- India

- /

- Construction

- /

- NSEI:AXISCADES

Is Now The Time To Put AXISCADES Technologies (NSE:AXISCADES) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like AXISCADES Technologies (NSE:AXISCADES), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide AXISCADES Technologies with the means to add long-term value to shareholders.

How Fast Is AXISCADES Technologies Growing Its Earnings Per Share?

In the last three years AXISCADES Technologies' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, AXISCADES Technologies' EPS grew from ₹11.07 to ₹18.50, over the previous 12 months. It's a rarity to see 67% year-on-year growth like that.

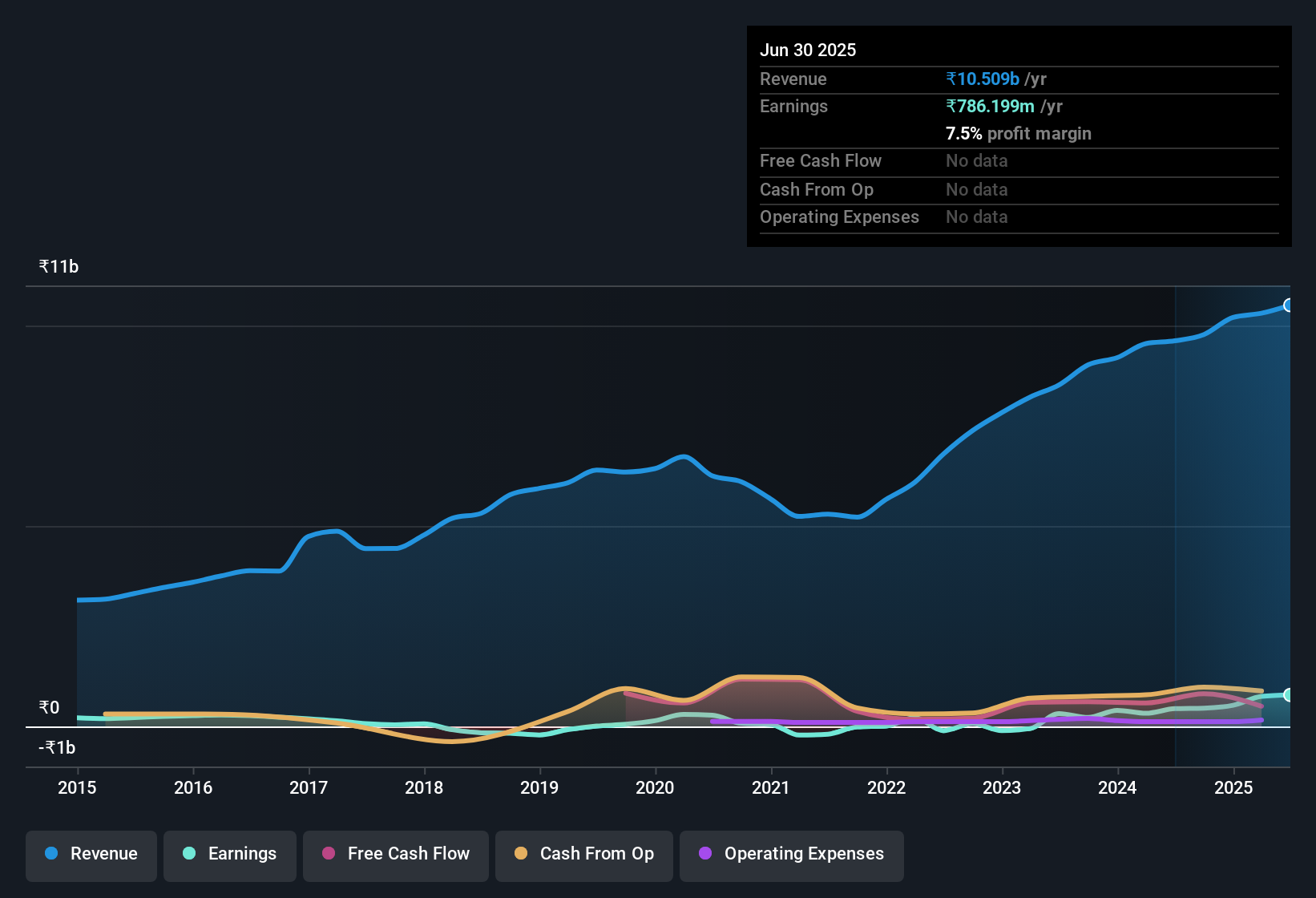

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. AXISCADES Technologies maintained stable EBIT margins over the last year, all while growing revenue 9.3% to ₹11b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

See our latest analysis for AXISCADES Technologies

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check AXISCADES Technologies' balance sheet strength, before getting too excited.

Are AXISCADES Technologies Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own AXISCADES Technologies shares worth a considerable sum. Indeed, they hold ₹2.0b worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 3.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to AXISCADES Technologies, with market caps between ₹35b and ₹142b, is around ₹36m.

The AXISCADES Technologies CEO received total compensation of only ₹718k in the year to March 2025. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add AXISCADES Technologies To Your Watchlist?

AXISCADES Technologies' earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that AXISCADES Technologies is worth considering carefully. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing AXISCADES Technologies' ROE with industry peers (and the market at large).

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AXISCADES

AXISCADES Technologies

Operates as an engineering solutions company in Europe, the United States, the Asia Pacific, and Canada.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives