti Marino generates revenue primarily from its Oil & Gas Business Unit (€422.52 million) and Renewables and Carbon segment (€248.67 million), with smaller contributions from Various Services (€0.73 million) and Shipbuilding (€16.17 million).

Rosetti Marino, a notable player in the energy services sector, has shown impressive financial strides recently. Its earnings surged by 293.7% over the past year, outpacing industry growth of 10.6%. The company's debt to equity ratio improved from 44.5% to 39.3% in five years, and it maintains more cash than its total debt. For the half-year ending June 2025, sales climbed to €318.95 million from €210.35 million last year, with net income rising to €11.67 million from €7.87 million previously—indicating robust performance despite recent share price volatility.

- Click to explore a detailed breakdown of our findings in Rosetti Marino's health report.

Gain insights into Rosetti Marino's past trends and performance with our Past report.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Miquel y Costas & Miquel, S.A. is a company that manufactures and sells thin and special lightweight paper primarily for the tobacco industry, operating in Spain, the European Union, OECD countries, and internationally with a market capitalization of €533.48 million.

Operations: Miquel y Costas & Miquel generates revenue primarily from the tobacco industry, contributing €252.19 million, and industrial products, adding €97.67 million. The company has a market capitalization of approximately €533.48 million.

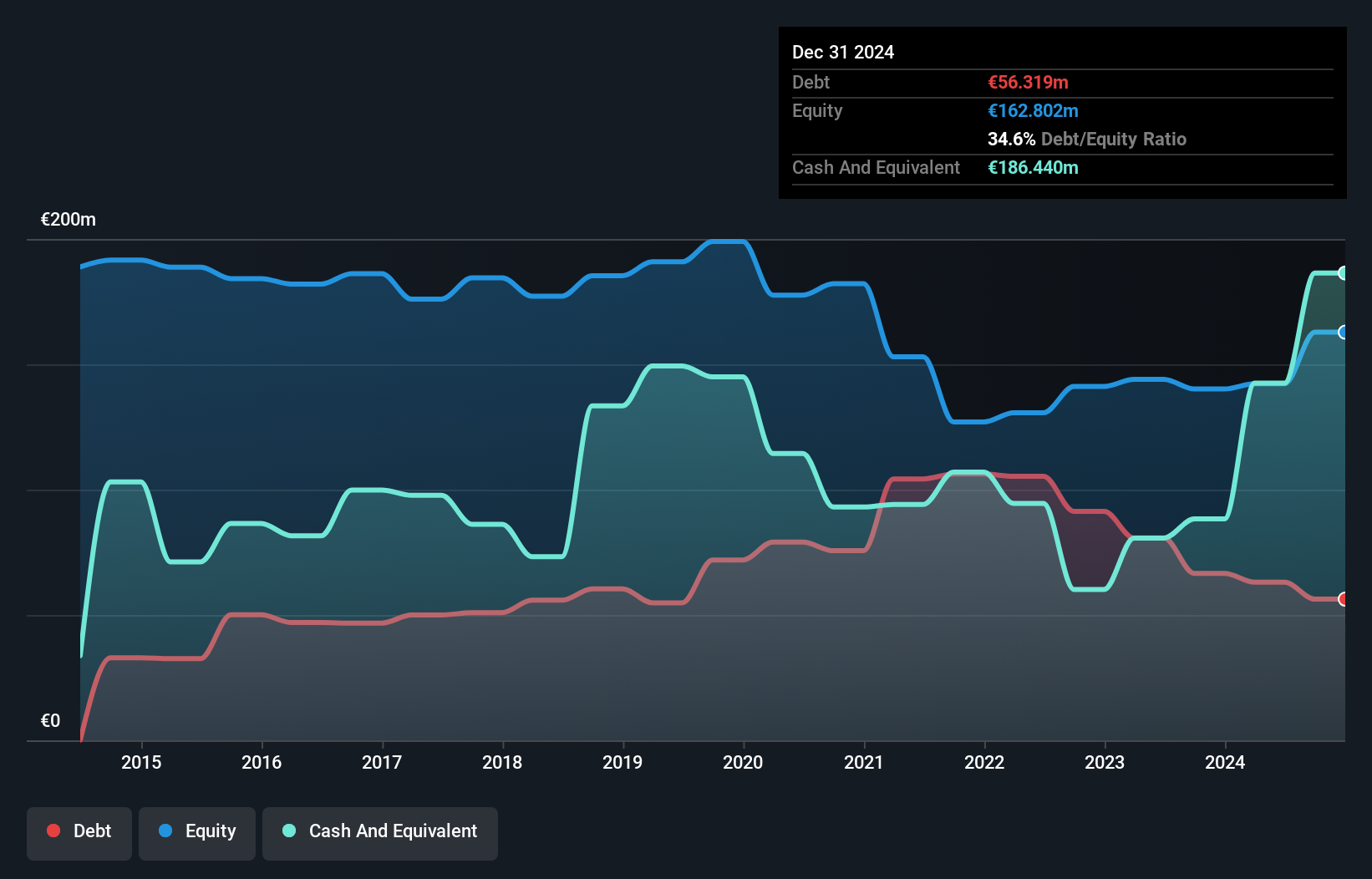

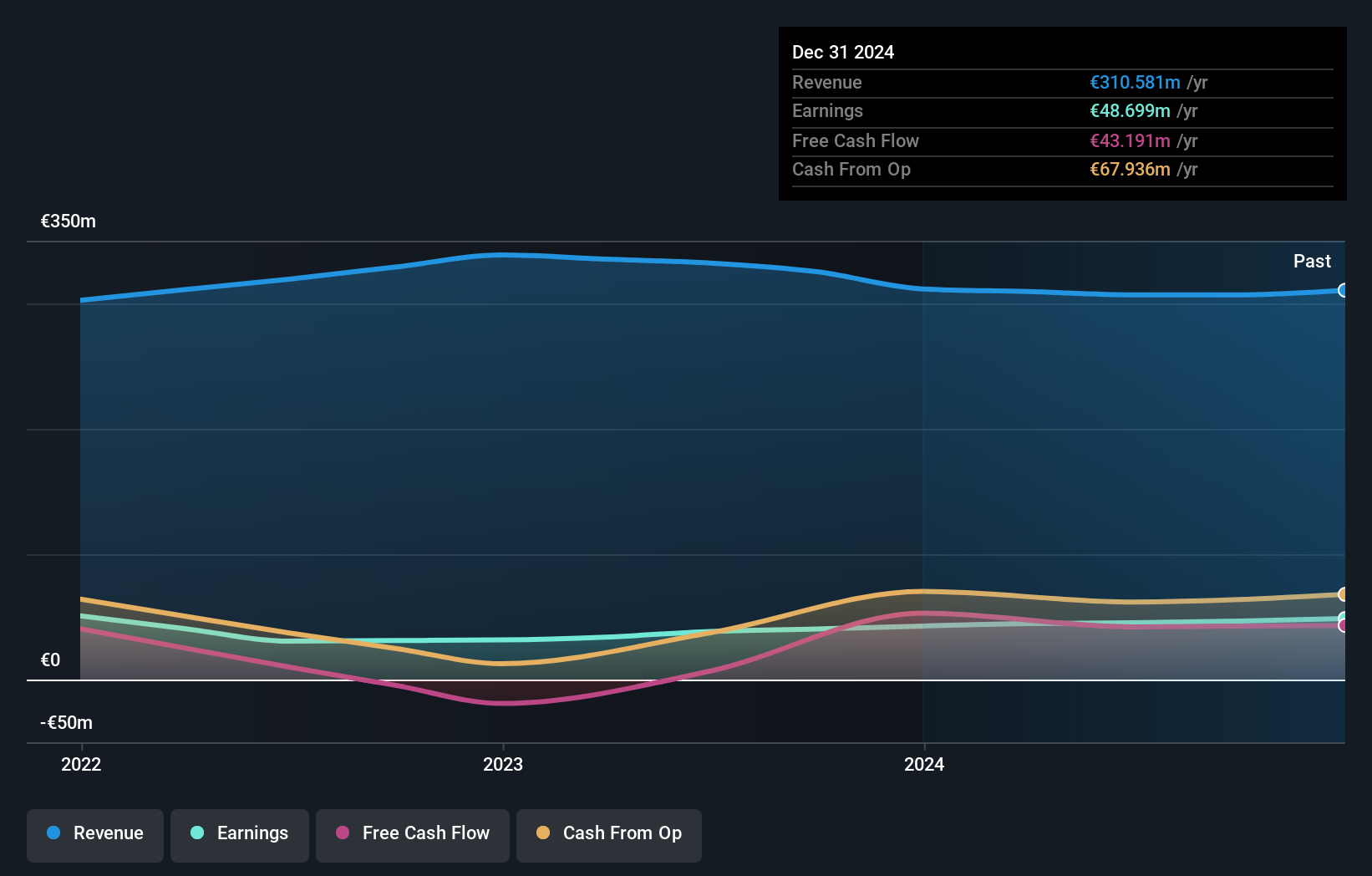

Miquel y Costas & Miquel, a notable player in the paper industry, has shown resilience despite challenges. Over the past year, earnings grew by 2.2%, outpacing a struggling forestry sector that saw a -24.2% change. The company's net debt to equity ratio improved from 25.2% to 13% over five years, reflecting prudent financial management and is currently at 5.9%, which is satisfactory by industry standards. While recent half-year sales rose to €169 million from €164 million last year, net income slipped slightly to €24 million from €26 million previously, with EPS at €0.64 compared to €0.7 prior year-end figures suggest strong cash flow generation of €43 million as of December 2024.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retail company that offers home decoration, consumables, seasonal products, leisure items, and DIY products across Sweden, Norway, Finland, and Germany with a market capitalization of approximately SEK9.86 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.99 billion and Norway SEK2.56 billion.

Rusta AB, a retailer in the Nordic region and Germany, is navigating an ambitious growth phase with plans to open 50 to 80 new stores over three years. Despite recent earnings showing a net income of SEK 174 million compared to SEK 231 million last year, Rusta's strong balance sheet and high-quality earnings position it well for expansion. The company trades at 49.1% below its estimated fair value, offering potential upside as it enhances store formats for better customer experience. However, challenges like currency fluctuations and rising costs could impact margins despite anticipated annual revenue growth of 9.2%.

Turning Ideas Into Actions

- Delve into our full catalog of 326 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Engages in the retail of products in home decoration, consumables, seasonal products, leisure, and Do It Yourself (DIY) categories in Sweden, Norway, Finland, and Germany.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives