Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:FSL

Exploring Infosys Wipro And TCS As High Growth Tech Stocks

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.3%, and over the past 12 months, it is up by an impressive 45%, with earnings forecast to grow by 17% annually. In this thriving environment, identifying high-growth tech stocks like Infosys, Wipro, and TCS can be crucial for investors looking to capitalize on robust market performance and strong earnings potential.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.11% | 42.50% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Firstsource Solutions (NSEI:FSL)

Simply Wall St Growth Rating: ★★★★☆☆

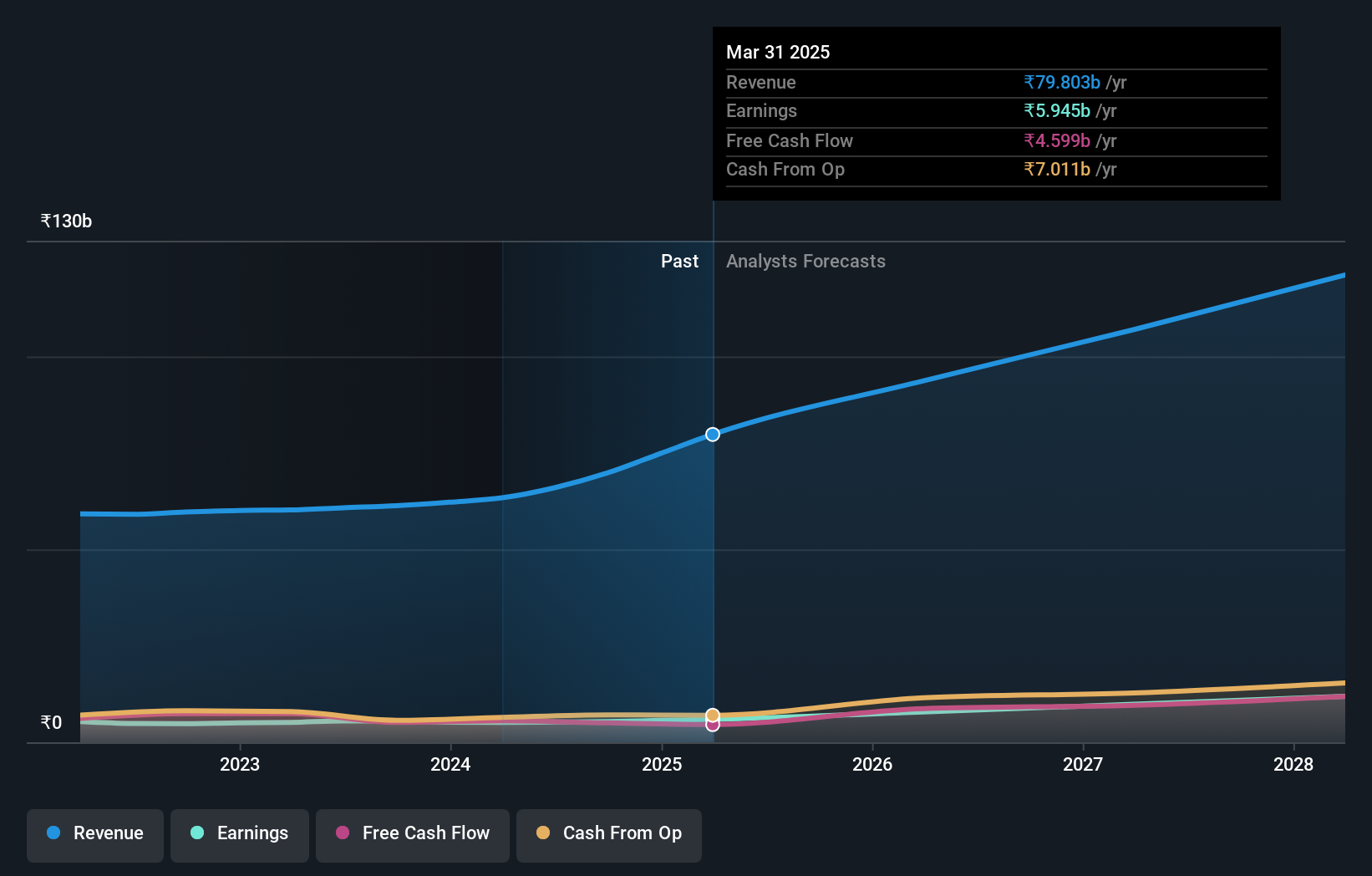

Overview: Firstsource Solutions Limited provides tech-enabled business processes across various sectors in multiple countries, including India, the United Kingdom, the United States, Asia, South Africa, the Philippines, Australia, and New Zealand; it has a market cap of ₹236.34 billion.

Operations: FSL generates revenue primarily from four segments: Banking and Financial Services (₹25.11 billion), Healthcare (₹22.27 billion), Communication, Media, and Technology (₹14.76 billion), and Diverse Industries (₹3.75 billion). The company operates internationally across various regions including India, the UK, the US, Asia, South Africa, the Philippines, Australia, and New Zealand.

Firstsource Solutions has recently embarked on strategic expansions and partnerships, notably with Microsoft to harness Azure OpenAI Service for enhancing digital transformation services globally. This collaboration is poised to elevate Firstsource's offerings in AI-driven solutions, reflecting a robust integration of cutting-edge technologies which is critical for sustaining competitiveness in the tech-driven market landscape. Additionally, the establishment of its new operations in Australia underscores Firstsource’s commitment to global expansion and local job creation, aligning with its growth trajectory that saw a 12.3% revenue increase this year. Despite a slower earnings growth rate at -5.5% compared to the industry average, the company's forward-looking initiatives like the relAI suite indicate potential for recovery and market penetration. With an expected annual profit growth of 20%, Firstsource is strategically positioning itself to leverage technological advancements and expand its client base in high-growth sectors such as HealthTech and FinTech through its innovative platforms.

- Take a closer look at Firstsource Solutions' potential here in our health report.

Explore historical data to track Firstsource Solutions' performance over time in our Past section.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

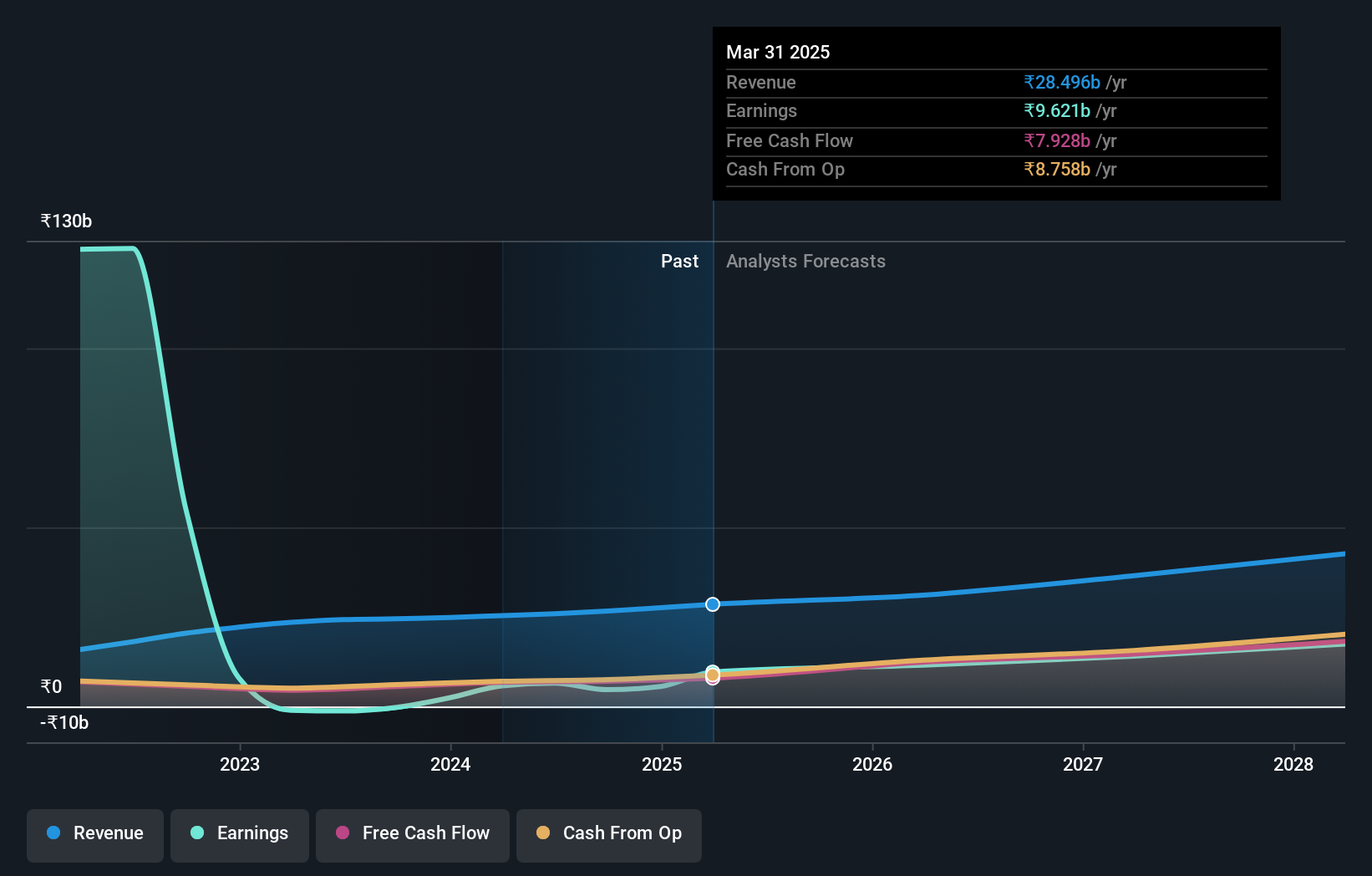

Overview: Info Edge (India) Limited operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally, with a market cap of ₹1.02 trillion.

Operations: The company generates revenue primarily from its recruitment solutions, which brought in ₹19.05 billion, and real estate classifieds under 99acres, contributing ₹3.67 billion.

Info Edge (India) has demonstrated a robust financial trajectory, with a notable revenue increase of 13% annually, outpacing the broader Indian market's growth rate of 10.1%. This growth is complemented by an impressive forecast for earnings expansion at 23.6% per year, signaling strong future prospects. The company's strategic focus on R&D is evident from its substantial investment in this area, which supports continuous innovation and competitive edge in the fast-evolving tech landscape. Recent executive appointments and increased dividend payouts reflect a proactive management approach aimed at bolstering both policy influence and shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of Info Edge (India).

Evaluate Info Edge (India)'s historical performance by accessing our past performance report.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited provides software products, services, and technology solutions in India, North America, and internationally with a market cap of ₹791.64 billion.

Operations: The company generates revenue from three primary segments: Healthcare & Life Sciences (₹23.88 billion), Software, Hi-Tech and Emerging Industries (₹46.41 billion), and Banking, Financial Services and Insurance (BFSI) (₹32.08 billion). The largest revenue contributor is the Software, Hi-Tech and Emerging Industries segment.

Persistent Systems has been making significant strides in the tech sector, evidenced by a robust 19.4% forecasted annual earnings growth which surpasses the broader Indian market's expectation of 17.3%. This growth trajectory is bolstered by a strong focus on R&D, with expenditures rising to enhance their capabilities in digital transformation services—a crucial area as businesses increasingly rely on advanced technologies for operational efficiency. The company's recent partnership with Mage Data™ underscores its commitment to expanding its data security solutions, further solidifying its position in a competitive landscape. Moreover, strategic executive changes and active participation in global tech conferences reflect Persistent's proactive approach to leadership and market engagement, promising continued relevance and dynamism in evolving tech domains.

- Click here and access our complete health analysis report to understand the dynamics of Persistent Systems.

Examine Persistent Systems' past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 39 Indian High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FSL

Firstsource Solutions

Provides tech-enabled business processes in India, the United Kingdom, the United States, Asia, South Africa, the Philippines, Australia, New Zealand, and internationally.