- India

- /

- Consumer Finance

- /

- NSEI:CHOLAFIN

Here's Why I Think Cholamandalam Investment and Finance (NSE:CHOLAFIN) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Cholamandalam Investment and Finance (NSE:CHOLAFIN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Cholamandalam Investment and Finance

How Quickly Is Cholamandalam Investment and Finance Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Cholamandalam Investment and Finance has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

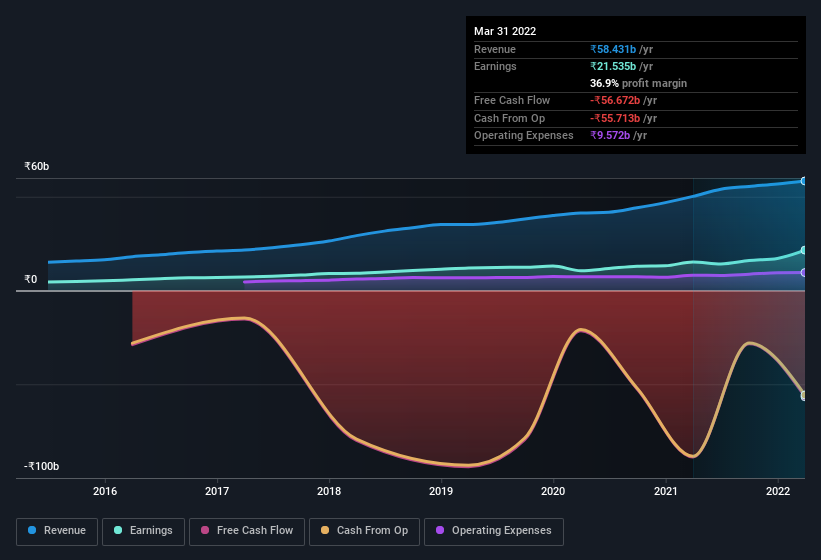

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Cholamandalam Investment and Finance's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Cholamandalam Investment and Finance's EBIT margins were flat over the last year, revenue grew by a solid 16% to ₹58b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Cholamandalam Investment and Finance's future profits.

Are Cholamandalam Investment and Finance Insiders Aligned With All Shareholders?

Since Cholamandalam Investment and Finance has a market capitalization of ₹539b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Notably, they have an enormous stake in the company, worth ₹8.3b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Cholamandalam Investment and Finance Deserve A Spot On Your Watchlist?

You can't deny that Cholamandalam Investment and Finance has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. What about risks? Every company has them, and we've spotted 1 warning sign for Cholamandalam Investment and Finance you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CHOLAFIN

Cholamandalam Investment and Finance

Operates as a non-banking finance company in India.

Exceptional growth potential with acceptable track record.