- India

- /

- Trade Distributors

- /

- NSEI:HINDWAREAP

Did Somany Home Innovation's (NSE:SHIL) Share Price Deserve to Gain 12%?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Over the last year the Somany Home Innovation Limited (NSE:SHIL) share price is up 12%, but that's less than the broader market return. Somany Home Innovation hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Somany Home Innovation

Given that Somany Home Innovation only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last year Somany Home Innovation saw its revenue shrink by 43%. The lacklustre gain of 12% over twelve months, is not a bad result given the falling revenue. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

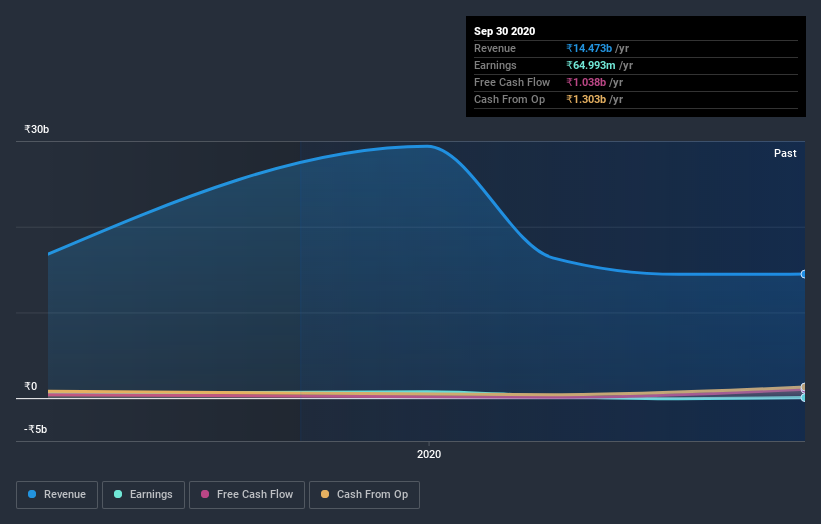

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Somany Home Innovation's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Somany Home Innovation shareholders have gained 12% for the year (even including dividends). While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 17%. However, that falls short of the 92% gain it has made, for shareholders, in the last three months. The very recent increase in the share price could be evidence that the narrative is changing for the better due to fundamental improvements. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Somany Home Innovation (including 2 which are potentially serious) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Somany Home Innovation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hindware Home Innovation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HINDWAREAP

Hindware Home Innovation

Engages in the manufacturing, selling and trading of building products, consumer appliances, and retail business in India.

Reasonable growth potential with imperfect balance sheet.