Procter & Gamble Health Limited's (NSE:PGHL) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Procter & Gamble Health (NSE:PGHL) has had a great run on the share market with its stock up by a significant 12% over the last month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Procter & Gamble Health's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Procter & Gamble Health is:

39% = ₹2.4b ÷ ₹6.1b (Based on the trailing twelve months to December 2024).

The 'return' refers to a company's earnings over the last year. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.39 in profit.

View our latest analysis for Procter & Gamble Health

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Procter & Gamble Health's Earnings Growth And 39% ROE

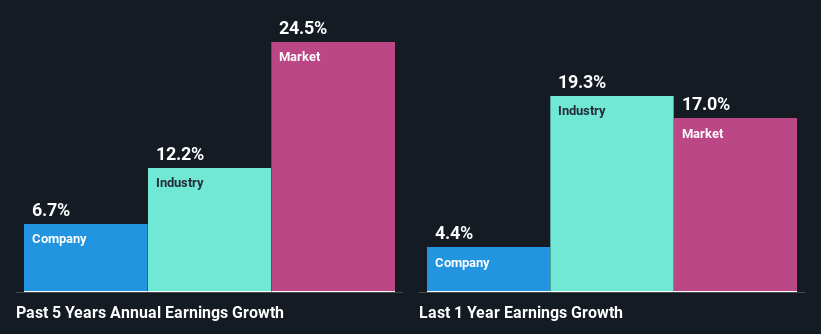

First thing first, we like that Procter & Gamble Health has an impressive ROE. Secondly, even when compared to the industry average of 13% the company's ROE is quite impressive. Probably as a result of this, Procter & Gamble Health was able to see a decent net income growth of 6.7% over the last five years.

Next, on comparing with the industry net income growth, we found that Procter & Gamble Health's reported growth was lower than the industry growth of 12% over the last few years, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Procter & Gamble Health's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Procter & Gamble Health Using Its Retained Earnings Effectively?

Procter & Gamble Health has a significant three-year median payout ratio of 73%, meaning that it is left with only 27% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Additionally, Procter & Gamble Health has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

Overall, we feel that Procter & Gamble Health certainly does have some positive factors to consider. The company has grown its earnings moderately as previously discussed. Still, the high ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be quite low. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PGHL

Procter & Gamble Health

Manufactures and markets pharmaceuticals and chemical products in India and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026