Ferrari (BIT:RACE): Exploring the Valuation Case After Recent Share Price Pullback

Reviewed by Simply Wall St

Ferrari (BIT:RACE) shares have had a mixed run lately, giving up ground over the past month after an extended multi-year climb that saw the stock double over the past five years. Investors may be reassessing recent moves as they weigh future growth against current valuations.

See our latest analysis for Ferrari.

This year, Ferrari’s share price has come under pressure. Despite a decade-long reputation for excellence, the stock is down noticeably in 2024. However, long-term holders have still enjoyed a remarkable 101% total shareholder return over five years, suggesting that the recent loss of momentum may be more about shifting market sentiment than fading fundamentals.

If you’re looking to discover what else the auto industry has to offer, now’s a great moment to explore See the full list for free.

With the recent pullback, the pressing question for investors is whether Ferrari’s current share price represents an attractive entry point or if the company’s strong fundamentals and future prospects are already fully reflected in the market.

Most Popular Narrative: 16.4% Undervalued

According to the most widely followed narrative, Ferrari’s current share price of €337.8 sits below their fair value estimate, suggesting that the market may be undervaluing its long-term growth and margin potential. A sharp focus on new product launches and strategic brand positioning is highlighted as a major catalyst for future upside.

Expanding the model lineup (for example, Amalfi, 296 Speciale, increased customization and personalization offerings) is successfully attracting new ultra-high-net-worth clients globally, especially in underpenetrated regions like China. This supports future revenue growth, average selling price improvements, and enhances long order backlog visibility.

Curious which future models, revenue streams, and bold analyst assumptions build the case for such a gap? Discover which forward-looking numbers, global shifts, and exclusive strategies combine to project a future valuation well above today’s stock price. Don’t miss the details that set this story apart.

Result: Fair Value of €404.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainties around Ferrari’s pace of electrification and rising input costs could challenge the company’s long-term earnings trajectory and pricing strength.

Find out about the key risks to this Ferrari narrative.

Another View: Pricing in Context

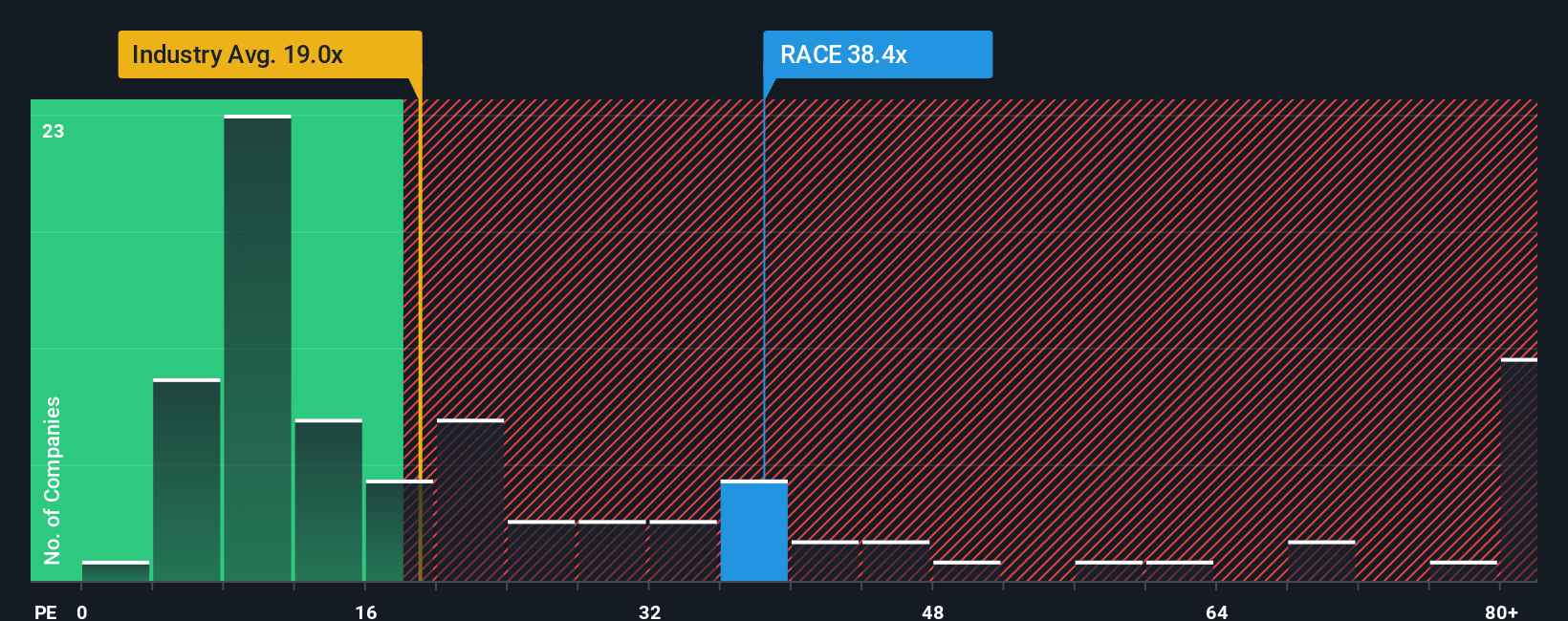

Despite the enthusiasm around Ferrari’s growth story, its price-to-earnings ratio of 37.4x stands well above the auto industry average of 18.2x and the peer average of 16.7x. This is also nearly double its fair ratio of 19.7x, which suggests the market may be demanding a premium for exclusivity; however, this also increases valuation risk if future growth falls short. Could this premium be justified, or is Ferrari’s allure driving the price out of line with fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you’re eager to investigate further or have your own perspective on Ferrari’s valuation, you can quickly craft a personal narrative using our tools, often in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ferrari.

Looking for More Smart Investment Opportunities?

Don’t let the chance slip by to find compelling stocks far beyond the obvious choices. Simply Wall Street’s powerful Screener reveals ideas you won’t want to miss.

- Uncover stable cash generators and accelerate your income strategy by tapping into these 15 dividend stocks with yields > 3% with attractive yields over 3%.

- Jump ahead of tomorrow’s tech trends by reviewing these 25 AI penny stocks set to benefit from artificial intelligence innovation.

- Find deeply discounted shares that are potentially overlooked by the broader market through these 915 undervalued stocks based on cash flows and upgrade your value playbook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026