- Italy

- /

- Capital Markets

- /

- BIT:BGN

Is Banca Generali (BIT:BGN) Shifting Priorities as Net Income Falls Despite Higher Net Interest Income?

Reviewed by Sasha Jovanovic

- Banca Generali announced its earnings results for the nine months ended September 30, 2025, highlighting net interest income of €242.78 million and net income of €314.61 million, both compared to the same period last year.

- The results revealed that while net interest income increased, there was a decrease in both net income and earnings per share, signaling a mixed performance across key financial metrics.

- We'll examine how Banca Generali's dip in net income impacts the longer-term investment narrative for the company.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Banca Generali Investment Narrative Recap

To be a shareholder in Banca Generali, you need to believe in its ability to leverage its advisor-led model and capitalize on Italy’s growing demand for personalized wealth management, despite evolving digital and demographic trends. The recent earnings news, showing higher net interest income but lower net income and EPS, does not materially shift the near-term catalysts or alter the biggest risk: the challenge posed by digital-first investing channels and competition pressuring traditional fee margins.

Among recent announcements, the cancellation of Mediobanca’s acquisition offer stands out. This event reinforces the importance of Banca Generali’s independence, especially as it seeks to drive organic growth through partnerships like the insurebanking initiative, which could be crucial in responding to revenue and profitability pressures highlighted in the latest results.

In contrast, investors should be especially aware of the structural risks from the accelerating shift toward low-cost digital investment platforms, as ...

Read the full narrative on Banca Generali (it's free!)

Banca Generali's outlook anticipates €1.0 billion in revenue and €419.4 million in earnings by 2028. This reflects a 1.2% annual revenue growth rate and a €27.6 million increase in earnings from the current €391.8 million.

Uncover how Banca Generali's forecasts yield a €56.10 fair value, a 5% upside to its current price.

Exploring Other Perspectives

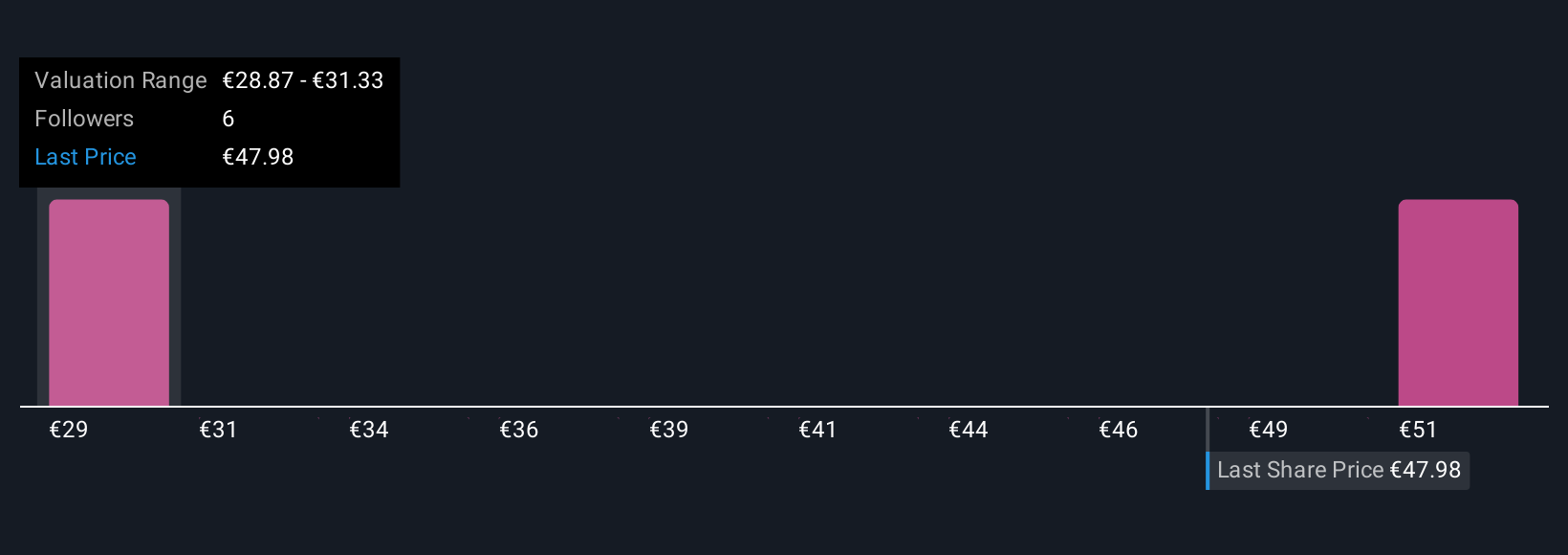

Three community-sourced fair value estimates for Banca Generali range widely from €29.47 to €56.10. While opinions differ, the company’s current reliance on advisor-driven client acquisition stands in clear focus as the industry pivots toward digital and lower-fee models, invite yourself to explore these varied viewpoints before forming your own outlook.

Explore 3 other fair value estimates on Banca Generali - why the stock might be worth as much as €56.10!

Build Your Own Banca Generali Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banca Generali research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Banca Generali research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banca Generali's overall financial health at a glance.

No Opportunity In Banca Generali?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banca Generali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BGN

Banca Generali

Distributes financial products and services for high net worth, affluent, and private customers through financial advisors in Italy.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives