Do UniCredit’s Confirmed Profit Guidance and Dividend Boost Reveal Strong Conviction in Its Strategy (BIT:UCG)?

Reviewed by Sasha Jovanovic

- UniCredit S.p.A. recently reported its third quarter 2025 results, highlighted by an increase in net income to €2.63 billion and confirmation of its net profit guidance for 2025 and 2027, alongside a €2.2 billion interim dividend paid on November 26, 2025.

- The reaffirmation of long-term profit targets and significant shareholder distributions underscores UniCredit's ongoing commitment to performance and capital return, even as core net interest income saw a modest decline versus the prior year.

- We'll now examine how UniCredit's confirmed multi-year profit guidance and robust dividend payment influence its broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

UniCredit Investment Narrative Recap

To be a shareholder in UniCredit, you generally need conviction in the company’s ability to deliver consistent profit growth and sustainable capital returns against the backdrop of Europe’s shifting banking landscape. The recent confirmation of multi-year net profit targets and the substantial interim dividend underlines management’s confidence, but does not notably change the primary short-term catalyst: execution of digital transformation, nor does it materially reduce the most significant risk tied to exposure in volatile, less mature markets. Among the new announcements, the reaffirmation of UniCredit’s net profit guidance for 2025 and 2027 stands out. This guidance reinforces management’s view of earnings resilience and is directly relevant for investors, serving as a vote of confidence in the bank’s ongoing efficiency initiatives, cost controls, and digital investments that underpin its growth ambitions. Conversely, investors should remain mindful of the ongoing risks linked to UniCredit’s credit quality in Central and Eastern Europe, as...

Read the full narrative on UniCredit (it's free!)

UniCredit's narrative projects €26.0 billion revenue and €10.3 billion earnings by 2028. This requires 1.6% yearly revenue growth and a €0.1 billion decrease in earnings from €10.4 billion today.

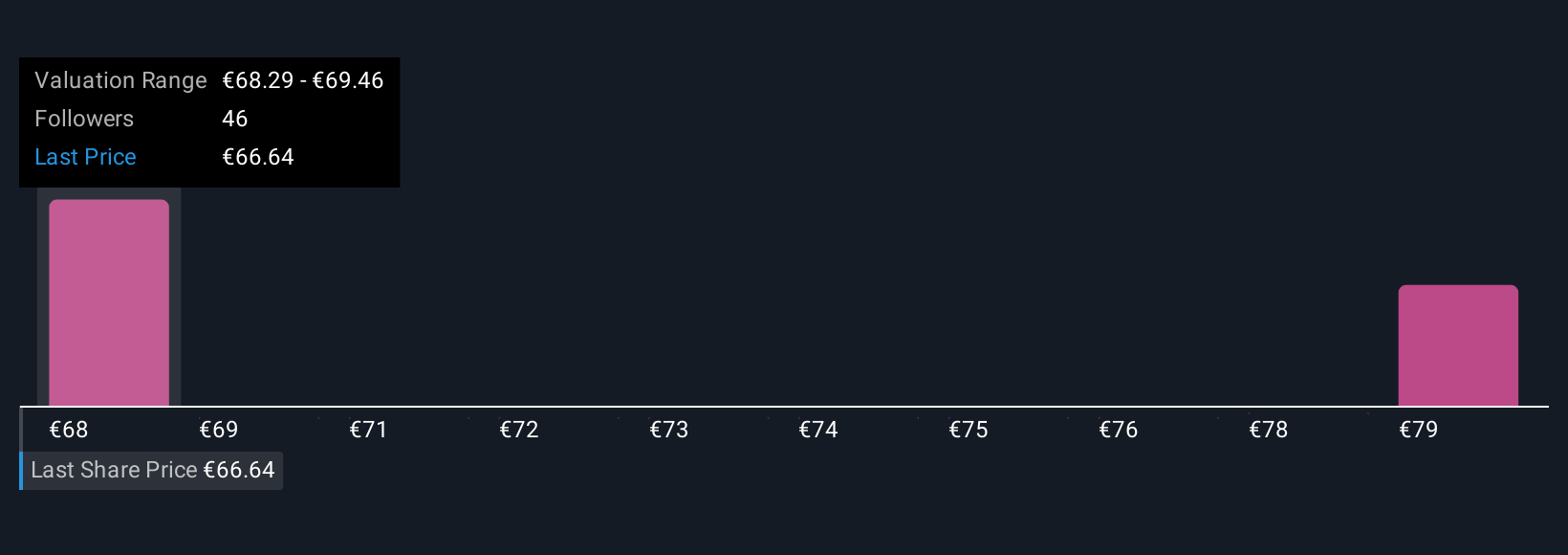

Uncover how UniCredit's forecasts yield a €68.29 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four private investors in the Simply Wall St Community estimate UniCredit’s fair value between €68.29 and €80. Recent profit guidance underscores management’s optimism, yet risks from volatile regional exposure still warrant close attention.

Explore 4 other fair value estimates on UniCredit - why the stock might be worth as much as 24% more than the current price!

Build Your Own UniCredit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UniCredit research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UniCredit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniCredit's overall financial health at a glance.

No Opportunity In UniCredit?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:UCG

UniCredit

Provides commercial banking services in Italy, Germany, Central Europe, and Eastern Europe.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives