How Investors May Respond To Banco di Desio (BIT:BDB) Nine-Month Net Income Decline

Reviewed by Sasha Jovanovic

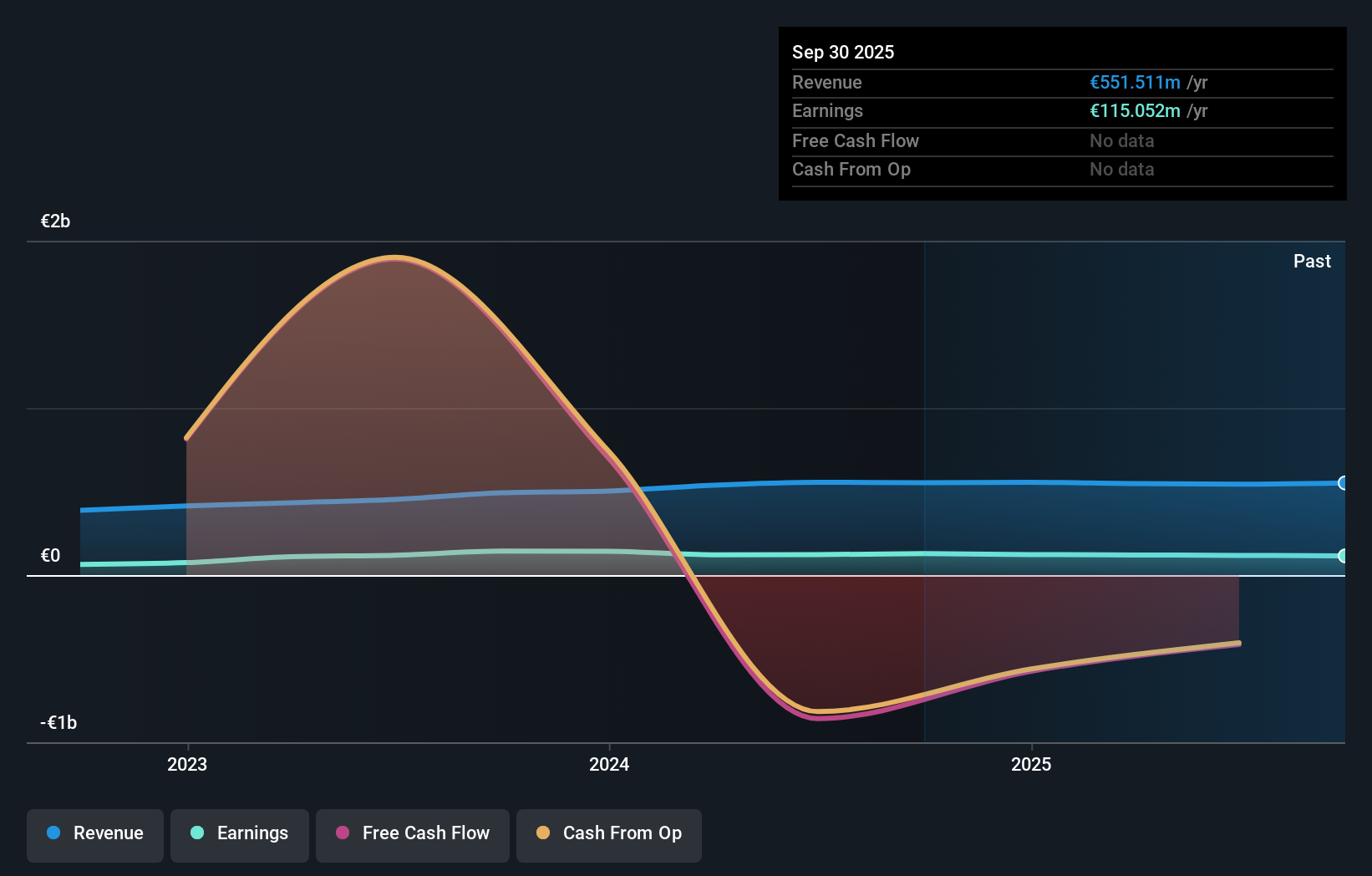

- Banco di Desio e della Brianza S.p.A. reported earnings results for the nine months ended September 30, 2025, with net income of €105.9 million compared to €116.4 million in the previous year.

- This decrease in net income over the period highlights shifting business conditions impacting the bank's financial results.

- We'll explore how the recent earnings decline shapes Banco di Desio e della Brianza's investment narrative and future performance outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Banco di Desio e della Brianza's Investment Narrative?

For shareholders of Banco di Desio e della Brianza, the big picture centers on whether the bank can stabilize profit levels as the recent decline in net income, now at €105.9 million for the nine months to September, signals persistent headwinds. The earnings drop, continuing a trend of softer quarterly results, may prompt investors to reassess short-term drivers such as cost control, net interest income resilience, and dividend sustainability in the wake of current market dynamics. While past inclusion in the S&P Global BMI Index and prior dividend announcements were positive signals, this latest update suggests ongoing pressure on profitability rather than a sharp shock, as recent share price gains appear largely unaffected. However, lingering risks, including low return on equity and underperformance against peers, could become more pronounced if earnings fail to recover in upcoming quarters. But unlike competitor banks, the return on equity is still considered low.

Banco di Desio e della Brianza's shares are on the way up, but they could be overextended by 12%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Banco di Desio e della Brianza - why the stock might be worth 11% less than the current price!

Build Your Own Banco di Desio e della Brianza Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco di Desio e della Brianza research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Banco di Desio e della Brianza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco di Desio e della Brianza's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco di Desio e della Brianza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BDB

Banco di Desio e della Brianza

Provides banking products and services to individuals and enterprises in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives