- Italy

- /

- Commercial Services

- /

- BIT:DOV

doValue S.p.A. (BIT:DOV) Soars 30% But It's A Story Of Risk Vs Reward

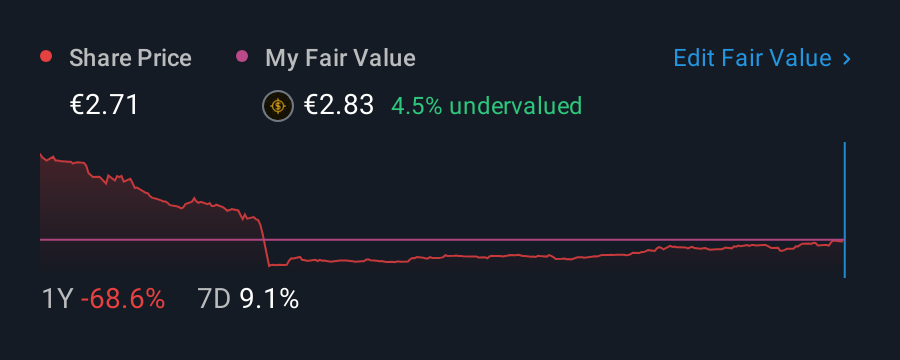

The doValue S.p.A. (BIT:DOV) share price has done very well over the last month, posting an excellent gain of 30%. But the last month did very little to improve the 68% share price decline over the last year.

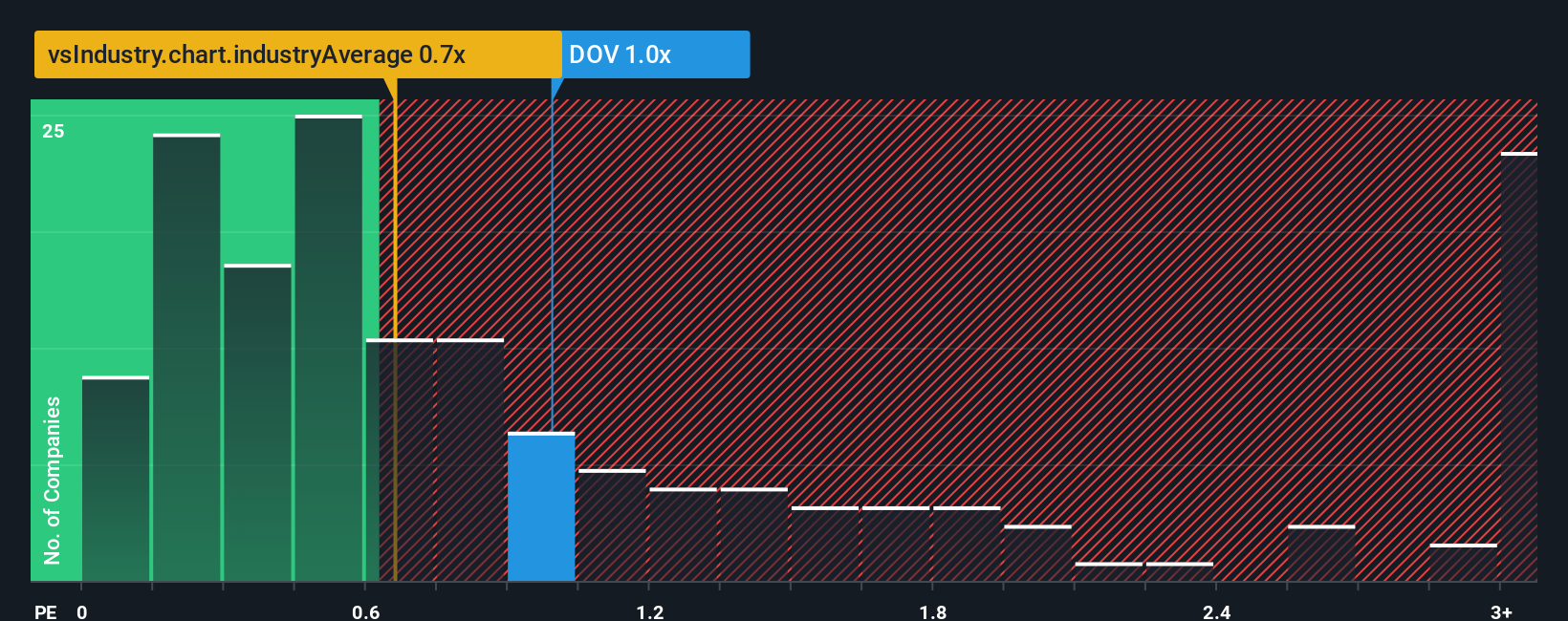

Although its price has surged higher, there still wouldn't be many who think doValue's price-to-sales (or "P/S") ratio of 1x is worth a mention when it essentially matches the median P/S in Italy's Commercial Services industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for doValue

What Does doValue's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, doValue has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on doValue.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like doValue's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.3% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 9.5% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we find it interesting that doValue is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

doValue appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, doValue's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with doValue (including 2 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DOV

doValue

Engages in the management of non-performing loans (NLP), unlikely to pay (UTP), early arrears, and performing loans for banks and investors in Italy, Spain, Greece, and Cyprus.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026