- Italy

- /

- Construction

- /

- BIT:ICOP

Undiscovered Gems in Europe for July 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of new trade tariffs and mixed economic signals, indices like the STOXX Europe 600 have shown resilience with a modest rise, despite recent setbacks due to tariff announcements. Amidst this backdrop, identifying stocks that can thrive involves looking for companies with strong fundamentals and potential for growth in sectors less impacted by geopolitical tensions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We'll examine a selection from our screener results.

I.CO.P.. Società Benefit (BIT:ICOP)

Simply Wall St Value Rating: ★★★★★★

Overview: I.CO.P. S.p.A. Società Benefit specializes in construction and special engineering services for both public and private sectors across Italy and internationally, with a market cap of €413.19 million.

Operations: I.CO.P. S.p.A. Società Benefit generates revenue primarily from its heavy construction segment, amounting to €110.92 million. The company's market capitalization is valued at €413.19 million, reflecting its financial standing in the industry.

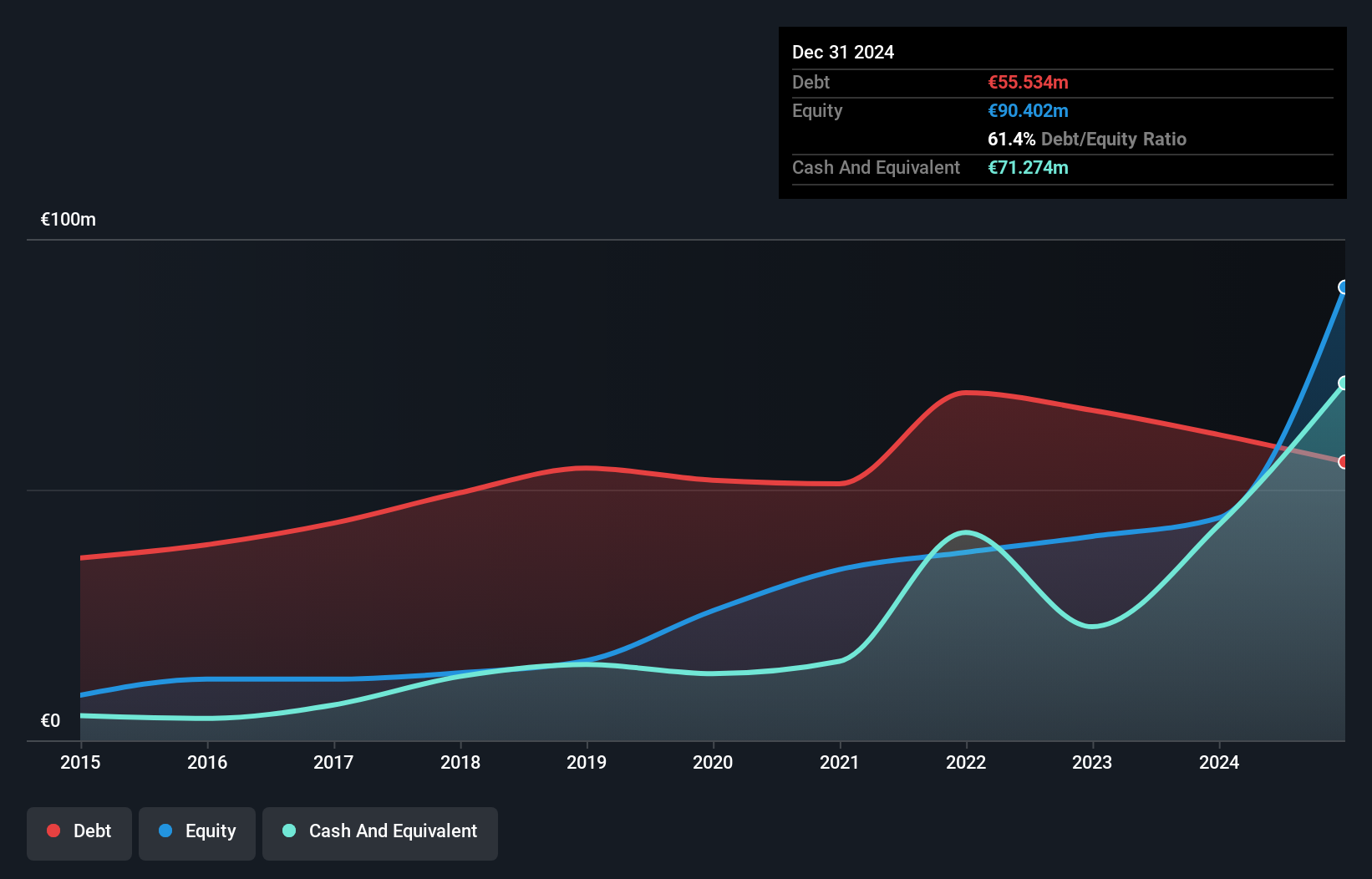

ICOP, a promising player in the European market, has seen its earnings skyrocket by 254% over the past year, outpacing the construction industry's 28%. Its debt-to-equity ratio has impressively dropped from 201% to 61% over five years, signaling prudent financial management. With interest payments well covered at a multiple of 12.5 times EBIT and trading nearly half below fair value estimates, ICOP presents an intriguing prospect. The company's non-cash earnings are robust, and it boasts more cash than total debt. Looking ahead, earnings are projected to grow by approximately 32% annually.

- Get an in-depth perspective on I.CO.P.. Società Benefit's performance by reading our health report here.

Assess I.CO.P.. Società Benefit's past performance with our detailed historical performance reports.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to diverse clients in France, with a market capitalization of approximately €613.55 million.

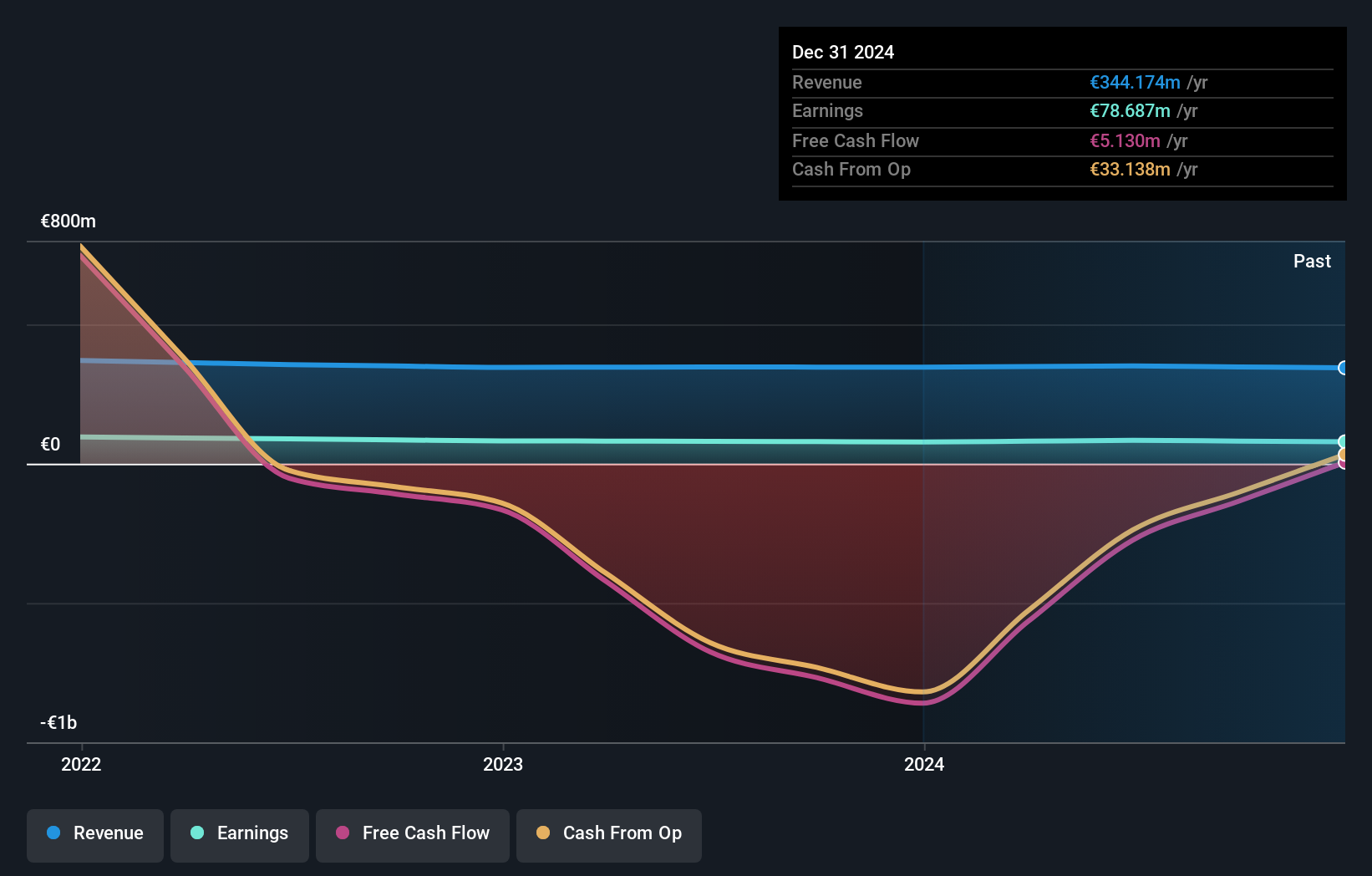

Operations: The cooperative generates revenue primarily from its retail banking segment, which accounted for €344.17 million.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative stands out with total assets of €24.6B and equity at €3.1B, reflecting a solid foundation. Its deposits and loans both tally up to €20B, indicating balanced financial operations. With a sufficient allowance for bad loans at 113% and non-performing loans at just 1.2%, the bank showcases prudent risk management practices. The price-to-earnings ratio of 7.8x suggests it is undervalued compared to the French market average of 16.2x, while earnings have grown by 2.6% annually over five years, hinting at steady progress despite industry challenges.

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nyab AB (publ) operates in Finland and Sweden, offering engineering, construction, and maintenance services for energy, infrastructure, and industrial projects across both public and private sectors with a market cap of SEK4.15 billion.

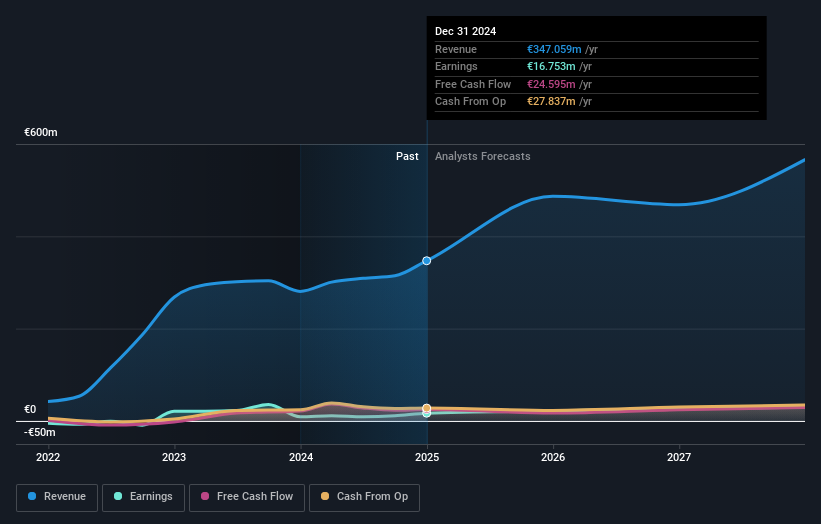

Operations: Nyab generates revenue primarily from its heavy construction segment, amounting to €393.48 million. The company has a market capitalization of approximately SEK4.15 billion.

Nyab is carving a niche in Europe's construction landscape, driven by robust earnings growth of 51% last year, far outpacing the industry's 10%. With a net debt to equity ratio at a satisfactory 1.4%, its financial health seems stable. Recent projects like the SEK 366 million contract for Stockholm's subway waterproofing and the SEK 409 million E4 road reconstruction bolster its order book. Despite liquidity concerns from negative free cash flow due to acquisitions, Nyab's EBIT covers interest payments comfortably at 53 times, indicating strong operational efficiency. Analysts foresee an annual revenue increase of around 16%, with potential upside in share value.

Key Takeaways

- Unlock our comprehensive list of 322 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOP

I.CO.P.. Società Benefit

Engages in providing construction and special engineering services to public and private clients in Italy and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives