Credito Emiliano (BIT:CE): Assessing Valuation After Generative AI Collaboration and Improved Earnings

Reviewed by Simply Wall St

Credito Emiliano (BIT:CE) caught market attention after announcing a new phase in its partnership with Google Cloud. The company aims to bring generative AI into daily workflows for its employees. This move comes shortly after improved earnings results.

See our latest analysis for Credito Emiliano.

Momentum has clearly picked up for Credito Emiliano, with the share price climbing nearly 10% over the past month and posting an impressive year-to-date gain of 38%. The combination of robust earnings and news of deeper AI adoption is adding to investor optimism. This has helped drive a remarkable one-year total shareholder return of 48% and a stellar 311% over five years, hinting at both long-term strength and renewed interest in the short term.

If you’re curious about what’s delivering outsized results lately, now is a great time to broaden your view and discover fast growing stocks with high insider ownership

With shares near recent highs and positive news fueling momentum, investors face a key question: Is Credito Emiliano undervalued given its growth initiatives, or is the market already factoring in all future gains?

Most Popular Narrative: 8% Overvalued

The most widely held narrative sets Credito Emiliano’s fair value at €13.65, which is 8% below the recent closing price of €14.78. The narrow gap between the narrative’s fair value and the current share price points to growing tensions about whether recent growth and digital innovations have already been priced in.

The market may be overestimating Credito Emiliano's ability to defend its net interest income and margins as European interest rates are expected to fall further into 2026, putting structural pressure on NII growth and potentially flattening or reducing core earnings. Investors could be pricing in persistent gains from recurring commissions and fee-based revenues, yet these may be vulnerable as digital disruption intensifies; fintechs and big techs are likely to further erode traditional banks' market share in wealth management and private banking, compressing revenue growth and customer retention.

What’s powering this tight valuation? The secret sauce is a bold combination of shifting interest rates, compressed profit margins, and digital disruption threatening revenue streams. Want to unravel the exact projection that tips the scales? Discover the numbers and logic behind this provocative stance on Credito Emiliano’s fair value.

Result: Fair Value of €13.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued customer growth and robust asset quality could fuel further gains. This may potentially challenge current assumptions about Credito Emiliano's earnings outlook.

Find out about the key risks to this Credito Emiliano narrative.

Another View: Market Ratios Paint a Different Picture

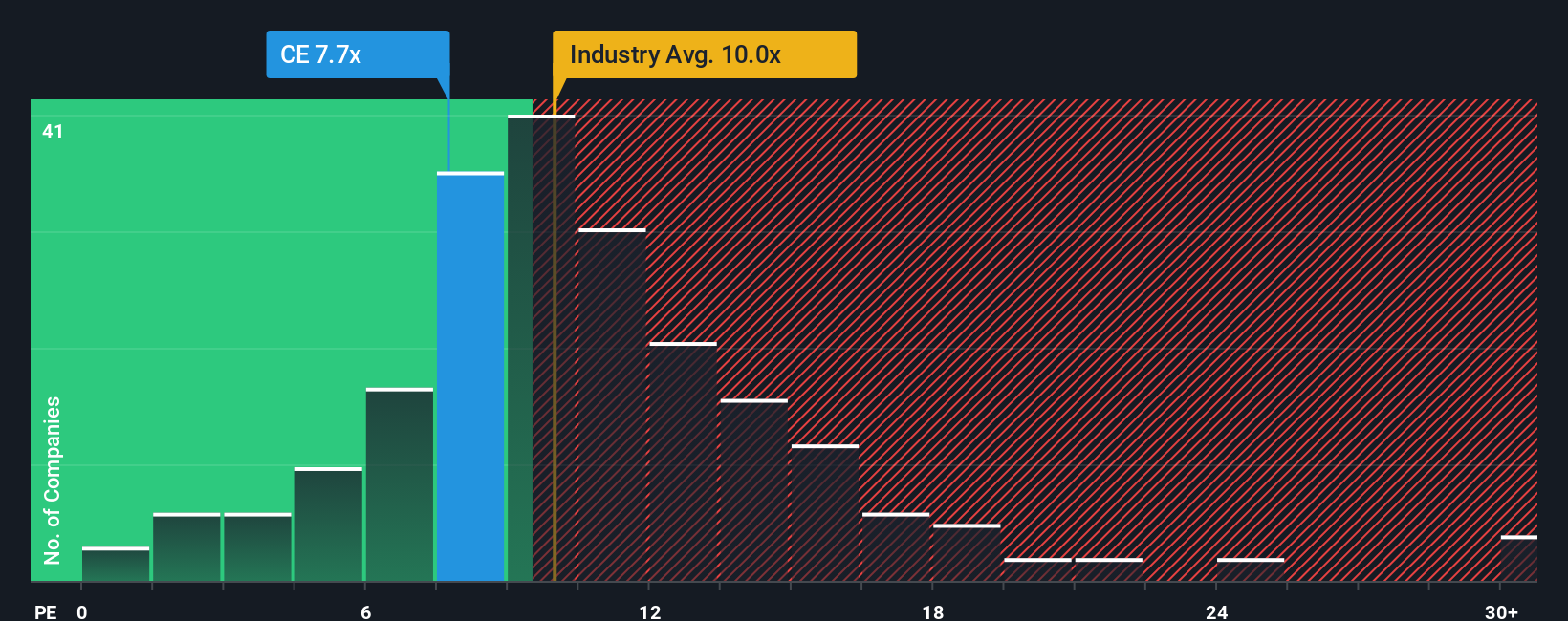

Looking through the lens of earnings multiples, Credito Emiliano trades at 7.9 times its earnings, which is noticeably lower than its peer average of 13.2x and the European industry average of 10.2x. However, compared to its fair ratio of 7.5x, shares are just a touch expensive. This narrow margin suggests little room for error or unexpected challenges. Could the market be too optimistic about future growth, or does it signal underlying opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credito Emiliano Narrative

If you see things differently or enjoy digging into the numbers yourself, you can develop your own view in just a few minutes. So why not Do it your way

A great starting point for your Credito Emiliano research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Opportunities?

Still searching for your next winning move? Let Simply Wall St guide you to fresh opportunities and emerging trends that could transform your portfolio outlook.

- Boost your income potential by securing a spot in these 14 dividend stocks with yields > 3%, which offers yields above 3% for steady long-term returns.

- Stay ahead of financial innovation and check out these 82 cryptocurrency and blockchain stocks, which is shaping the future of payments, security, and digital assets.

- Tap into tomorrow’s breakthroughs by spotting hidden value within these 27 AI penny stocks, positioned at the forefront of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CE

Credito Emiliano

Engages in commercial banking and wealth management activities in Italy.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives