- India

- /

- Specialty Stores

- /

- NSEI:NYKAA

Investors one-year losses continue as FSN E-Commerce Ventures (NSE:NYKAA) dips a further 3.1% this week, earnings continue to decline

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that FSN E-Commerce Ventures Limited (NSE:NYKAA) stock has had a really bad year. The share price has slid 59% in that time. FSN E-Commerce Ventures may have better days ahead, of course; we've only looked at a one year period. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days.

If the past week is anything to go by, investor sentiment for FSN E-Commerce Ventures isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for FSN E-Commerce Ventures

While FSN E-Commerce Ventures made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last twelve months, FSN E-Commerce Ventures increased its revenue by 36%. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 59% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

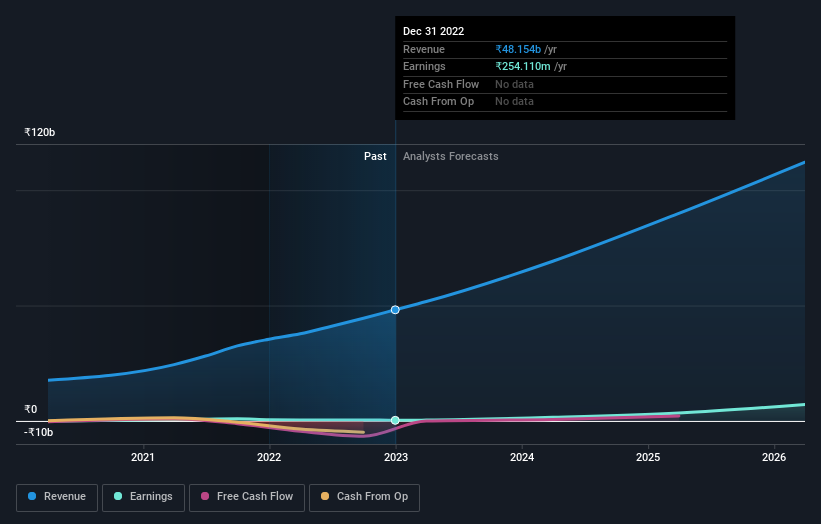

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

FSN E-Commerce Ventures shareholders are down 59% for the year, even worse than the market loss of 2.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 6.2% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for FSN E-Commerce Ventures you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NYKAA

FSN E-Commerce Ventures

Through its subsidiaries, provides a range of beauty, personal care, and fashion products for women, men, kids, and home in India and internationally.

High growth potential with solid track record.