- Italy

- /

- Diversified Financial

- /

- BIT:IF

Banca IFIS (BIT:IF) Is Up 11.9% After Surge in Nine-Month Net Income – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Banca IFIS S.p.A. announced its third-quarter and nine-month 2025 earnings, posting net interest income of €101.2 million for the quarter and net income of €407.5 million.

- The dramatic rise in year-to-date net income compared to the same period last year highlights a marked improvement in profitability for the company.

- To understand how this surge in profitability could reshape Banca IFIS’s investment narrative, we’ll review its implications for future growth and integration.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Banca IFIS Investment Narrative Recap

To be a shareholder in Banca IFIS, you need to believe in the bank’s ability to navigate Italy’s NPL and SME markets while creating value through integration of recent acquisitions. The recent earnings announcement delivered a significant, unusual spike in nine-month net income, highlighting near-term profitability, but it does not materially shift the catalyst or alleviate the biggest short-term risk: integration of illimity, with its complexity and required restructuring costs, remains the key issue that could pressure earnings for some time.

Among recent developments, the full-year dividend proposal of €2.12 per share, already partly distributed, underscores management’s confidence in ongoing capital strength and shareholder returns. However, this is particularly relevant now as investors assess whether robust dividend payments can be safely sustained against the backdrop of ongoing integration and restructuring expenses, which still weigh heavily on the bank’s immediate outlook.

By contrast, the complexity and cost of post-merger integration remains a crucial risk investors should be aware of, especially if...

Read the full narrative on Banca IFIS (it's free!)

Banca IFIS is projected to reach €845.6 million in revenue and €192.3 million in earnings by 2028. This outlook assumes 10.0% annual revenue growth and a €37.2 million increase in earnings from the current €155.1 million.

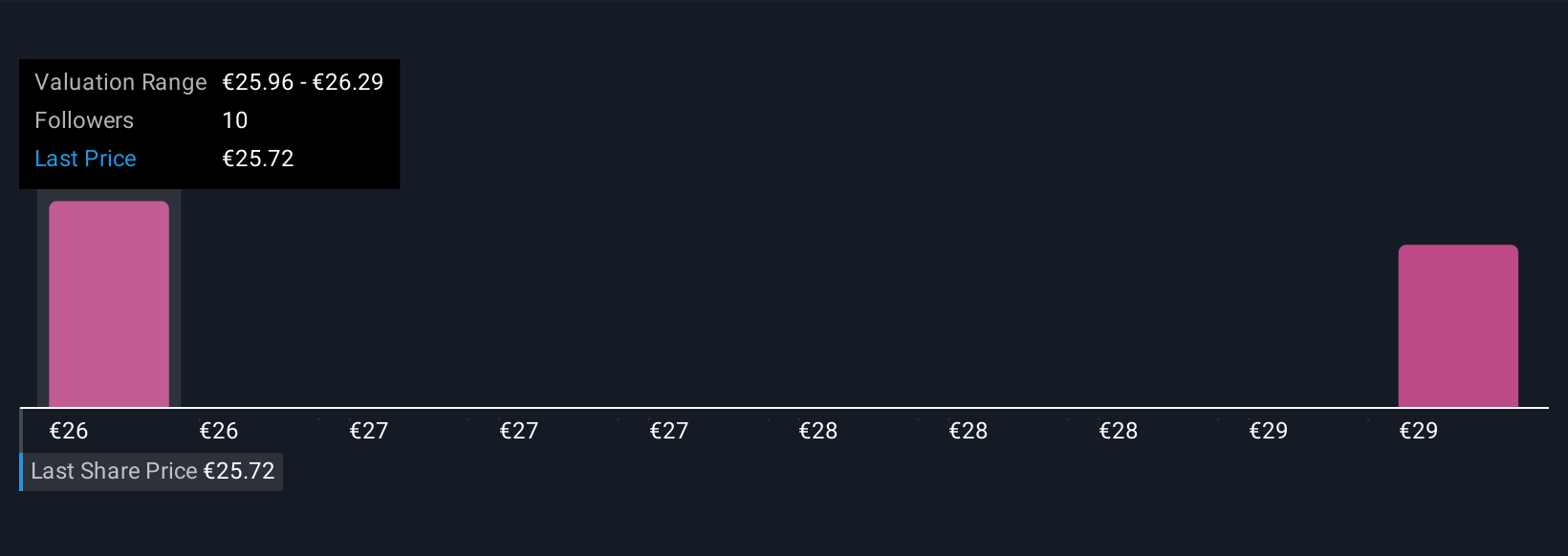

Uncover how Banca IFIS' forecasts yield a €25.96 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community estimated Banca IFIS’s fair value between €25.96 and €26.79 per share. While these views differ, integrating illimity and managing related restructuring costs could affect how both professional and individual investors assess future profitability and risk.

Explore 2 other fair value estimates on Banca IFIS - why the stock might be worth just €25.96!

Build Your Own Banca IFIS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banca IFIS research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Banca IFIS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banca IFIS' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banca IFIS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:IF

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives