Slower Tourism Sales Might Change The Case For Investing In Moncler (BIT:MONC)

Reviewed by Sasha Jovanovic

- Moncler recently reported a 1% year-on-year sales decline for the third quarter, with a solid performance in China and the Americas offset by weak tourist demand in Europe and Japan, and plans to open a flagship store on Fifth Avenue in New York by June 2026.

- Despite revenues slightly exceeding analyst expectations, the company's performance lagged behind some luxury peers, and management projected a more cautious outlook for upcoming quarters due to ongoing regional headwinds.

- We’ll examine how Moncler’s softer sales in key tourism markets may reshape its investment narrative and growth assumptions going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Moncler Investment Narrative Recap

Moncler’s investment case rests on its ability to weather shifting consumer trends and tourist flows, with ongoing expansion in China and the Americas as a key catalyst. The recent third-quarter sales dip, driven by weaker tourism in Europe and Japan, raises the importance of Moncler’s exposure to international travel and signals that recovery in these regions remains the most significant risk. The news event does not appear to materially alter the near-term outlook, but reinforces attention on geographic revenue balance.

Moncler’s plan to open a New York Fifth Avenue flagship underscores its focus on direct-to-consumer growth in major markets. This aligns closely with its strategy to diversify revenue streams beyond regions most affected by weaker tourism and to strengthen long-term brand positioning, both of which could mitigate headline risks tied to fluctuating international visitor demand.

But even as Moncler expands in resilient regions, the contrast in performance highlights for investors the importance of understanding ongoing exposure to...

Read the full narrative on Moncler (it's free!)

Moncler's narrative projects €3.8 billion revenue and €770.1 million earnings by 2028. This requires 6.7% yearly revenue growth and a €157.8 million earnings increase from €612.3 million today.

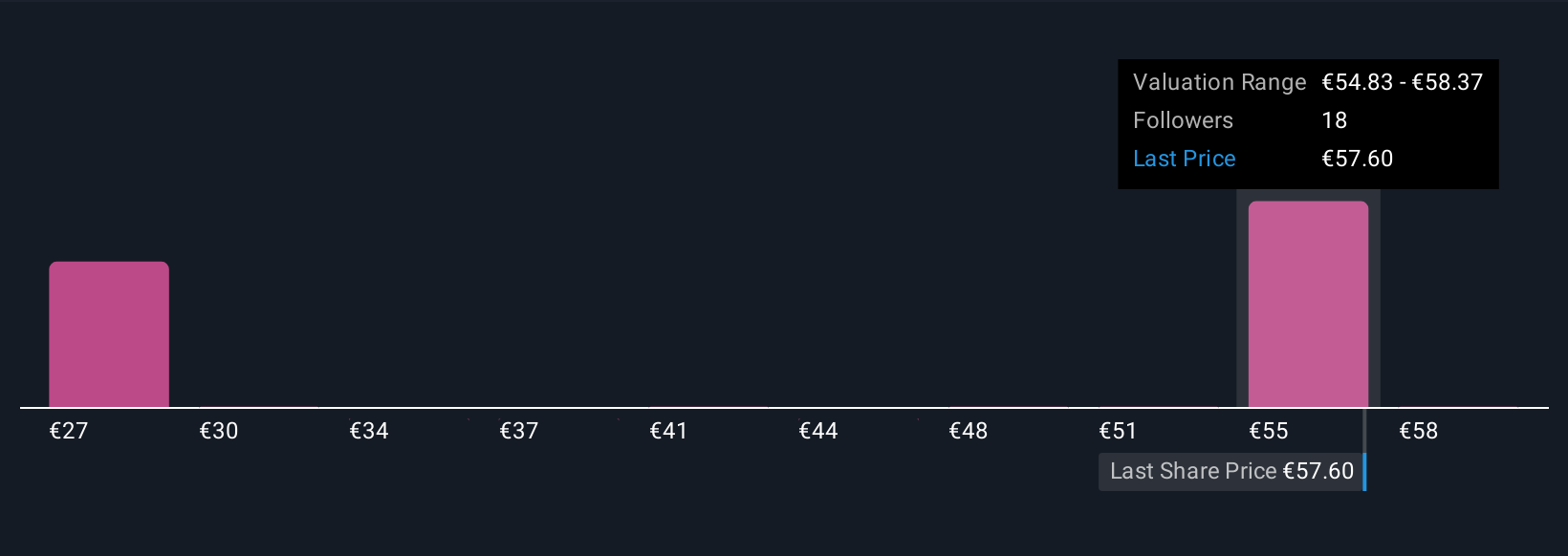

Uncover how Moncler's forecasts yield a €56.37 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Eight Simply Wall St Community fair value estimates for Moncler span a wide range, from €26.59 to €61.91. While some see steep undervaluation, the group’s sensitivity to tourist demand in Europe and Japan remains a central consideration for future results.

Explore 8 other fair value estimates on Moncler - why the stock might be worth as much as 19% more than the current price!

Build Your Own Moncler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moncler research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Moncler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moncler's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MONC

Moncler

Produces and distributes clothing for men, women and children, footwear, glasses, and other accessories under the Moncler and Stone Island brands in Italy, rest of Europe, Asia, the Middle East, Africa, and the Americas.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives