- Italy

- /

- Aerospace & Defense

- /

- BIT:LDO

Leonardo (BIT:LDO) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Leonardo (BIT:LDO), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Leonardo with the means to add long-term value to shareholders.

Leonardo's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Leonardo managed to grow EPS by 16% per year, over three years. That's a pretty good rate, if the company can sustain it.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Leonardo is growing revenues, and EBIT margins improved by 2.2 percentage points to 9.1%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

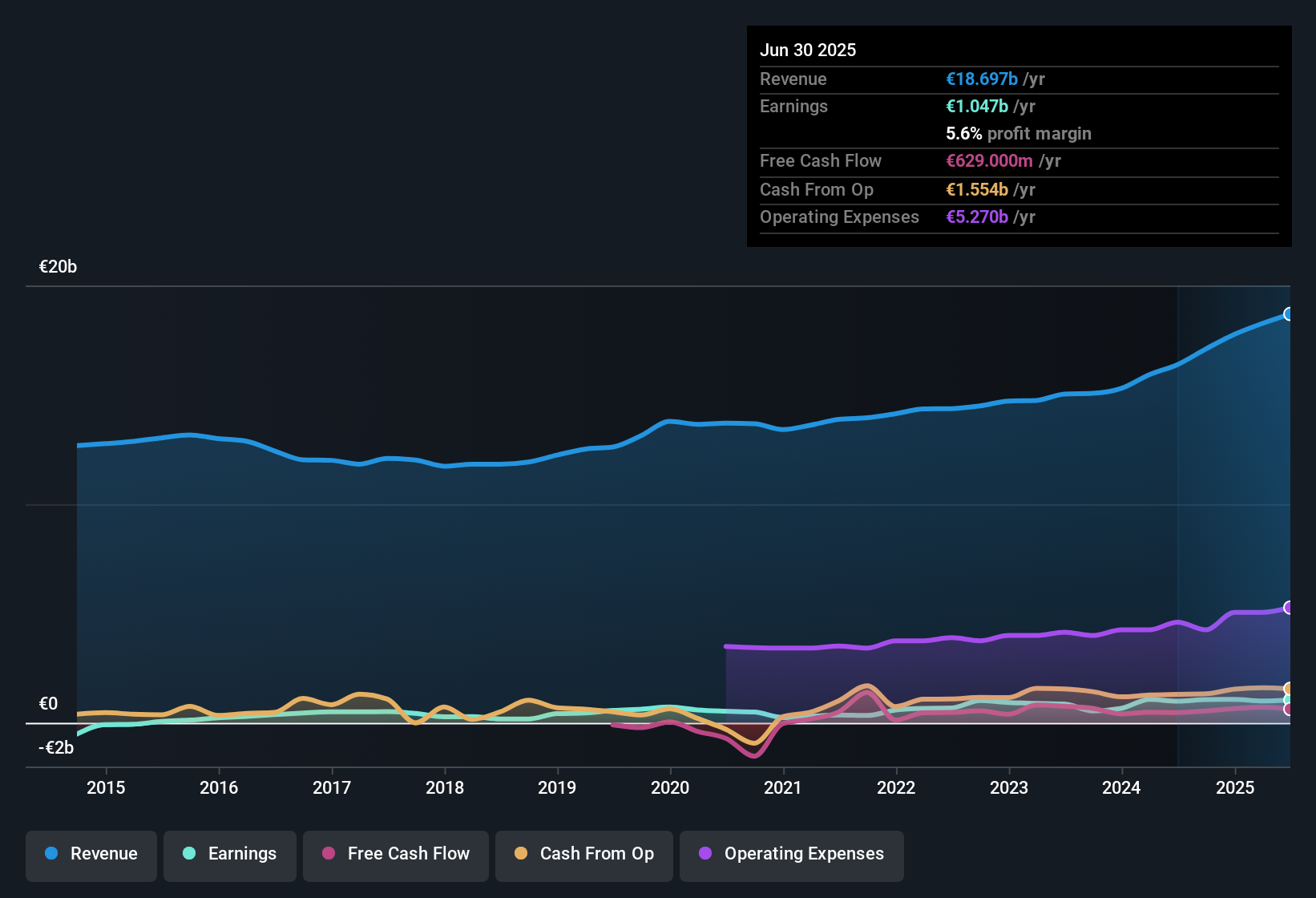

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Check out our latest analysis for Leonardo

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Leonardo's forecast profits?

Are Leonardo Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

For the sake of balance, it should be noted that Leonardo insiders sold €9.2k worth of shares last year. But that doesn't beat the large €97k share acquisition by Independent Director Dominique Levy. Overall, that is something good to take away.

It's commendable to see that insiders have been buying shares in Leonardo, but there is more evidence of shareholder friendly management. Namely, Leonardo has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Leonardo, with market caps over €6.8b, is about €3.3m.

The Leonardo CEO received €2.4m in compensation for the year ending December 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Leonardo Worth Keeping An Eye On?

As previously touched on, Leonardo is a growing business, which is encouraging. And there's more to Leonardo, with the insider buying and modest CEO pay being a great look for those with an eye on the company. If these factors aren't enough to secure Leonardo a spot on the watchlist, then it certainly warrants a closer look at the very least. What about risks? Every company has them, and we've spotted 1 warning sign for Leonardo you should know about.

Keen growth investors love to see insider activity. Thankfully, Leonardo isn't the only one. You can see a a curated list of Italian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:LDO

Leonardo

An industrial and technological company, engages in the helicopters, defense electronics and security, cyber security and solutions, aircraft, aerostructures, and space sectors in Italy, the United Kingdom, rest of Europe, the United States of America, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives